👋 G’day

Welcome back to another day of insights

Today’s brief:

Ashurst tops Big 8 for female partners

Qantas tries to expand beard ban

Crown settles laundering case

Here’s your latest 👇

PRACTICE POINTS

JORC overhaul

ASX-listed miners, heads up: a major JORC Code update is coming by end-2025, with a one-year transition to follow. Some key changes are:

a new “specialist” role to support competent persons on technical matters

mandatory public CVs for competent persons to be uploaded to the JORC website

a new “reasonable prospects for economic extraction” concept replacing the word “eventual” in mineral resource reporting

new rules to report reconciliation performance comparing an estimate to a prior estimate or production results to the estimate

With over 8,000 consultation comments on the draft, the changes are no small tweak: Hopgood Ganim

*

Australia’s carbon credit market is still stuck in analogue mode. Under current law, buyers need to consult the Australian National Registry of Emissions Units to determine title, and security interests aren’t even recorded in the same registry. That means messy ownership layers, slow transfers, and higher legal risk. But Holding Redlich reflects on potential reforms. If the Australian Carbon Exchange is declared a financial market, trades will automatically be free of security interests, streamlining transactions. Meanwhile, the new blockchain-enabled Unit & Certificate Registry will let ACCUs carry ‘attributes’ like co-benefits and provenance. Here’s the rundown: Holding Redlich

*

ASIC has banned Anthony Azizi from managing companies until 2030, after the collapse of three construction firms owing over $93.7m to 300+ creditors. ASIC found Azizi failed to meet the statutory lodgement requirements, keep proper financials, or prevent insolvent trading. Liquidators at Worrells and Vincents flagged misconduct, triggering the disqualification under section 206F of the Corporations Act: ASIC

WORD ON THE STREET

Ashurst tops gender rankings

When it comes to % of female partners at top-tier firms, Ashurst leads the pack with a whopping 46.1%. Close behind are HSF Kramer (41.2%), Allens (41%), and G+T (40%). All four hit the 40% target. But not everyone’s killing it - Clayton Utz lags at 30.8%. We broke down the figures here.

*

Crown’s $73m class action settlement over money laundering lapses could see Maurice Blackburn pocket $19.9m in legal fees, nearly 27.5% of the payout. The firm will collect its cut over three staggered payments. The case alleged Crown misled shareholders and failed on anti-money laundering obligations: Lawyerly

*

PwC has sold its 84-person restructuring arm to Teneo for an undisclosed multimillion-dollar sum, marking its fourth advisory sell-off since the tax leaks scandal. The team includes 14 partners. Teneo’s expanding with a new Brisbane office, betting big on becoming a go-to crisis adviser across APAC: AFR

*

Steven Lurie’s been bumped up to partner in Clyde & Co’s Sydney insurance team, rounding out a string of hires, including three new special counsel in recent months. With over 25 years’ PI experience, Lurie’s known for defending engineers, lawyers, and D&Os in high-stakes claims: Australasian Lawyer

TALKING POINTS

Albo’s year begins

Albo’s “year of delivery” begins. Fresh off a landslide win, Albanese is bringing Parliament back early to roll out student debt cuts, childcare reforms and new worker protections. Labor holds 94 seats and the Coalition slumped to just 43 (its lowest ever share). And in the Senate, Labor only needs one major party to pass bills, sidelining the rest of the crossbench: AFR

*

Unless you’ve been living under a rock, you’ve probably seen the viral CEO and HR kiss cam moment. Now it’s official: Astronomer Inc. CEO Andy Byron has resigned, after getting caught canoodling with his Chief People Officer at Coldplay. No word yet on CPO Kristin Cabot’s future, but the company says the standards expected of its leaders "was not met": Reuters

*

Did you know Qantas has a no-beard policy? Well, now it wants that policy to apply to QantasLink pilots too, citing oxygen mask safety. But pilots are pushing back, pointing to a 2024 US study that found no evidence facial hair impacts mask performance. Virgin, Emirates and even the RAAF allow beards—so some pilots are now growing facial hair in protest: The Australian

THE TREASURY

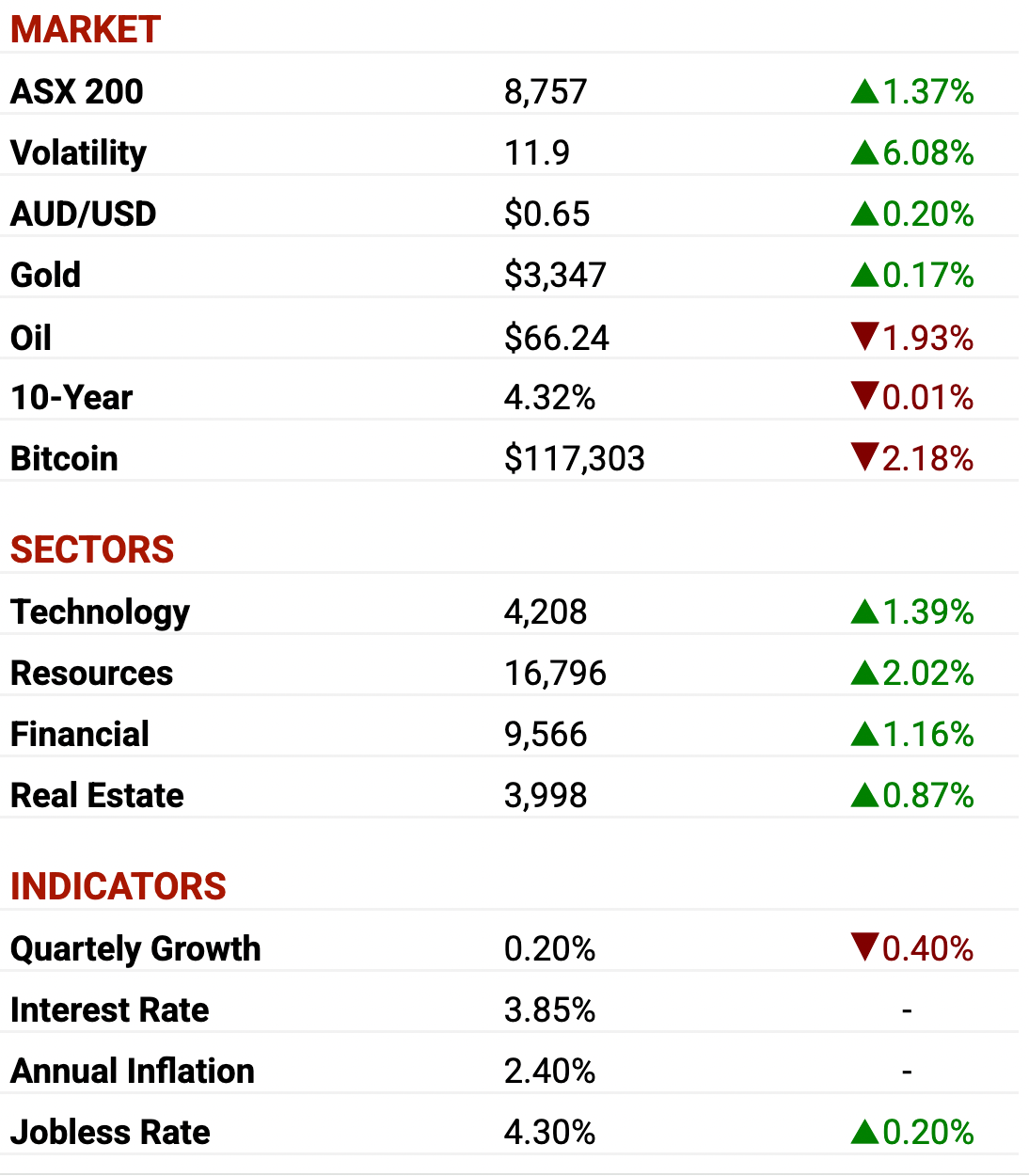

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

$600m student play

Cedar Pacific: is shopping UniLodge, Australia’s biggest student accom manager, in a $500m–$600m sale run by UBS. Interest is being quietly tested with Mirvac, GPT and Charter Hall, plus Singapore’s Mapletree and CapitaLand. UniLodge doesn’t own the assets, making it a capital-light, fee-heavy play for REITs chasing alt assets: The Australian

*

Regis Resources: is weighing a move on the 70% of Tropicana it doesn’t own, holding talks with AngloGold Ashanti. Regis paid $900m for its 30% in 2021, backed by a $650m raise via BofA, which implies a $3bn price tag for Tropicana. With no debt, $517m in cash and bullion, investors are watching closely - another raise could be on the cards: AFR

*

Hostplus and IFM Investors: are circling an extra 15.3% stake in Adelaide Airport, currently held by Igneo and tipped to fetch around $350m. With pre-emptive rights in play and Barrenjoey running the sale, existing shareholders are first in line. The deal adds to a string of recent airport trades amid steady institutional appetite: The Australian

SECTOR SPECIFIC

Costco cracks $5bn

🚜 DIGGERS

BHP has dumped its $1.4bn Tanzanian nickel project, walking away from its 17% stake in Kabanga just as it had the chance to take control. It’ll cop a loss and wait until at least 2029 for repayment. It’s a clear sign: the era of nickel bets is over, and BHP’s chasing higher-return plays elsewhere: AFR

*

Lithium stocks surged on Friday after China ordered Zangge Mining to halt operations, easing oversupply fears. PLS jumped 7.8%, while Liontown, MinRes and IGO also gained. Spodumene hit US$700/t, up 2.2% overnight. The rally gives a much-needed jolt to Aussie lithium miners: Capital Brief

🏦 FIN

ASIC is probing Metrics Credit Partners over loan valuation and governance concerns, as part of a broader two-year review into private markets. Metrics says it's unaware of any investigation, but the move ramps up pressure on private credit amid surging scrutiny of unlisted assets and investor risk: Bloomberg

*

Trump just signed the first US stablecoin law, calling it a “giant step” for crypto and a move to lock in the US dollar’s global dominance. The law requires dollar-for-dollar reserves for issuers. Trump says it’ll “secure the dollar’s status as the world’s reserve currency”: Bloomberg

🏠 RETAIL & REAL ESTATE

Costco’s annualised sales have surged to $5bn in Australia, shaking up the $120bn supermarket sector. Its bulk-buy model and $65 membership fee are pulling shoppers away from Coles and Woolies, with 1.5 million members now doing big monthly shops. Analysts say it’s eating into traditional grocers’ impulse buys: The Australian

*

Canadian pension giant PSP Investments is tipping up to $800m into Aliro Group’s flagship industrial fund, backing a fresh wave of warehouse and logistics deals. The move gives Aliro more firepower in a hotly contested market, where data centres, resi developers and e-comm giants are all scrapping for inner-city industrial land: The Australian

📱 TECH & STARTUPS

Employment Hero has taken Seek to court, accusing it of anticompetitive conduct after Seek cut off access to its hiring API. The stoush pits investor against investee, with Seek still holding a stake via its growth fund. Thompson claims the move disrupts hiring for thousands and is all about protecting Seek’s paid listings model: AFR

*

The ATO is auditing Google, Amazon and Microsoft over claims they’re under-reporting profits from local data centres and funnelling revenue offshore. The ATO suspects Aussie centres are far from “low-value services” and wants more tax paid here. With $26bn in new data centre investment tipped by 2030, the tax fight over AI infrastructure is just getting started: AFR

P.S.

Till next time,

-Team PB