👋 G’day

Welcome back to another day of insights

Today’s brief:

Sidley intern fired for biting colleagues

US salary wars on ice…for now

UK lowers voting age to 16

Here’s your latest 👇

PRACTICE POINTS

Hell or high water enforced

In Desktop v Nano, the Delaware Court sent a loud signal: buyers can’t backpedal on "hell or high water" commitments just because the deal gets inconvenient. Nano agreed to take “all action necessary” to secure approval from from Committee of Foreign Investment in the US (CFIUS), including entering a National Security Agreement. After a Nano board reshuffle, the new board tried using the CFIUS approval process to tank the deal. Nano pointed to a 10% carve-out, arguing it didn’t need to accept conditions that would result in losing control of more than 10% of Desktop’s revenue. The problem? The Merger Agreement also included a broad list of “required terms” that Nano was required to accept in the NSA. The court held these overrode the carve-out, and in any event, none of the proposed NSA conditions met the 10% threshold. Hell or high water clauses are rare in Aussie M&A. But with the ACCC imposing conditions under the merger control regime, dealmakers will need to think more strategically about how much regulatory risk they’re really willing to shoulder: Ashurst

*

The NT has revamped the Aboriginal Sacred Sites Act, aimed at streamlining approvals while strengthening protections. Developers can now transfer Authority Certificates when projects change hands, and add 'recorded parties' like JV partners or contractors without restarting the approval process. The changes also introduce enforceable undertakings for minor breaches, giving the Aboriginal Areas Protection Authority new tools to secure compliance without jumping straight to prosecution. The shake-up is part of a broader push to reduce red tape: Allens

*

The Federal Court has ruled that the ABC unlawfully terminated journalist Antoinette Lattouf for expressing a political opinion, in breach of s 772(1)(f) and s 50 of the Fair Work Act. Lattouf was dumped mid-week after reposting a Human Rights Watch video accusing Israel of using starvation as a weapon in Gaza. The Court found the dismissal was politically motivated and procedurally flawed. Importantly, the Court confirmed that political opinion is a protected ground, even for casuals, and that an employer can’t sidestep this by simply paying out a short-term contract. It also clarified that enterprise agreement processes must be followed, especially when misconduct is alleged. For employers, this is a strong reminder: short gigs still attract full FWA protections, and dismissals tied to political expression need to be handled with extreme care: Chamberlains

WORD ON THE STREET

BigLaw biter

We’ve all witnessed the odd problematic clerk. But we think this one takes the cake. A US Sidley intern has been booted for reportedly biting five colleagues, including a member of HR. Dubbed “Bitegirl”, her self-declared “fun fact” was that she likes biting. There were even claims that her officemate wore long sleeves “because she kept getting bit”. Interns say she meant it playfully, but Sidley didn’t find it so cute... Roll on Friday

*

Speaking of the US, salary wars are officially on ice. If you’re considering a New York move, don’t worry - it’s still ridiculously more than Aussie salaries. The Cravath scale is holding firm at $225k base for juniors, but no raises are expected this year. M&A’s limp recovery means firms are cautious with associate hiring is down nearly 40% from its peak, and lateral poaching has slowed: Bloomberg

*

Some of the ASX’s juiciest audit contracts are in play as Wesfarmers, Brambles, Qantas and Seek put their books up for review. Macquarie’s $75m audit is the big prize, with KPMG and EY vying to replace PwC. But there’s fresh conflict concerns with ex–big four partners now sitting on the audit committees of these companies: AFR

*

Squire Patton Boggs’ James Nguyen says being a lawyer turned out “quite different” to what he imagined, but in the best way. He thrives on deep client relationships, team dynamics, and seeing the businesses he advises scale. His next mission? Growing SPB’s private equity game in Sydney: Australasian Lawyer

TALKING POINTS

UK lowers bar

In the UK, 16 yo’s can’t drink, but you know what they can do? Vote. The UK will lower the voting age to 16 for all elections by 2029, delivering on Labour’s campaign promise. They will also be able to register to vote from age 14. Critics say the age threshold is inconsistent, given they’re still barred from drinking, marrying or enlisting: The Daily Aus

*

Here’s a fun fact. Australia’s internet lifeline runs through just 15 undersea cables, making it a prime target for sabotage. Retired Brigadier Ian Langford says just two snips could take out banking, commerce and military comms. He’s calling for joint drills, new cable routes and co-investment to plug the gaps. For now, the issue’s not even on parliament’s radar: Capital Brief

*

Tasmania is back where it started after its second election in 16 months - another hung parliament. Despite moving a no-confidence motion against Jeremy Rockliff’s Lib minority government, Labor’s off with a worse position than last time, with just 26% of the vote. Labor could still govern with support from the Greens or independents. But either way, looks like minority rule is the new norm in Tas: The Guardian

THE TREASURY

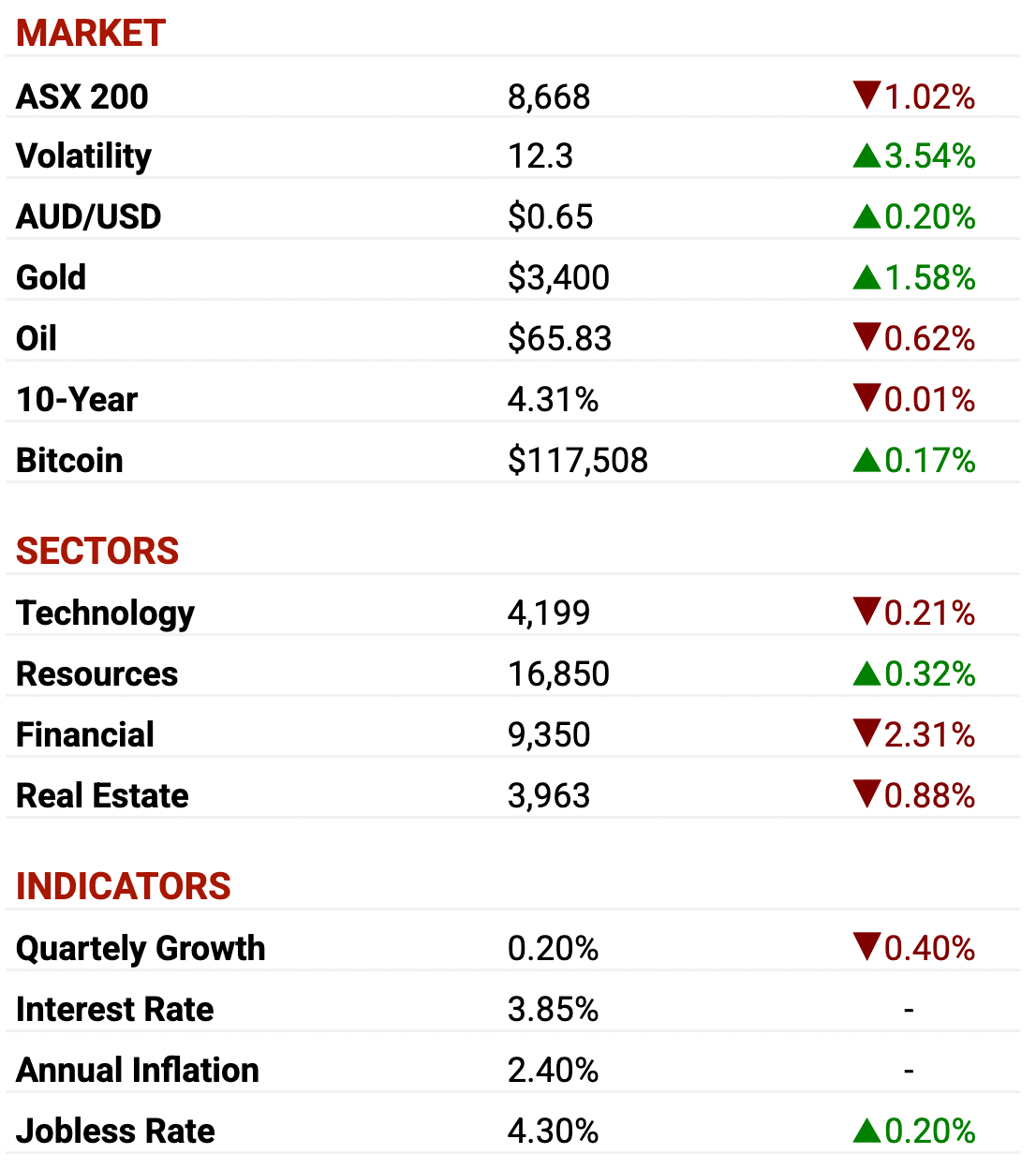

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Big bill battles

Lawyers and bankers: are turning litigious as clients push back on monster deal fees. Circle is disputing a contract that could see FT Partners score $5bn if Circle is ever sold. Quinn Emanuel wants $30m from Nano Dimension after closing a deal with its client Desktop Metal. Meanwhile, Musk’s X is fighting Wachtell’s $90m “success fee” from the Twitter deal, despite just $17m in hourly work: Financial Times

*

Insignia Financial: has warned there’s “no certainty” its $3.4bn CC Capital deal will proceed, sending shares down 6% in morning trade. CC flagged it was finalising financing back on 1 July, but the clock’s ticking. The US suitor’s $5 per share bid now looks shaky, with Insignia last trading at $3.92: Capital Brief

*

Macquarie: is putting Paraway Pastoral on the block after 17 years, eyeing $2.5bn+ for the 4.4m-hectare cattle and sheep empire. With 28 stations and 450,000 head of livestock, the move follows a strategic review and echoes Macquarie’s past agri exits like Lawson Grains: AFR

SECTOR SPECIFIC

Retail recession

🚜 DIGGERS

While the cash flow from the Carmichael mine looks solid, Adani Mining and Bowen Rail racked up $500m in losses last year in Australia, largely due to $255m in related-party interest and lease payments. Meanwhile, Singapore-based Adani Global Pte, the parent company, pocketed $109m in profit: AFR

*

Shell, Omega and Elixir are drilling into what could be Australia’s next energy jackpot. The Taroom Trough is being likened to the Bass Strait, with early wells hinting at tens of trillions of cubic feet of gas and billions of barrels of oil. Shell is flying in rigs from the US, and juniors are racing to lock in acreage: AFR

🏦 FIN

Ahead of Macquarie’s Thursday AGM, market chatter ramped up about Shemara Wikramanayake’s future, but insiders say she’s not going anywhere. At 62, she’s apparently energised and in control - can’t relate. With $1bn freed up from the asset management sale, all eyes are on where she’ll steer the ship next - private credit, real estate, or another Trump-era energy play could be on the cards: Capital Brief

*

Block (formerly Square) is the latest fintech to join the S&P 500, replacing Hess Corp from 23 July. Shares jumped nearly 10% on the news, joining Coinbase as the second fintech to crack the index this year: FinExtra

🏠 RETAIL & REAL ESTATE

The ACCC’s sham discount case against Coles and Woolies now hinges on 24 everyday products, from Tim Tams to deodorant. Each retailer picked 12 items to defend their price hike claims. The court wants a quick, clean fight - but analysts warn the grocers may have stacked the list in their favour. Trial kicks off soon: AFR

*

TFG, owner of Connor, Tarocash and yd, says Australia’s retail sector is still stuck in a funk, with sales down 3% to $745m and earnings off 15.6%. It follows Country Road’s “retail recession” call, as high rents, wages and skittish shoppers weigh on apparel brands: The Australian

📱 TECH & STARTUPS

A previously unknown flaw in Microsoft SharePoint is being actively exploited, with researchers saying it’s likely the work of one threat actor, so far. The FBI’s investigating, and over 8,000 servers across industries and governments could already be compromised: Reuters

*

After its US$20bn Adobe deal was canned, Figma’s now going public on the NYSE, targeting a US$16.4bn valuation. It's hoping to raise US$1.03bn, riding a rebound in tech listings. Profits have tripled, revenue’s up 46%, and it has US$70m in bitcoin exposure: Yahoo Finance

Till next time,

-Team PB