G’day.

Welcome to Point Blank – Happy hump day.

It’s coffee and newsletter time – here’s what you need to know 👇

💼 Practice Points

In what could be a significant decision, a Victorian county court recognises invasion of privacy at common law and awards a woman $30,000 after her father spoke to the media about surviving a murder attempt orchestrated by her mother, with such information disclosed in a joint counselling session. Woah…

Acknowledging that wrongdoings of privacy historically fall within the breach of confidence equitable doctrine, Tran J posited, “it is better viewed as separate and distinct from the action for breach of confidence”.

But while not a separate tort, it is the “recognition of the bifurcation which has developed in relation to the action known as breach of confidence” between (1) actions that protect confidential trade information, and (2) actions that “protect human dignity in privacy”. Tran J renames category 2 as “an action for invasion of privacy”.

Employers beware—employees who sustain injuries while WFH can claim workers’ comp. An employee tripped over her pet fence (erected unbeknownst to her employer) while going to her kitchen for a coffee break. As coffee breaks were authorised and encouraged by her employer, the break was deemed during her employment.

Turns out, insurers can’t be trusted—the Federal Court found that a “pre-existing condition” term in certain HCF Life Insurance policies could mislead the public. This term allowed HCF Life to deny coverage if a customer did not disclose, or was not even aware of, a pre-existing condition. As this condition breached the Insurance Contracts Act, the Federal Court found that it misled consumers by making it seem like HCF had broader rights than it actually did under the Act.

📢 Talking Points

Defence spending ramps up, with the Australian Government investing A$21 billion in domestic missile and munitions manufacturing over a decade in the face of a regional arms race.

As the dust settles on the pandemic, a COVID-19 inquiry comments on the fallout from Australia’s response: heavy-handed, inconsistent pandemic restrictions shattered public trust, and the economic response fuelled inflation. The government’s next challenge? Rebuilding trust and prepping for future crises.

With Halloween around the corner, here’s a spooky stat for you: Sydney’s median house price has soared to a chilling $1.65m. But fear not, the rapid growth is finally cooling off, giving buyers a fighting chance.

Donald Trump’s rally at Madison Square Garden drew a hefty crowd, packed with celebrities, despite being criticised as reminiscent of a 1939 pro-Nazi protest. More controversy struck when out-spoken comedian Tony Hinchcliffe blasted Puerto Rico as a ‘floating island of garbage’ – Trump’s response ‘I don’t know him, someone put him up there’. We’re less than a week from the election, and Kamala Harris’ lead over Trump has narrowed to less than 1 percentage point nationally, setting the stage for a nail-biting finish in the battleground states.

🏦 The Treasury

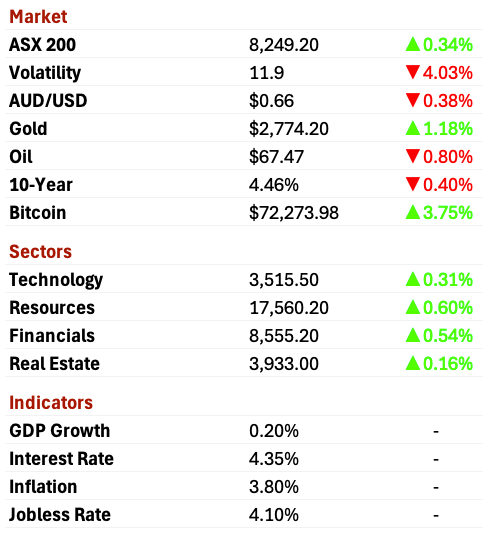

Sharemarket fell lower this morning, ahead of key inflation data to be released that will be pivotal in RBA’s decision to cut rates.

Inflation hedges still bear fruit, as Bitcoin tops US$73.5k overnight, just shy of a new record high. Gold continues to shine with a new high of US$2.8k an ounce.

ASX as at market close. Commodities and crypto in US dollars.

🤝 Deal Room

Flight Centre Travel Group wedges up its market share with the new acquisition of Manchester-based Cruise Club UK. The cash-funded private deal has no disclosed price tag but Club records £20 million ($40 million) turnover.

Australian Ethical Investments and privately owned Future Super have been in on-and-off talks about a potential merger but have not yet seen eye-to-eye. Sources say the deal structure may involve Australian Ethical offering scrip to essentially reverse list Future Super onto ASX.

The sale of Rex is looking more tenuous—with buyers requiring to splash out $300m to cover Rex’s debts, a government bail-out is on the cards. Yay for taxpayers.

In other sky travel news, Dexus is offloading a 9.7% stake in Melbourne and Launceston airports, marking Australia’s 4th airport sell-down in 2024.

🧐 Wednesday Wisdom

“The best time to plant a tree was 20 years ago. The second-best time is now."

🏗 Sector Specific

Diggers

Pilbara Minerals has slashed its FY25 guidance and placed its WA Ngungaju plant on care and maintenance as lithium prices continue to eat into the miner’s revenue.

Gina Rinehart scores a $2.8bn iron ore payday in the latest $4bn dividend from mining giant Roy Hill, where Hancock Prospecting controls 70% of the operations – a big win for the rich. Despite the new deep pockets, Rinehart warns the industry is under threat of competition from other nations due to government tape and bureaucratic cost burdens.

A worker has been killed at Rio Tinto’s iron ore project in Guinea, making it the company’s fifth death in 2024, raising serious concerns about its safety standards.

MinRes’ board was first informed of Ellison’s tax evasion scandal in June 2022, more than two years before the scandal was leaked. The ASX threatened to suspend trading until MinRes explained why it didn’t disclose the scandal. The board’s excuse was that it “did not consider these matters to be materially price sensitive”… MinRes’ stock price is down 20% since the scandal came to light, and is the 7th most shorted stock on the ASX.

In the Santos / ACCR trial, the court heard evidence on an email from Santos’s ex-head of sustainability raising concerns about the company’s “meh” attitude towards emissions cuts, while former Santos exec Brett Woods insists that Santos was always fully committed to net zero. Yet, Santos’ lawyers contend that activist demands deter companies from attempting to decarbonise.

Fin

In a sweeping audit shake-up, ASIC has warned 3000 auditors to self-report any conflicts of interest or dodgy accounts. Those who don’t will find ASIC knocking at their door.

Aussie Super’s CIO Mark Delaney says the $1.1b loss on education start-up Pluralsight still hurts—“I’m not a genius”—but with $340b for 3.4 million Aussies on the line, he’s taking notes and moving forward.

Tech & Media

The rumour mill says that WIN Television-backed Andrew Lancaster or acting CEO Matt Stanton will ascend as Nine’s new CEO. Meanwhile, pressure mounts for Nine chair Catherine West to step down after revelations of the company’s questionable culture.

Remember the CrowdStrike global, crash which caused the “blue screen of death”? CrowdStrike and US airline Delta are now suing each other over the outage. Delta claims that CrowdStrike forced faulty and untested updates on its customers, causing 7000 flight cancellations, which cost the carrier more than US$500m (A$761m). While CrowdStrike denies causing the harm, Delta claims.

🏘️ Word on the Street

A recent study found that almost 1/3 of Aussie lawyers are BYO-ing personal AI tools like Chatork because their firms still haven’t rolled out official AI assistants, opening the door for Medibank-style data breaches.

R&I partner Katie Hiwillin will leave Jones Day for Clayton Utz at a time when formal insolvencies are at record highs.

Have a practice point, new deal or something to share? Hit reply to reach out. ☝️