👋 G’day

Greetings all who made it through this short week, do enjoy your long weekend pt. 2

Today’s brief:

KWM looks to axe its global CEO position

A&O promotes 3 Aussies to its global profit pool

The right to disconnect is centre stage this election

Here’s what you need to know 👇

PRACTICE POINTS

Anti-slavery push

The metals and mining sector is firmly in the spotlight as the government moves to toughen modern slavery rules. A review of the Modern Slavery Act found the regime hasn’t driven real change—and Canberra agrees. Potential reforms include expanded reporting criteria, mandatory due diligence and penalties for non-compliance. While changes aren’t locked in yet, the arrival of Australia’s first Anti-Slavery Commissioner signals changes are coming: G+T

*

Two fresh Takeovers Panel calls are a reminder of the rights and wrongs of rights issues. Under GN17, a rights issue won’t be unacceptable if there’s a clear funding need, proper structuring and a fair dispersion strategy. But Alara’s $15.3m raise failed on all fronts—no clear need, poor funding alternatives, a shortfall strategy that favoured its largest shareholder, and unmanaged conflicts. Compare that to ERA’s $880m raise, where despite Rio lifting its stake from 86% to 99%, the Panel waved it through. Genuine funding need, a level playing field on shortfall allocations, and an independent board committee managing conflicts: KWM

*

ASIC is rolling out a shiny new AFS licensing portal on May 5. The move is part of its digital revamp to make applying for, varying, and cancelling licences easier. No change to the eligibility rules, but the process gets slicker with pre-filled data and smarter forms to cut down assessment times. Expect updated guides (RG 1–3) to drop alongside the launch. Stay tuned.

WORD ON THE STREET

KWM’s China fallout

KWM may ditch its global chief exec role altogether, after a decade of patchy China-Australia ties and cross-border friction. The firm hasn’t replaced Sue Kench, who stepped down in January, and says its international management committee may fill the gap instead. With China-Australia investment down 90% since the 2012 merger, KWM is weighing if a global CEO still makes sense: AFR

*

The ACT DPP will stop prosecuting regulatory offences like construction breaches and animal welfare cases from 30 June, blaming resource strain and the need to prioritise serious crime. Agencies are now scrambling to fill the gap, with warnings the move could lead to delays and “anarchy and lawlessness”: The Australian

*

A&O Shearman has promoted 33 lawyers globally, including 3 new partners in Australia: Jackson Allen (Perth, ENRI), Jackie Donald (Perth, M&A), and Simone Lowes (Sydney, M&A). The move follows the firm’s US merger and a plan to cut 10% of partners this financial year: Lawyers Weekly

TALKING POINTS

Robot army

China’s secret weapon in the trade war? An army of AI-powered factory robots. Automation is advancing faster in China than in the US, Germany or Japan, with more robots per 10,000 workers than almost anywhere except South Korea and Singapore. Backed by Beijing’s “Made in China 2025” strategy and $137bn in funding, China can keep exports price lower, giving it an edge in the trade war: NY Times

*

Another Dutton backflip. This time it's on his pledge to keep Labor’s EV tax breaks, dumping the policy just two days after promising no changes. The FBT exemption for electric cars—worth up to $91k—has been wildly popular, saving drivers thousands. It’s Dutton’s second major U-turn this campaign, after shelving his push to force public servants back to the office full-time: AFR

*

US Treasury boss Scott Bessent has flagged that the tariff standoff with China won’t hold, telling investors the current 145% tariffs are unsustainable and a de-escalation is coming soon. While a full trade deal could still be some time off, China has signalled it was open to trade talks with the US, a day after US President Donald Trump said he was willing to cut tariffs: Bloomberg

*

The Coalition has vowed to repeal the workers’ right to disconnect, which lets workers ignore after-hours calls and emails unless they are reasonable. Labor, unions and health groups back the laws, while Dutton and Michaelia Cash argue they’re costly and confusing. Now, mental health experts have sounded the alarm about the changes. The debate is now front and centre this election: The Guardian

THE TREASURY

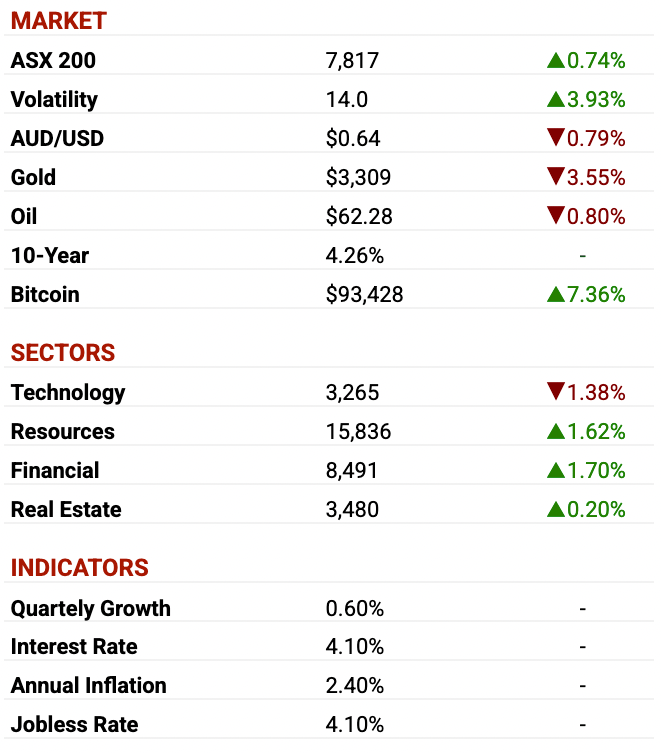

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

ASX backlash

ASX: is copping heat for letting James Hardie shift its primary listing to New York via a $14bn Azek merger—without a shareholder vote. Treasurer Jim Chalmers says he’s raised the issue directly with ASX chair David Clarke, seeking clarification, but has so far ruled out stepping in: AFR

*

Macquarie’s: $2.8bn sale of its US and European public markets arm to Nomura has fuelled talk that its Australian equities and fixed income business could be next. With Wall Street giants also struggling to make strong returns in public markets, some insiders say it’s only a matter of time before Macquarie follows suit at home. A&O Shearman acts for Macquarie, while White & Case advises Nomura: The Australian

*

Boeing: offloads its Digital Aviation Solutions arm—including Jeppesen and ForeFlight—to Thoma Bravo for US$10.6bn, as it looks to focus on its core businesses and bolster its balance sheet. The deal includes around 3,900 staff and is set to close by the end of 2025, with Boeing keeping core digital tools for fleet maintenance and repair: Capital Brief

*

Brownes Dairy: has been put up for sale after its China-based backer, Mengniu Dairy Co, called in a $200m loan. The WA milk giant expects no changes to its daily ops while the sale kicks off. McGrathNicol is running the bid process that adds to a busy dairy M&A pipeline, alongside Fonterra’s $4bn Mainland Group process already underway: AFR

🚨 There’s 30 ways to be a sh*t lawyer

We created a guide on how not to be promoted.

Doing these simple things will hold your career back.

Share Point Blank to unlock 30 ways to be a bad lawyer.

Are you sure you aren’t doing these things?

Click the button below to find out.

SECTOR SPECIFIC

MinRes board walkout

🚜 DIGGERS

The last member of MinRes’ ethics committee, Denise McComish, has quit just a week after two other directors walked, leaving the scandal-hit miner without its independent oversight group. All three were among the loudest critics of founder Chris Ellison, who remains in charge despite admitting to misleading the board: AFR

*

Lindian Resources has dropped criminal charges against two Chinese nationals, accused of trespassing and taking geological samples at its Kangankunde rare earths project in Malawi. The men were detained by Lindian security after GPS devices allegedly showed they’d entered the lease area: The Australian

🏦 FIN

Over 100 Aussie FinTechs have fired off a letter to both major political parties, warning that policy delays and regulatory gridlock are putting the sector at risk. With 62% citing compliance headaches as their top challenge as they call for action on open banking, digital assets, debanking and tax incentives before more startups head offshore: Capital Brief

*

In a sleepy pre-long weekend market, more than $1.5bn in CBA shares changed hands—triple the usual volume—fuelled by heavy buying from Jarden and UBS, which nabbed a third of the day’s trades. CBA jumped 4.2% in its biggest one-day gain since 2022, with theories swirling around safe-haven buying as Trump backs down in the trade war: AFR, The Australian

🏠 RETAIL & REAL ESTATE

*

Commercial office heavyweight Dexus is going hard on housing, launching a $140m luxury apartment project at Mona Vale and ramping up its “living” play across student digs, retirement homes and land lots. With DREP II gunning for up to $1bn, the ASX-listed landlord says the resi supply squeeze is real, and the investment window is closing fast: AFR

📱 TECH & START UP

Optus has quietly built out its AI strategy with Google and Anthropic, rolling out tools that it says are already boosting sales and cutting costs. A coding co-pilot lifted engineering output 20%, while an AI writing assistant helped lift call centre sales by 9%. After its cyber breach and network outage debacles, Optus is betting AI will help rebuild trust—and margins: Capital Brief

*

The EU has handed down its first fines under the new Digital Markets Act, hitting Apple with €500m over app store breaches and Meta with €200m for its “pay or consent” ad model. Apple now faces a cease-and-desist order and the threat of daily fines if it fails to comply by June, with more penalties potentially on the way: Politico

P.S.

Want to tell us something?

Reply to this email for a confidential chat.

New here?

👋 You’re in good company. You’re reading this alongside new readers from HSF, KWM, Allens, Corrs + more. Know someone who should be here? Forward this on.

Till next time,

-Team PB