👋 G’day

Today’s brief:

Macquarie execs disclose office romance.

Brookfield throws its hat in the ring for Insignia Financial.

WA fights Albanese on Native Title Act amendment.

Here’s what you need to know to stay ahead (and don’t forget your Wednesday wisdom). 👇

PRACTICE POINTS

WA pushes for Native Title fix

WA’s asking the Federal Government to amend the Native Title Act to validate mining leases. The move would clear up the legal mess left by the 2017 Forrest & Forrest decision, which cast doubt on the validity of many leases. The Cook government introduced the Mining Amendment Bill 2024 in November to back the validation of all pending and future leases. However, changes to the Native Title Act are needed for these measures to take effect: The Australian

ACCC’s latest retail sweep of over 2000 Aussie retailers uncovered some dodgy T&Cs that could land businesses in hot water under the ACL. The regulator’s sending a clear message: stop misleading customers about their rights. That means no more blanket “no refund” policies or slapping time limits on returns for faulty goods.

The Federal Court ruled that a statutory demand can be validly served on a perceived temporarily empty office. In this case, an ATO officer rocked up to the locked office with a “call this number if unattended” sign, slid the documents under the door, and didn’t bother to call the number. The office had been permanently empty since 2018. The Court held serving officers don’t need to investigate beyond the registered office unless they know the office is permanently vacant.

WORD ON THE STREET

Macquarie’s office romance

In a world of 16-hour workdays, office romances are no longer surprising. But what do you do when the boss and a direct report get together? For Macquarie execs Tim Joyce and Georgina Lalor, it means disclosing their relationship and reshuffling reporting lines: AFR

HopgoodGanim just made a bold move, poaching a team of eight from Corrs Chambers Westgarth’s Brisbane real estate practice. Leading the team will be Corrs partner Greg Hassall, who will join as a consultant, while ex-special counsel James Cooper steps up as a partner at HopgoodGanim: Lawyers Weekly

Cybersecurity expert Rachael Falk and KPMG partner Kathleen Conner are joining Ashurst’s risk advisory division as partners pushing the division to 23 partners globally, including 19 based in Australia: AFR

Westpac CEO Anthony Miller has tapped Paul Fowler from CBA to lead its business banking division: AFR

Johnson Winter Slattery adds a new health and safety partner. Alena Titterton joins the firm after spending 8 years at Clyde & Co, which continues to face a mass exodus: Lawyers Weekly

TALKING POINTS

Footy faces “concussion class action”

Margalit Lawyers are bringing a "concussion class action" against the AFL over alleged brain injuries suffered by footy players on the field. They’ve now locked in lead plaintiffs to bring a separate action against 17 clubs. The AFL’s got DLA Piper in its corner: Lawyerly

Australia’s privacy watchdog is keeping its beady eyes on Chinese AI firm DeepSeek. After an outright ban in Italy and investigations across the EU. The Australian government has even banned the platform on all government devices: Capital Brief, SMH

Beijing fired back with retaliatory tariffs on US exports after Trump doubled down on duties for Chinese goods, ramping up fears of a full-blown trade war between the world’s two biggest economies. Meanwhile, Trump hit pause on broader tariffs for neighbours Canada, Mexico, and Colombia within the last week: AFR

How insulated is Australia from the trade war? Well, Australia’s dodging the worst of Trump’s tariff storm—at least for now. Citi economists say our political ties with Washington and the fact that only 3% of our exports go to the US mean Trump 2.0 won’t be an economic disaster. Treasurer Jim Chalmers says we’re well-placed to ride out a global trade war, though we’re “not immune.” But with fresh US tariffs on China—our biggest trading partner— Australia will definitely feel the ripples, especially in commodities: Bloomberg

TREASURY

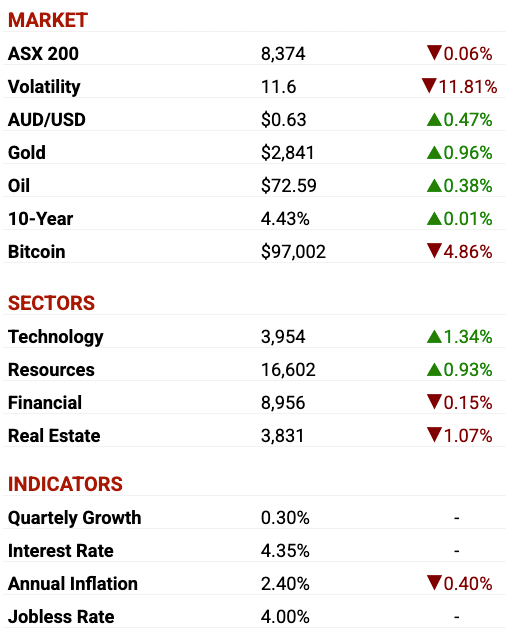

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

2025’s biggest IPO?

TPG is eyeing an IPO for its pets and vets business, Greencross, which could give Virgin Australia a run for its money as 2025’s biggest IPO if it goes ahead: AFR

Brookfield has thrown its hat in the ring for Insignia Financial with a proposal to acquire the firm via a scheme of arrangement at $A4.60 cash per share. That’s the third contender, with CC Capital Partners and Bain Capital ready to put up a tough fight. KWM continue to advise Insignia through this auction stand-off.

Twiggy’s Fortescue will now acquire all of the shares in Red Hawk Mining Limited after buying up 75% of the iron miner. The bid comes with an improved price, moving from $1.05 to $1.20 per Red Hawk share.

Seek’s bid to acquire workplace software player Xref has hit a wall after Xref shareholders shot down a $41m takeover offer. Despite backing from the board and an independent expert, only 67.6% of shares voted in favour—well short of the 75% threshold needed to seal the deal.

US private equity giant KKR has upped its bid for Japan’s Fuji Soft by 4%, intensifying its battle with Bain Capital for the US$4bn IT firm. The ongoing saga highlights the fierce competition in Japan’s dealmaking scene, as global firms target companies with untapped assets or shaky governance: Reuters

Transurban is sitting on a $60bn toll road portfolio, while its market cap is at $41bn. Its underperforming share price has investors betting that it could become a prime acquisition target for pension funds: AFR.

Some Wednesday wisdom for you…

不怕慢,就怕站。

Don't fear going slow, only fear standing still.

SECTOR SPECIFIC

Deloitte’s expensive error

🚜 DIGGERS

BP is hitting the brakes on its Kwinana renewable fuels project as part of a broader cost-cutting spree. It’s the second setback for Australia’s green sector in a day—Queensland’s new government just pulled funding for a $620m hydrogen project. Tough times for the country’s clean energy push: Bloomberg

Rio Tinto’s iron ore shipments are in for more turbulence this quarter after tropical cyclones disrupted operations at two key Pilbara ports. The mining giant sent ships out of Cape Lambert and Dampier to dodge rough swells, adding to supply headaches. Strong wind warnings remain in place, though Taliah is tracking west and away from the region—for now: Reuters

🏦 FIN

Deloitte’s in hot water, agreeing to pay $31m as part of a $43m settlement over its role in auditing Noumi (formerly Freedom Foods). The misleading accounts, spanning 2014-2020, led to hefty investor losses, making this one of Australia’s largest auditor settlements. Noumi was repped by Ashurst, and the class had Slater & Gordon and Phi Finney McDonald: Lawyerly, AFR

Westpac’s business bank is sweetening the deal for small businesses with a year of basic legal services. The bank’s $10m investment in legal provider Lawpath gives customers a 12-month subscription to an archive of legal documents and business registration services: AFR

Pimco’s making a big play in Australian residential mortgage-backed securities (RMBS), betting they’ll outshine corporate debt as the RBA’s likely to cut interest rates soon. The firm’s ramping up its AAA-RMBS holdings for the months ahead, thanks to strong structural tailwinds: Bloomberg

🏡 RETAIL & REAL ESTATE

Woolies is shaking things up with a major restructure, creating a new division, Woolworths Retail. Led by the company’s chief supply chain officer, Annette Karantoni, the division will oversee supermarkets and home-brand products as Woolies works to bounce back from a sales growth slump: AFR

Oceania Glass, Australia’s largest and sole maker of architectural glass, has gone into administration—less than a year after it successfully claimed China and Thailand were flooding the market with cheap glass: The Australian

📱 TECH

Over $4bn flowed into Aussie tech startups like FleetSpace, BetaShares, and Bugcrowd last year—a boost the ecosystem will welcome. A new report ranks 2024 as the third-highest funding year on record. But it’s not all smooth sailing: only 23% of investors closed a fundraise, while 37% fell short of their targets. There’s plenty of cash to splash, but the fundraising game is tougher than ever: Capital Brief

Sydney startup Lorikeet is making waves with its AI-powered customer service agents, already in play at big names like Eucalyptus, Immutable, and Step. With a $100m valuation under its belt, co-founders Steve Hind and Jamie Hall—ex-Stripe and Google execs—are proving that their tech can deliver serious results: AFR

Apple slammed the new EU’s (let’s say) super explicit app Hot Tub, saying the EU’s digital rules are eroding trust in its brand. Once proud gatekeepers—Steve Jobs said Apple has a “moral responsibility” here —Apple now sees its control weakened by the Digital Markets Act, which forced the door open to alternative app stores: Reuters

P.S.

Like Point Blank?

Share the conversion with just 2 people today, and you’ll unlock 15 ways to be a bad lawyer.

It’s easier to win when you know what to avoid.

(Plus, it helps us out a bunch).

Click the button below.

Want to tell us something?

Reply to this email to tell us what we should cover.

New here?

👋 You’re in good company. You’re reading this alongside readers from HSF, KWM, Allens, and Baker McKenzie. Sign up now for insights delivered directly to your inbox.