👋 G’day

Welcome back to another day of insights

Today’s brief:

AI tool fakes citation for BigLaw firm at court

OpenAI’s $10bn overhaul with ex-Apple head

Mayne Pharma deal in jeopardy after MAC event

Here’s the latest 👇

PRACTICE POINTS

Director resignations clarified

In Re AMBBB Pty Ltd, Justice Black clarified how directors can resign where neither a constitution nor replaceable rules dictate the process. The case involved Mr Horne, who signed and delivered a letter of resignation to AMBBB and its accountant. Although the company’s constitution couldn’t be located, Black J found that a resignation can take effect if it’s executed and properly delivered—even without formal acceptance—unless the constitution says otherwise. Importantly, the Court also confirmed that a company’s requirement to have at least one director under s. 201A of the Corporations Act refers to a statutory director, not a de facto or shadow director.

*

In its latest update, ASX has sent a clear reminder to listed companies looking to boost their placement capacity under Listing Rule 7.1A — shareholder approval is key and remains subject to conditions. And if you’re suspended, don’t count on running a renounceable rights issue. ASX won’t approve a timetable unless you’re back trading during the offer period. ASX is tightening the rules and also raising the fees. From 1 July 2025, annual, debt and additional listing fees are going up—initial listing fees follow suit on 1 Jan 2026.

*

ASIC is seeking special leave to appeal the Full Federal Court’s ruling in its case against Block Earner, after the court found the company’s fixed-yield crypto product was not a financial product. The case turns on the scope of what counts as a financial product under the Corporations Act—a definition ASIC says was meant to be broad and tech-neutral. ASIC wants clarity on when interest-earning and asset-conversion products are regulated, arguing the outcome affects not just crypto but all financial services. The High Court will decide whether to hear the case.

WORD ON THE STREET

Judge slams AI blunder

Latham & Watkins has taken the blame for a dodgy citation in the UMG v Anthropic copyright stoush, telling a US judge that its lawyer used Claude to generate a citation, only for the bot to fabricate the title and authors. The judge wasn’t amused, calling it “grave”. Latham’s now promised extra review layers to avoid another AI-assisted facepalm: Reuters

*

Allens has added Gavin Rakoczy to its Banking & Finance partnership, bringing deep expertise in restructuring and distressed debt. With 15+ years of experience, Rakoczy strengthens Allens' creds in the private capital and restructuring space—a savvy play as distressed deals ramp up in a tougher market.

*

Two years post-scandal, PwC Australia says it’s a “totally different firm”—but CEO Kevin Burrowes admits it’s not out of the woods yet. The firm has now implemented 40/47 governance reforms, added four independent directors, and is pushing for a board overhaul. But with a police probe ongoing and Canberra relations still frosty, trust is a work in progress: The Australian

*

🚶♂️ Know who’s on the move? Hit reply.

TALKING POINTS

India opens legal doors

India cracks the door for foreign firms. The Bar Council of India has tweaked the rules, opening up the Indian legal market to foreign players, with strings attached. They can now advise on foreign M&A, IP, contracts and arbitration, but can’t touch Indian law or step foot in an Indian court. A cautious opening, but clearly not a free-for-all: ThePrint

*

Does the Aussie carbon scheme need an overhaul? Top carbon market players GreenCollar, Climate Friendly and AgriProve have slammed the federal government’s carbon market program, saying it’s lost trust and risks derailing the net-zero push. Critics blame botched reforms, integrity issues, and activist interference. With big business walking away, pressure’s mounting on Josh Wilson MP to work up a fix fast: The Australian

*

The latest Board Diversity Index shows ASX300 boards have made real gains on gender — 73% now have over 30% women, up from 399 seats in 2016 to 781 in 2025. But beyond gender? Crickets. Cultural diversity, LGBTQ+ and disability representation have flatlined or gone backwards. Still 91.9% Anglo-Celtic, and zero directors openly report a disability: AICD

THE TREASURY

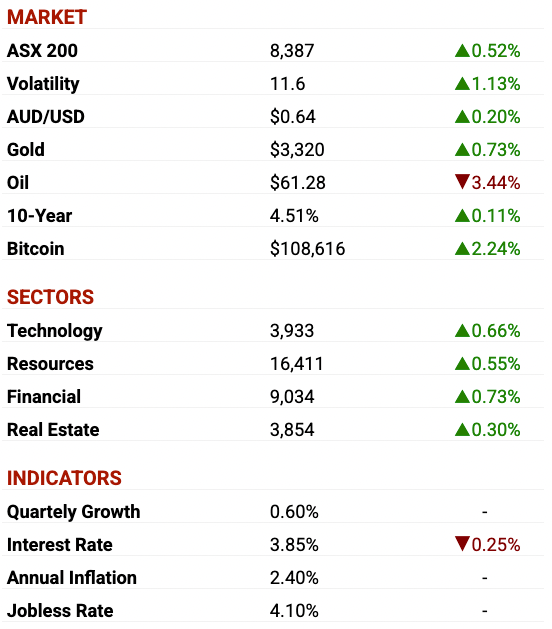

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Virgin tests IPO runway

Virgin Australia: is courting cornerstone investors ahead of a possible June IPO, with Bain Capital eyeing a $3bn valuation. Barrenjoey, UBS and Goldman Sachs are running the process, mirroring GYG’s small-float playbook. Backed by strong H1 earnings ($439m) and a 34.4% market share, the airline’s hoping to lock in premium pricing: The Australian

*

Gold Fields: has secured FIRB approval for its $3.7bn takeover of Gold Road Resources, clearing a key hurdle for full control of WA’s Gruyere gold mine. Gold Road shareholders will get $3.40/share, including a special dividend. HSF are advising Gold Field and Corrs has Gold Road’s back: Mining Weekly

*

Tabcorp: has fielded buyout interest from Intralot for its gaming monitoring arm Max Gaming, potentially worth up to $610m. Under its Max brand, Tabcorp runs Australia’s biggest slot machine monitoring business, holding 67% market share. Tabcorp boss launched a strategic review into the future of Tabcorp, but no decision yet on a sale: The Australian

*

Mayne Pharma: shares crashed 30% after Cosette raised the alarm on a “material adverse change”, threatening to pull its $672m takeover. The concerns? Weak April trading, a lawsuit with TherapeuticsMD, and an FDA warning over birth control ads. Mayne disputes the claim, but Cosette has 10 days to walk unless it’s resolved: Capital Brief

SECTOR SPECIFIC

OpenAI redesigned for $10.1bn

🚜 DIGGERS

Despite a brutal 90% lithium price plunge, Aussie miners aren’t rattled. IGO’s Ivan Vella says lithium is “too big to fail”, with CATL’s $7bn Hong Kong IPO proving long-term demand is alive and well. Liontown shrugged off sodium-ion buzz, while PLS backed its high-grade Brazil play, even as forecasts show Australia’s grip on global supply could slip by 2035: AFR

*

Malcolm Bundey – a former Deloitte auditor with zero mining experience – has been parachuted in as incoming MinRes chair after what the company called an “extensive international search”. The packaging exec-turned-private equity player lands in Perth’s biggest governance mess with a $750k salary and options: AustralianMining, AFR

🏦 FIN

JPMorgan moves from crypto foe to facilitator. Despite once calling bitcoin a haven for criminals, Jamie Dimon now says JPMorgan will let clients buy it, though it won’t hold the coins or cheerlead the trend. “I don’t think you should smoke, but I defend your right to,” he quipped. The shift comes as Trump-era regulators loosen crypto rules for US banks: FinExtra

*

The Finance Sector Union has sent an open letter to NAB CEO Andrew Irvine, slamming the bank’s new mandate for more office days as “regressive and unnecessary.” Junior staff are being pushed to three days a week, team leads to four. The FSU says the move reeks of “control over trust”, warning workers may walk if the bank doesn't back down: The Australian

🏠 RETAIL & REAL ESTATE

Brisbane’s CBD office market remains the best-performing in the Asia-Pacific, with annual rental growth hitting 14.2%—despite signs of stabilisation. Knight Frank tips a breather this year (just 2.2% rent growth), but with no new office space coming online between 2026 and 2028, any spare space is expected to be snapped up quickly: Commo

*

Dexus has won a temporary injunction in its bitter court battle with super fund giants trying to force it out of Melbourne Airport. The co-owners allege Dexus breached confidentiality when it tried to sell a 9.7% slice of its $4bn stake. With board access restored and a full hearing set for August, the airport fight is only just taking off: The Australian

📱 TECH & STARTUP

OpenAI is snapping up AI device startup io — co-founded by ex-Apple design chief Jony Ive. The monster A$10.1bn (US$6.5bn) all-stock deal is its biggest yet. Ive will now lead design across OpenAI, while Altman remains in the CEO seat. The pair are working on a “crazy, ambitious” new AI-powered device due in 2026. A reimagining of computing is coming, says Altman: Capital Brief

*

Airwallex just raised a monster $467m, making it the first Aussie tech start-up since Canva to win backing from all three major local VC firms: Blackbird, Square Peg and Airtree. The raise values the global payments unicorn at $6.2bn. IPO plans are brewing, but co-founder Lucy Liu says they’ll only list when the market’s ready: AFR

Till next time,

-Team PB