👋 G’day

Welcome back to another day of insights

Today’s brief:

Allens leads decade of Aussie megadeals

53% of firms haven’t adopted new tech

Lawyer fees slashed in class appeal

Here’s your latest 👇

PRACTICE POINTS

Director deal voided

The NSW Supreme Court has found Ms Sopharak breached her fiduciary and statutory duties by selling her company’s restaurant to her own newly set-up entity for just $2. As sole director and shareholder of the purchaser, the court said she had a clear conflict of interest. The sale was made without shareholder consent or a proper valuation. The court ruled the transaction wasn't in the best interests of the company, especially as the company still owed $93k to the ATO and held assets worth far more than $2. Ms Sopharak also tried to argue she should be excused under s 1318, but the court said no—she acted for personal gain. The sale was rescinded.

*

Do you even know if you’re using AI? Courts keep calling out lawyers for filing AI-generated work riddled with fake citations. Whether the draft came from a chatbot, a clerk, or “summarise this doc” tools, the principle is the same: you're responsible. Recent cases show some lawyers didn’t realise research tools now blend AI into search results. Supervisors aren't off the hook either—training and clear policies are key. The QLS has a free AI companion guide to help firms navigate the risks: QLS

*

The Full Federal Court has dismissed an appeal by the acting law firm in a class action, confirming a significant $1.14m reduction in legal fees, even though it partly agreed with the appellants. The original $11m settlement would’ve gone entirely to lawyers, leaving group members with effectively nothing. While the Court accepted that a mediation might not have succeeded, it still found costs incurred due to a nine-month delay in expert evidence were unjustified. The ruling reinforces that under s 33V(2) of the FCA Act, courts can and will trim costs, even when settlements are otherwise fair and especially where unexplained delays inflate the bill.

WORD ON THE STREET

Allens’ mega deals

From Rio Tinto’s $3.5bn hostile win in 2000 to Santos’ $36.4bn merger bid in 2025, Allens has led some of the biggest M&A deals in Aussie history. Whether it's BHP-Billiton, Wesfarmers-Coles, or Sydney Airport’s $32bn sale, Allens has been behind the scenes shaping market-defining transactions. We’ve dived into Allens’ decade-defining deals. Check it out here.

*

Clifford Chance has launched a dedicated transactional Construction team in Australia, tapping Katie Joukadjian from Pinsents to lead it. The hire deepens the firm’s front-end major projects capability. It follows a hiring spree across M&A and class actions, with CC clearly in growth mode: Clifford Chance

*

A UK paralegal has been jailed for 20 months after using erasable ink to alter cheques and steal £11.5k from vulnerable clients. Emma Amey exploited her firm's power of attorney access, even buying things online with clients’ debit cards. The judge slammed the conduct as “despicable and contrived”. The fraud went undetected for 2 years: Legal Cheek

*

Despite all the hype, 53% of firms haven’t adopted new legal tech in five years. But change is brewing. 10% are prepping 20%+ spend boosts, with mid-tier firms driving the shift. The adoption is slow and trust-led. And 58% discover tech via peer referrals, not sales calls: Agile Market Intelligence

TALKING POINTS

AI cuts out creators

As AI models pump out recipes, playlists and news recaps, creators are getting cut from the profits. Royalties for AI-generated content are being floated, but the kicker? Big labels and media giants score the cash, while indie artists and writers are left with crumbs. Just ask News Corp, pocketing $250m from OpenAI, while most creators see zilch: Capital Brief

*

A growing number of under-25s answer work calls without saying hello, and employers aren’t loving it. Recruiters say ghost-greeting is baffling, and poor phone manners are costing young workers jobs. Some stay silent over identity fraud fears, others just find calls rude. Either way, Gen Zs need to bring back saying hello: AFR

*

Women now hold 45 chair roles across ASX 300 boards, but that’s still just 15%. The ASX 20 leads the charge with 42% female directors, while the ASX 300 trails at 37.5%. It's a steady climb, but despite the progress, leadership at the top remains stubbornly bloke-heavy: AICD

*

THE TREASURY

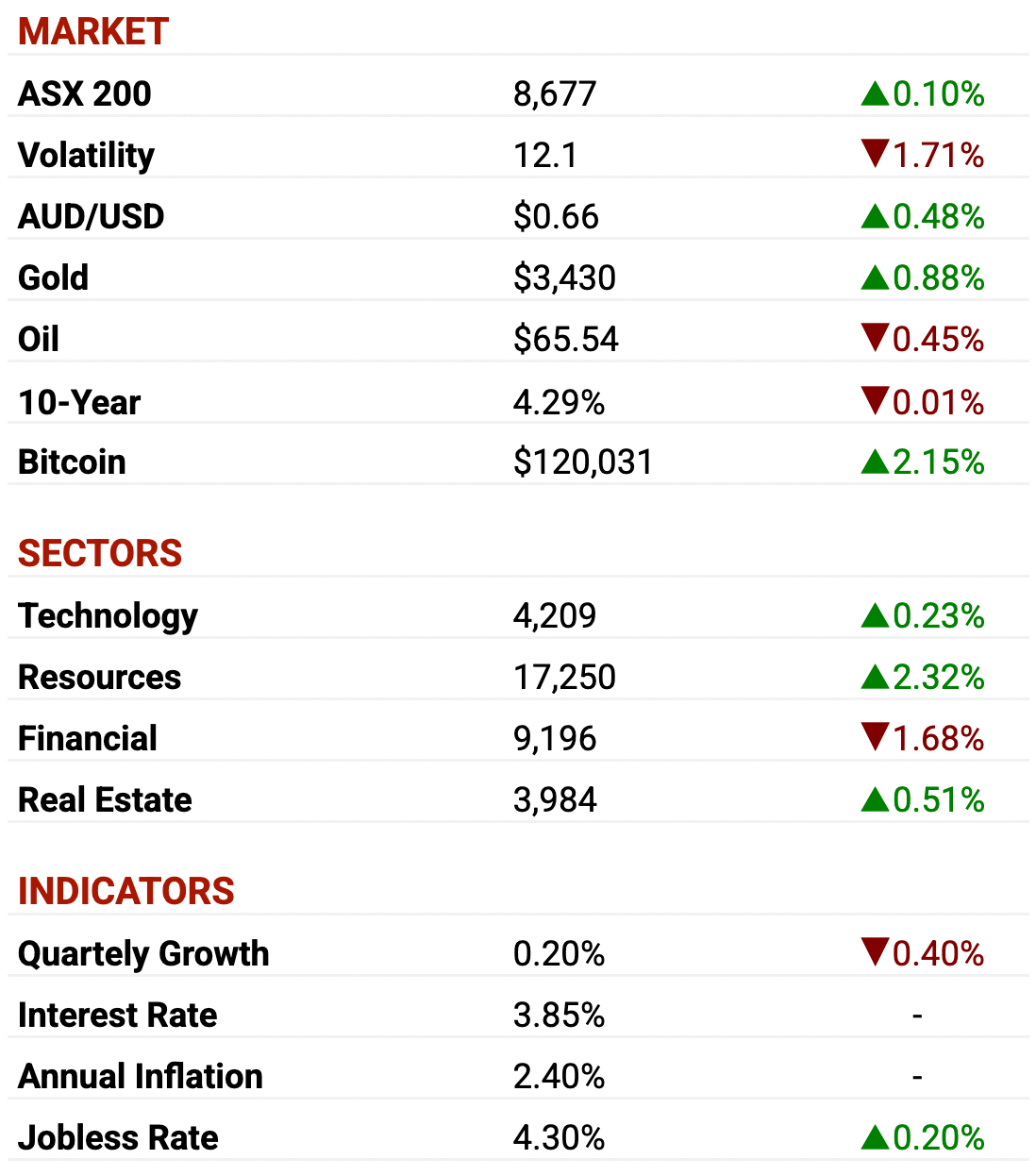

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Insignia seals deal

CC Capital: has sealed a $4.80 per share cash offer for Insignia Financial, ending months of back-and-forth. CEO Scott Hartley says the deal reflects how undervalued Insignia was on the ASX. It’s a discount to Bain’s earlier $5 bid, but with $330bn FUM and a turnaround in motion, investors are calling it a fair shake. KWM is advising Insignia, and Ashurst is repping CC: AFR

*

Spartan Resources: has officially been snapped up by Ramelius Resources, with the $0.25 cash and 0.6957 scrip per share scheme now legally effective. Spartan shares were suspended as the WA Supreme Court orders were lodged with ASIC. Both stocks jumped on the news as the gold sector consolidation keeps humming. HSF Kramer advises Spartan, Allion Partners for Ramelius: ASX

*

MIXI Australia has kicked off its all-cash $1.20 per share takeover for PointsBet, already locking in 17.18% via director support and pre-bid deals with Bennelong and Pictet. With no gaming approvals left to chase and the board’s backing (absent a better offer), MIXI’s open until 25 Aug. But betr’s lurking, so it ain’t over yet: NationalTribune

SECTOR SPECIFIC

Rinehart’s pink palace

🚜 DIGGERS

Gina Rinehart officially has too much money. She’s splashing $270m on her West Perth HQ, including a pink facade, private radio studio, cat-themed meeting room, and yes, a helipad for her $10m chopper. The five-storey Roy Hill HQ will host up to 12 landings a year. Perth council’s still mulling it over: AFR

*

Northern Star’s $1.3bn Hemi project—set to become one of Australia’s biggest gold mines—is facing an EPA appeal from the Kariyarra Aboriginal Corporation over how it plans to discharge wastewater. KAC says relations with De Grey soured and wants stronger protections for the Turner River: AFR

🏦 FIN

Proxy firms Ownership Matters and Glass Lewis are urging investors to vote against Macquarie’s pay report, slamming the $24m payout to CEO Shemara Wikramanayake despite compliance blow-ups. A wave of global funds, including CalPERS and SBA Florida, are backing the revolt, setting the stage for Macquarie’s first-ever shareholder strike at tomorrow’s AGM: AFR

*

ASX-listed MoneyMe’s now a principal issuer on Mastercard’s network, unlocking direct access to global rails and faster product rollouts. It’s also plugged in new card-processing tech from US firm Episode Six, giving it more control over card features, design and distribution. CEO Clayton Howes says it’s a “high-margin” play that fills a gap where the big banks have underdelivered: FSTMedia

🏠 RETAIL & REAL ESTATE

Hostplus has moved to oust Lendlease from managing its $2bn industrial property fund, backing Mirvac as a replacement. It’s the opening shot in a battle for Lendlease’s $10bn APPF empire, which includes office and retail funds too. Lucrative management fees and future control of high-performing industrial assets are on the line: The Australian

*

SP Setia has snapped up a $114m site in Carlton, marking the suburb’s biggest development deal in over a decade. The Malaysian developer ditched office plans on nearby La Trobe St last year to ride the apartment resurgence, and this new Queensberry St site could house retail, residential and student accomm: The Australian

📱 TECH & STARTUPS

Melbourne-based Everlab has raised $15m in seed funding, one of 2025’s biggest so far, to take its full-body MRI health checks global. The pricey $3k–$15k annual service has 3k+ paying members and a hefty waitlist. Next stop? Clinics in Europe, the US and APAC by 2026: AFR

*

Telstra is axing another 550 roles as part of its ongoing enterprise division restructure, but insists the move isn’t AI-related. This follows last year’s headcount reduction of 1900 roles (out of a proposed 2800) aimed at boosting productivity. The telco is still targeting $350m in savings as it simplifies ops and chases its projected $2.28bn profit: The Australian

Till next time,

-Team PB