👋 G’day

Welcome back to another day of insights

Today’s brief:

Kirkland, Latham and DLA dominate revenue

Future rainmakers are jumping for equity pay

Awkward Rudd moment in critical minerals deal

WORD ON THE STREET

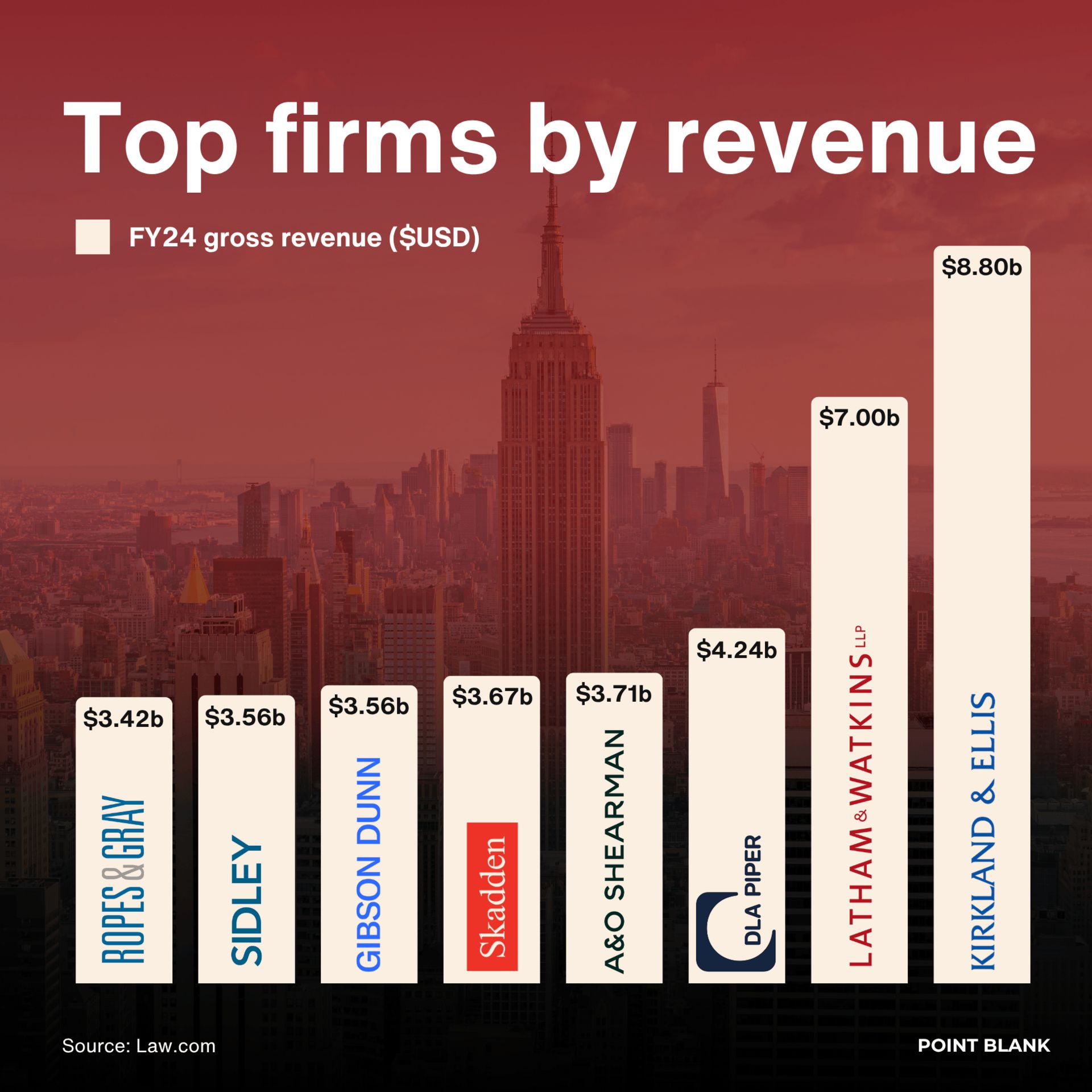

World’s richest firms

It’s winner-take-all at the top. Global 200 data shows total Big Law revenue jumped 11.8%, but the top 10 firms now control almost 20% of the global pie. Kirkland & Ellis leads with US$8.8b, ahead of Latham & Watkins (US$7b) and DLA Piper (US$4.2b). Check out the full article here: Point Blank

*

A former solicitor trainee has been permanently banned from the profession after helping her brother escape following a fatal drive-by shooting in Manchester. She hid him in a hotel and transferred £2.8k to help him flee abroad. The SRA calling her conduct “premeditated”: Point Blank

*

In Big Law’s new “free-agent era”, newly minted partners at top firms are being courted by rivals who see them as future rainmakers. Those partners on non-equity tracks are most likely to move - often promoted in title but not pay, they’re using the new badge to jump for better equity prospects: Law.com

*

A barrister and a solicitor have blown up on LinkedIn after announcing their marriage in the form of a courtroom judgment, complete with citations and a no-appeals clause… no lie. The post, dubbed Dove v Crombleholme [2025] 1 LMR 1010, has racked up over 2,000 reactions from lawyers applauding the rare “positive LinkedIn update.”: Legal Cheek

PRACTICE POINTS

ASX eyes tighter approvals

Corporate: The ASX has opened consultation on reforms to shareholder approval requirements for dilutive acquisitions and dual-listed entities. Key proposals include mandatory shareholder votes when a dual-listed company changes to Foreign Exempt status or delists from ASX - moves ASX says are potentially significant enough to warrant investor input. It’s also considering lowering the cap on share issues under takeover or merger exceptions to 25% for ASX300 companies, while maintaining flexibility for smaller caps. For significant acquisitions, ASX isn’t yet proposing new rules but is inviting feedback on whether major transactions without share issues should also trigger shareholder approval. Options range from keeping the status quo to adding guidance or formally amending Listing Rules. Get your subs in - submissions close 15 Dec: ASX

*

IP: Hall & Wilcox’s John Bassilios has dropped a sharp guide to protecting IP in fintech, breaking down how to lock down your code, brand and innovation. Think of it like your IP 101 — Copyright automatically shields your software as a literary work, while patents can cover functionality if it’s novel and inventive. Protect the confidential stuff (eg, algorithms, data and know-how) via NDAs. On ownership, IP made by employees stays with the employer, but contractors keep their IP unless it’s assigned in writing. Joint ownership can get messy, with patent co-owners not being able to license without consent, and copyright or trademark co-owners needing full agreement. Trademarks registered through IP Australia last 10 years and help avoid accidental infringement. A handy roadmap for founders and lawyers that want to brush up on their IP know-how: Lexology

*

Regulatory: Two former Statewide Super executives have been acquitted of dishonesty charges in South Australia. Former CFO Grant Eastwood and CRO Kieran Netting were accused of breaching ss 184(2)(a)-(b) of the Corps Act over service procurements made in 2019. The case, referred by ASIC and prosecuted by the CDPP, alleged the pair acted dishonestly in the fund’s procurement process — but the jury disagreed. The verdict underscores the high bar for proving dishonesty under corporate law, even in regulator-backed prosecutions: ASIC

TALKING POINTS

Louvre heist

Thieves in balaclavas and hi-vis vests broke into the Louvre Museum in broad daylight, stealing “priceless” crown jewels once owned by Napoleon’s wife, Empress Marie Louise, and Empress Eugenie. The four-minute raid saw the robbers escape on motorbikes after smashing display cases in Apollo’s Gallery. President Macron called it “an attack on our history”: ABC News

*

An otherwise smooth Albanese–Trump meeting turned awkward when Trump was asked about Kevin Rudd’s past attacks, calling him “the most destructive president in history.” Not realising Rudd was in the room, Trump quipped, “I don’t like you either – and I probably never will.” Rudd later apologised, and Trump said “all’s forgiven” as the pair sealed a critical minerals deal. The opposition now call for Rudd to go: AFR

TREASURY TUESDAY

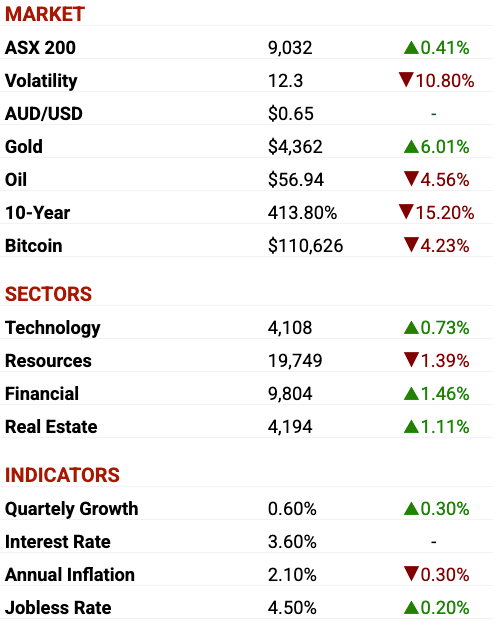

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Stock image merger stalls

The Getty Images and Shutterstock: $5.7bn merger has hit a hurdle, with the UK Competition and Markets Authority warning it could “substantially lessen competition.” The CMA says GenAI tools aren’t yet credible substitutes for stock imagery due to quality and licensing risks: Capital Brief

*

Gold Fields: fresh off its $3.6bn Gold Road takeover, is tipped as a frontrunner for BHP’s $1bn asset sell-off in WA. The South African miner’s nearby operations make it a logical buyer for BHP’s mining tenements and Kambalda concentrator, which could be repurposed for gold: The Australian

SECTOR SPECIFIC

AU-US critical minerals pact

🚜 DIGGERS

Donald Trump and Anthony Albanese have inked an $8.5bn deal to boost US-Australia cooperation on critical minerals, aiming to cut reliance on China. The agreement includes US and Australian funding for new projects, such as a Pentagon-backed gallium refinery in WA, and pledges to adopt “price floor” trade standards. Trump also confirmed plans to proceed with submarine sales under AUKUS, while pressing Australia to lift defence spending: Bloomberg

*

Santos CFO Sherry Duhe says she was sacked days after raising concerns about CEO Kevin Gallagher’s leadership style. Chairman Keith Spence told her she was “no longer needed” after she refused to sign an NDA that would’ve secured her a good leaver payout. The move has fuelled investor worries over governance at Santos: AFR

🏦 FIN

ANZ CEO Nuno Matos has shut down data tech firm DataCo, blindsiding clients including Nine Entertainment, SBS and Southern Cross Media. The move, part of Matos’s cost-cutting overhaul, could expose the bank to compensation claims. DataCo’s “clean room” tech powered ad effectiveness insights using ANZ’s transaction data, with several commercial deals signed just weeks before its abrupt shutdown: AFR

*

CommSec has posted a $155.7m profit, up 36%. The CBA-owned broker reported revenue of $288.7 million, with over 40% of Australian investors now on its platform. Rivals Ord Minnett, Shaw and Partners, and Euroz Hartleys also reported profit gains, mirroring trends seen at Robinhood and Charles Schwab as investors pile into trading amid market volatility: AFR

🏠 RETAIL & REAL ESTATE

AussieSuper has committed $1.1bn to launch a UK housing investment platform, targeting rental and student housing. The fund, which manages $385bn, plans to deploy £8bn into the UK by 2030, with its local portfolio tipped to hit £18bn. UK Chancellor Rachel Reeves says the move will help get “Britain building again”: Capital Brief

*

S&P Global Ratings expects China’s housing downturn to drag on, forecasting an 8% fall in property sales for 2025 and a further 6–7% drop in 2026 as demand stays weak. Developers like Cifi, Sunac and Country Garden are racing to restructure billions in offshore debt, with creditors eager to “get things done and move on.” S&P says housing prices won’t stabilise until unsold inventory starts to fall: SCMP

📱 TECH & STARTUPS

A massive AWS outage knocked out access to Amazon, Zoom, Snapchat, Canva, Coinbase, and Microsoft 365, disrupting users worldwide. Amazon Web Services blamed the blackout on DNS issues in its US-East-1 region, but said the problem has now been “fully mitigated.” Gaming platforms like Fortnite and Roblox also crashed, underscoring global reliance on Amazon’s cloud infrastructure: The Australian

*

Startmate is overhauling its accelerator program with new Founder Streams, offering 12-week, sector-specific programs led by experienced founders from Canva, Microsoft, Leonardo.AI, Google and others. CEO Michael Batko says the model doubles down on Startmate’s “superpower” of mentorship, giving startups hands-on guidance tailored to AI, hardware, B2B and consumer sectors. Each founder will join a specialised stream to set goals, de-risk assumptions and scale faster: Startup Daily

JOB OPPORTUNITIES

P.S.

Till next time,

-Team PB