👋 G’day

Welcome back to another day of insights

Today’s brief:

Golden retriever joins Federal Court team

Tax Board launches new partner investigations

Execs cautious on AI, with 95% of projects failing

WORD ON THE STREET

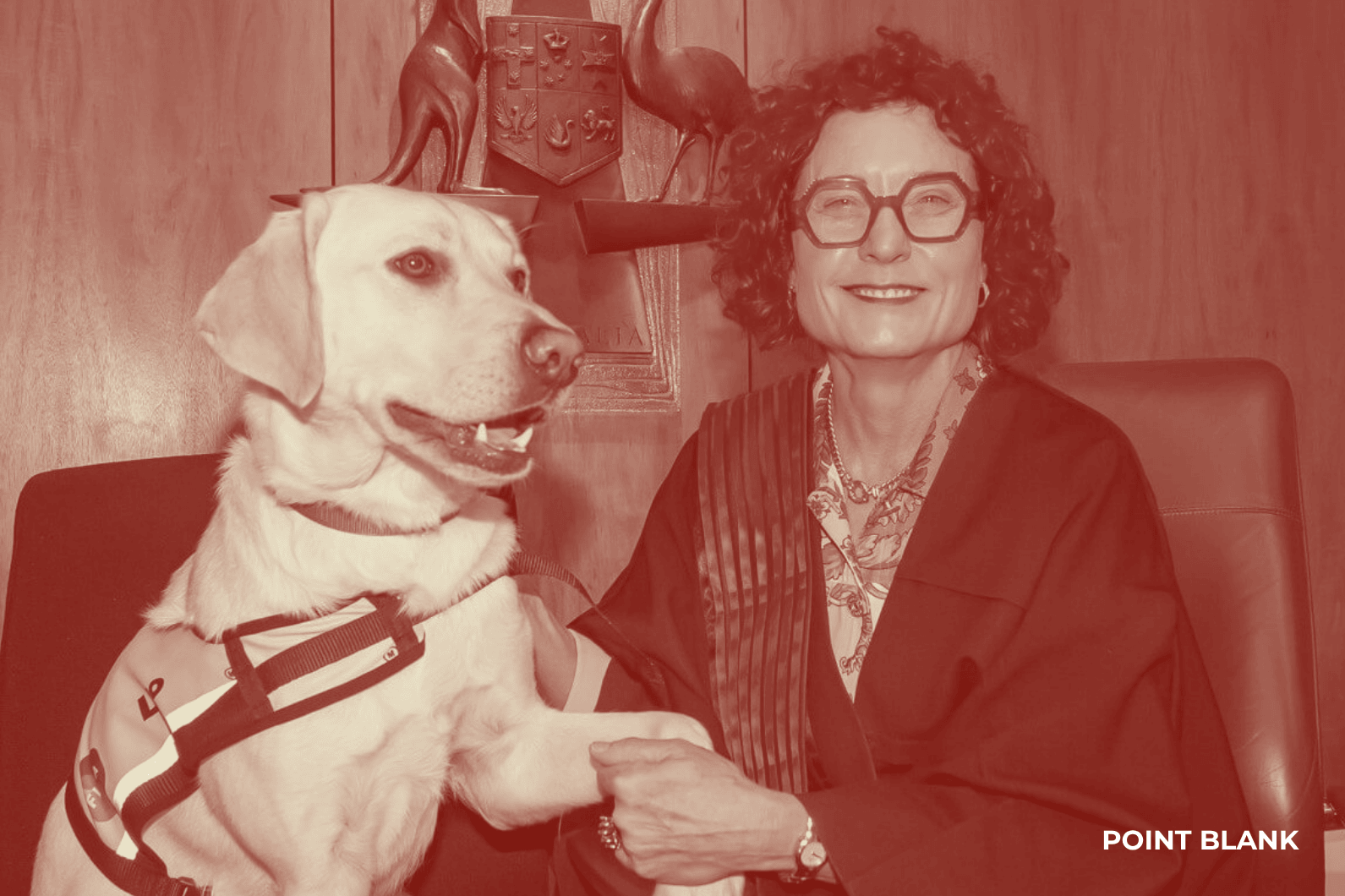

Court’s newest recruit

The FCFCOA has sworn in Leo, a golden retriever trained by Guide Dogs Australia, as its newest court dog in Brisbane. The first male in the national program, Leo was welcomed at a special swearing-in ceremony, joining his counterparts in Melbourne, Sydney and Parramatta. Funded by QLS and FLPA, Leo will help children and vulnerable litigants feel calmer in court: Point Blank

*

PwC faces fresh scrutiny as tax watchdog opens new probes. The Tax Board has launched fresh investigations into current and former PwC partners over potential code breaches, extending the fallout from the firm’s tax leaks scandal. It comes as the AFP’s Operation Alesia continues, with 90,000 documents under review. PwC has overhauled governance under CEO Kevin Burrowes, meeting nearly all of its 47 “commitments to change.”: AFR

*

In an interview with the AFR, NSW Chief Justice Andrew Bell warned that attacks on judges, the rise of “tech barons” like Musk and Zuck, and public mistrust are eroding faith in justice. He called the rule of law “civic infrastructure,” urging greater funding, access and transparency to restore trust in the courts: AFR

*

Private equity is flooding the legal sector. Deals are surging across Europe and Australia, with firms like Cravath, Skadden and Mayer Brown advising on multi-million-dollar law firm investments. From Inflexion’s $450m DWF buyout to Investcorp’s stake in Stowe Family Law, investors are betting big on legal tech, AI and global expansion: Law.com

PRACTICE POINTS

40-year precedent overturned

Government/Constitutional: The High Court has ruled that the Federal Government can pass laws that retroactively fix unconstitutional State laws, overturning nearly 40 years of precedent. In G Global v Commissioner of State Revenue, the Court upheld a Commonwealth Act which revived Queensland and Victoria’s foreign buyer surcharges. Those surcharges conflicted with international treaties. To fix this, the Commonwealth later passed an Amending Act, which retroactively amended the original Act to say the treaties operate subject to any inconsistent State or Commonwealth law. The Court agreed the State laws were invalid at the time because they clashed with Commonwealth treaty laws under s 109 of the Constitution. But get this — the Court also OK’d the fact that the Commonwealth later cured that inconsistency by changing its own law with retroactive effect, as if the conflict had never existed. In doing so, the Court overturned its 1984 Metwally decision: Clayton Utz

*

M&A/IP: Australia’s new mandatory merger regime will extend far beyond traditional M&A, with major implications for IP transactions. From next year, assignments, licences, options and royalty transfers involving IP must be notified to the ACCC if they meet new monetary thresholds, even if they look like ordinary commercialisation deals. Crucially, patents lose their “ordinary course” exemption, meaning every patent assignment or licence must be tested for notification. The rules apply where the IP is used in an Australian business and thresholds are met. Failing to notify renders the transaction void, stripping standing to sue for infringement, and may even attract penalties: Gilbert + Tobin

*

Property: The Retail Leases Amendment (Review) Bill 2025 (NSW) has dropped, kicking off the first wave of reforms from the Act’s statutory review. The Bill tweaks the Retail Leases Act 1994 with new disclosure rules, a lawyer waiver option for the 7-day disclosure period, and accountants are now allowed to certify outgoings for standalone sites. Lessors can also recoup lease prep costs when parties ditch an assignment for a new lease, and extensions are now possible if the tenant delays holding things up. The relocation rent test gets sharper too, factoring in foot traffic, retail mix and layout — not just value. COVID-19 provisions are finally scrapped, with all changes applying only to future leases once proclaimed.

TALKING POINTS

Protest law struck down

The NSW Supreme Court has ruled that Labor’s anti-protest law giving police powers to move on demonstrations near places of worship is unconstitutional. The Palestine Action Group successfully argued that it breached the implied freedom of political communication. Justice Anna Mitchelmore said protests in civic areas often occur near worship sites, and the law’s burden on free speech “goes further than the constitutionally valid baseline”: The Guardian

*

Corporate Australia is hedging its bets on AI, with execs cautious about returns after an MIT study found 95% of AI projects fail to deliver profits. A Dayforce survey shows 40% of executives fear their skills are becoming obsolete, and some even regret their career choice. As one futurist put it, leaders are “excited and terrified” — AI’s hype hasn’t yet met its business case: The Australian

DEAL ROOM

Beauty sale

L’Oréal: Kering, the owner of Gucci, is offloading its beauty arm to L’Oréal for €4bn (A$7.2bn), including Creed and 50-year licences for Bottega Veneta and Balenciaga. The cash helps chip away at €9.5bn (A$17bn) net debt and pivots focus back to fashion, while Gucci wrestles with slower China demand: Reuters

*

Ontario Teachers: is looking set to sell its Sydney Desalination Plant stake to partner UTA, run by Morrison, after bids landed near book value. UTA’s pre-emptive rights make it the frontrunner to take full control of the asset, jointly bought for $2.3bn in 2012: The Australian

SECTOR SPECIFIC

Romance scams rise

🚜 DIGGERS

Rio Tinto’s new CEO Simon Trott plans to cut layers and simplify operations. He’s already shrunk the exec team, combined the lithium with the aluminium division, and will sell the titanium and borates division. Trott signalled more asset sales and job cuts could follow as he pushes for a leaner Rio: AFR

*

Woodside has blasted the surge in environmental lawsuits targeting its North West Shelf gas project, calling them “vexatious”. The company says 12 cases have been filed in five years, mostly dismissed or withdrawn. Activists argue they’re enforcing legitimate scrutiny, but Woodside insists the legal barrage is stalling investment: The Australian

🏦 FIN

The UK’s FCA says banks and payment firms must tighten monitoring and staff training after romance scams cost UK victims £108m in 2024, up 9% year-on-year. The scams involve fraudsters who engineer false romantic relationships or friendships, usually via social media or dating sites, deceiving victims into sending money: FinExtra

*

Shares in three Blackbird VC funds have been sold at an average 35% discount, spooking investors who fear its start-up valuations are overstated. The markdowns affect its 2018, 2020 and 2022 funds, which back firms like Canva, Airwallex and Heidi Health. Once Australia’s VC crown jewel, Blackbird now faces valuation jitters as rising rates and AI-fuelled hype test the tech sector’s resilience: AFR

🏠 RETAIL & REAL ESTATE

Rello, a real estate-backed fintech, is under ASIC scrutiny for offering home-buying finance without a credit licence. The company insists its advances of up to $250k are “service agreements” and “not loans.” Consumer Action Law Centre warns the model skirts regulation, urging ASIC to act before more borrowers get burned: The Australian

*

Australia’s TGA is warning that SPF data may be unreliable, after more than 20 sunscreen brands (including Ultra Violette, Aspect Sun, and We Are Feel Good Inc) failed to meet their SPF50+ claims. The regulator says flawed testing has shaken consumer trust, with sunscreen sales down 10% ahead of summer: AFR

📱 TECH & STARTUPS

OpenAI is scouting Australian data centre deals as part of a $US500bn (A$771bn) global AI infrastructure spree through its Stargate venture with Oracle and SoftBank. OpenAI’s Chris Lehane says the company will invest in Australia “one way or another,” even if Canberra refuses to relax copyright laws. With rivals like AirTrunk and CDC expanding, Lehane says the country could become a “global AI playground.” AFR

*

Uber is piloting a new program that pays drivers and couriers to complete “digital tasks” to help train AI models. Like uploading photos or recording voice samples. The company says it’s a way for drivers to earn during downtime, with payouts up to $1 per task. The move expands Uber’s AI Solutions business, even as autonomous vehicles threaten driver jobs: Capital Brief

JOB OPPORTUNITIES

P.S.

Till next time,

-Team PB