👋 G’day

Welcome back to another day of insights

Today’s brief:

Court sends message with Qantas fine

Law firms behind the CoStar-Domain deal

NT Chief Justice calls out “traditional violence”

Here’s your latest 👇

PRACTICE POINTS

Qantas’ $90m blunder

The Federal Court has imposed a $90m penalty on Qantas for illegally sacking 1,820 ground staff in 2020, with Justice Michael Lee describing the airline as showing the “wrong kind of sorry”. He voiced “disquiet” about what went on inside Qantas’ leadership, doubted the sincerity of its contrition, and criticised the absence of CEO Vanessa Hudson’s testimony. Lee condemned Qantas’ opaque decision-making, attempts to obscure former CEO Alan Joyce’s role, and its PR “spin” of court rulings. Half the penalty will be paid to the Transport Workers’ Union, with the remainder still to be allocated. The fine comes on top of $120m in compensation already agreed with workers, taking the cost of the unlawful outsourcing above $200m. The Court made clear, this is a message to big businesses who will face hefty penalties — and those funds will go to unions to enforce the Act: The Guardian

*

The ACCC has commenced Federal Court proceedings against Google Asia Pacific. Google is playing ball, admitting it breached s 45 CCA after striking revenue share deals with Telstra and Optus that required Android phones to pre-install Google Search exclusively between Dec 2019–Mar 2021. In return, the telcos received a cut of ad revenue. Google has agreed with the ACCC to pay a $55m penalty (subject to Court approval), and signed enforceable undertakings to remove pre-installation and default restrictions from contracts. The ACCC says the case ensures consumers have more search choice, as AI tools reshape competition, and confirms that exclusive default arrangements will remain a regulatory priority: ACCC

*

The Federal Court of Australia has launched a review of its digital practices and procedures, including the Technology and the Court Practice Note (GPN-TECH), guidelines and possible rule changes. It’s seeking submissions on virtual hearings, live streaming, digital court books and expert conferencing by AVL, plus the role of AI in litigation and whether regulation is needed across all courts. Submissions close 26 September 2025.

WORD ON THE STREET

Top firms drive Domain deal

CoStar’s $4.43-a-share swoop on Domain is now officially approved, giving Nine a tidy $1.4bn payday and Domain a path off the ASX. Gilbert + Tobin led for Domain with Costas Condoleon and Karen Evans-Cullen; Corrs ran point for CoStar via Sandy Mak and Adam Foreman; while Ashurst advised long-time client Nine. Check out our deal deep dive here.

*

Goldman Sachs now says 17% of US legal jobs are at risk from AI automation, or around 228,000 roles. Well, it’s not as dire as GS’s forecast two years ago, when it said 44% of legal tasks could be automated. Don’t fret just yet, Goldman reckons risk doesn’t equal replacement. Mass lawyer layoffs aren’t imminent, but the legal sector remains firmly on AI’s radar: Artificial awyer

*

A former employment lawyer was struck off in the UK after admitting she misled the employment tribunal by blaming phantom IT issues for missing key emails. She also misled multiple clients—one of whom she settled for without instructions. The SDT found “serious, deliberate and repeated” dishonesty, stripping her of anonymity and her practising certificate: Law Gazette

*

Catherine Pedler, former head of Ashurst’s Perth disputes team, has joined A&O Shearman as a partner. With 14 years at Ashurst and cross-border experience in energy, mining and regulatory disputes, she’s been brought in to strengthen the firm’s litigation practice. The hire marks another move in A&O Shearman’s 15-year Aussie growth push: Lawyers Weekly

TALKING POINTS

Four-day dream stalls

It might be time to move to Belgium. It was the first Euro country to legislate a 4-day work week in 2022. Since then, more than 200 UK companies have adopted the shorter workweek. While global rivals rave about happier staff, Aussie companies are dragging their feet. Unilever and Bupa canned their trials, calling the model too rigid, and unions now want it on the table at this week’s productivity summit. Surveys show 65% of workers love the idea, but for most, flexibility still outranks long weekends: AFR

*

Wastewater testing shows Aussies consumed 22.2 tonnes of cocaine, meth, MDMA and heroin in 2024 — the highest since monitoring began. Cocaine use surged 69%, hitting record levels, while meth use jumped 21%. The Northern Territory saw the sharpest spikes, with cocaine up 222%. The ACIC says the post-COVID drug trade rebound could keep pushing usage higher in coming years: TDA

*

NT Chief Justice Michael Grant says extreme attacks on Aboriginal women are being excused as so-called “traditional rights”, branding them “bullshit traditional violence”. Speaking at a Piddington Society event, he warned domestic violence in the NT has worsened despite federal laws barring customary law as a defence. He said alcohol fuels 90% of assaults, with sexual jealousy often cited as a trigger in cases before the court: The Australian

DEAL ROOM

Aurizon mulls $8bn sell-down

Aurizon: is weighing a sell-down of its $8bn Central Queensland Coal Network, with Ares and Apollo among suitors circling. The 2670km “below rail” asset hauls coal for BHP, Glencore and Whitehaven, generating $956m EBITDA in FY25. Goldman Sachs is running the process, with a 49% stake tipped to fetch $3–4bn to appease frustrated shareholders: AFR

*

PointsBet: is the prize in a heated tussle, with Betr confirming its scrip bid is now open and due to close on 22 Sept, unless extended. But the board still backs MIXI’s $1.25 cash offer, which has gone unconditional and shuts 25 Aug. MIXI’s lifted its stake to 33%, while Betr sits at 19.6% and spruiks synergies.*

Heaps Normal: has pulled in Robbie Williams as a new shareholder, after the pop star fell for the no-alc beer on tour. The Sydney brewer, growing revenues 20% last year, is pushing into the UK and US with Rob on promo duty. With a Series B raise on the cards, the brand’s already outpacing the broader non-alc category by 4x: AFR

SECTOR SPECIFIC

AirTrunk’s record green loan

🚜 DIGGERS

Rare earths junior Kaili Resources – backed by Yitai Coal – rocketed 8650% yesterday, forcing an ASX price query. The miner pinned it on drilling approval news, but fundies weren’t buying it. Less than $2m traded before the stock closed up 2900% at $1.08, with some punters tipping a pump-and-dump: AFR

*

The WA gov is wooing Japanese energy giants to replace BP, which walked away from its 40.5% stake in the $50b Australian Renewable Energy Hub in the Pilbara. BP quit over delays in offtake deals, leaving InterContinental Energy and CWP Global to push on. Analysts say Japan could revive the project, but only if costs and pricing hurdles are cracked: AFR

🏦 FIN

NAB CEO Andrew Irvine has revealed the bank will cop a $130m blow this year after uncovering fresh staff underpayments — six years after its first payroll scandal cost $250m. A new payroll platform exposed the errors, and costs could climb further as reviews continue. The disclosure overshadowed flat $1.77bn cash earnings for the June quarter: The Australian

*

Goldman Sachs is expanding its Aussie private wealth arm as family offices boom off the back of Canva, Atlassian and old mining money. With just 13 staff on the ground, Goldman’s targeting clients with $100m+ to invest, offering access to global bankers and private deals. Boss Jean-Paul Churchouse says it’s “only getting started” in Australia: Bloomberg

🏠 RETAIL & REAL ESTATE

Lendlease is fighting to defend its $10bn Australian funds empire after Mirvac, backed by disgruntled supers, moved to oust it as manager. CEO Tony Lombardo pointed to a $225m profit turnaround and strong fund performance, with shares up 5.5%. But losing the funds would gut its local firepower, just as it chases $25bn in development projects: The Australian

*

REA Group has tapped Cameron McIntyre, ex-Car Group CEO, as its next chief exec, replacing Owen Wilson after a decade at the helm. McIntyre starts Nov 3, just as REA faces an ACCC probe into agent pricing. Despite soft listings, REA still posted double-digit earnings growth and a record $1.38 dividend. That’s a cushy seat for McIntyre to slide into: AFR

📱 TECH & STARTUPS

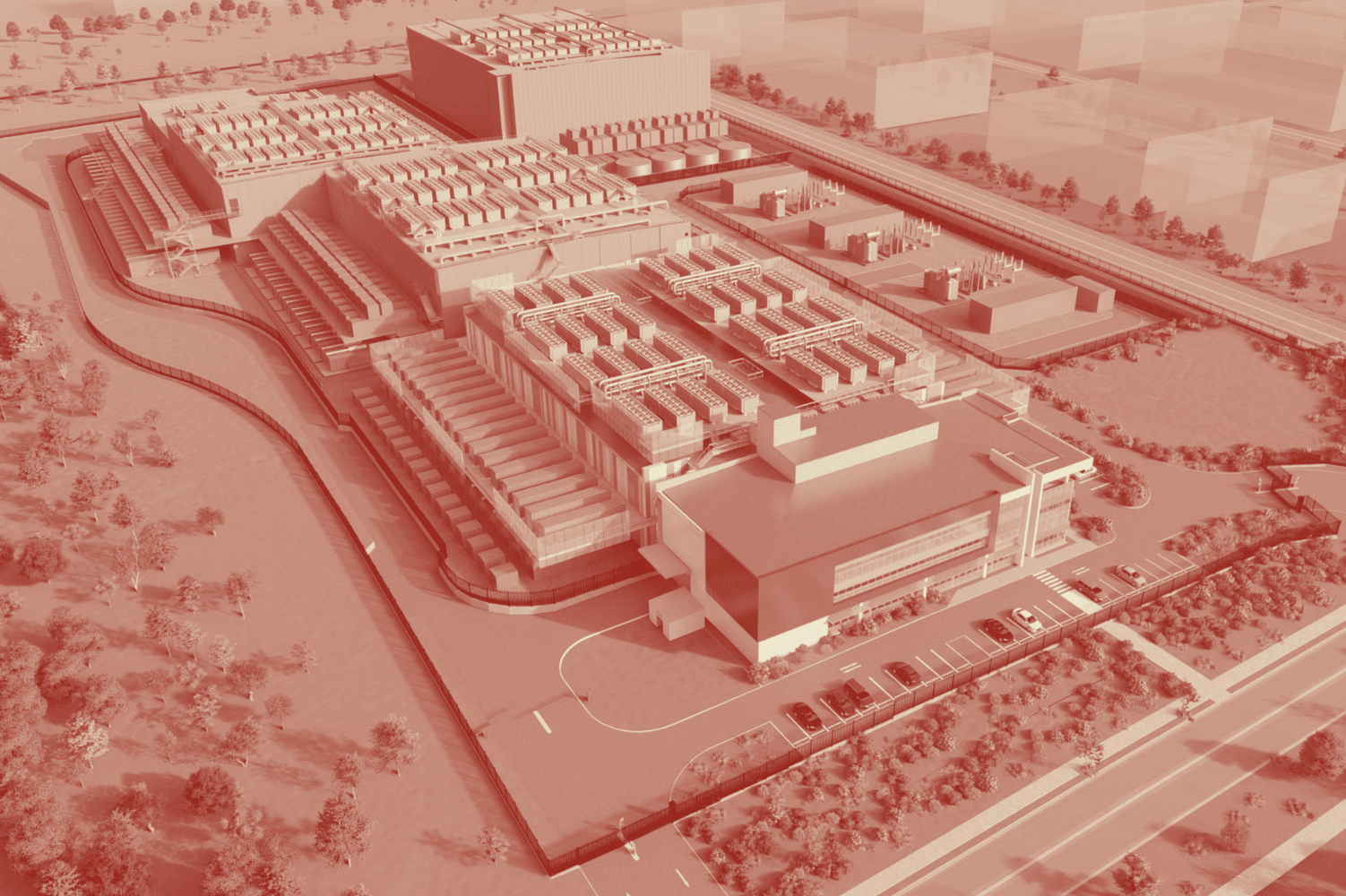

AirTrunk, now owned by Blackstone, has locked in a $2.7bn green loan to fund its second Singapore data centre – the largest ever in the nation. Backed by 20+ banks led by Credit Agricole, DBS and ING, the deal cements AirTrunk’s role as the go-to infra play for AI-hungry cloud giants like AWS, Microsoft and Google: AFR

*

Advance VC, founded by ex-Tidal investor Max Kausman, has raised $15m to snap up discounted stakes in VC funds like Blackbird, Tidal and Startmate. Backers include Stake’s Matt Leibowitz and Decjuba’s Tania Austin. With IPOs on ice and funds dragging past 10 years, Advance is offering liquidity to cashed-up sellers while gaining indirect exposure to Canva, Airwallex and PsiQuantum: AFR

Till next time,

-Team PB