👋 G’day

Today’s brief:

Is hiring engineers the move?

HWL Ebsworth chief exits

It’s “CEO killing season”

Here’s your latest, PB Sub #{{join_number}} 👇

WORD ON THE STREET

Engineers, not juniors

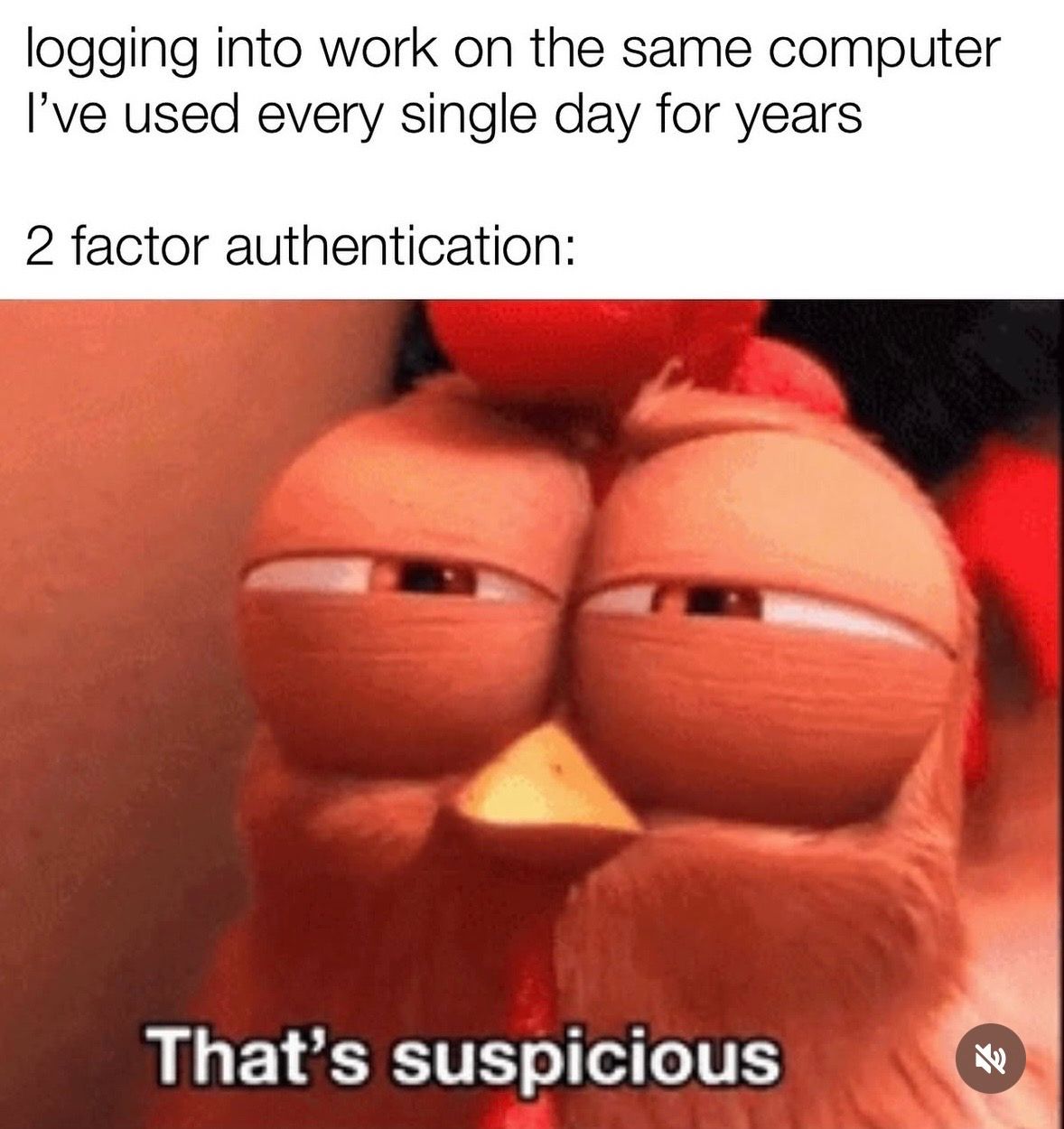

Hire engineers, not juniors? Founder and legal AI researcher Alexander Kardos-Nyheim says firms chasing an AI edge should “hire 30 data engineers tomorrow”, not more associates. The real moat isn’t flashy wrappers - it’s structured, proprietary data that lets models reason and cite properly. And we agree - the biggest accelerator for law firms will be tapping into their existing data, not trial-and-error prompting: NB

But to help you get better bang for buck from your fancy AI tool, Microsoft and the Singapore Academy of Law dropped a prompt-engineering playbook for lawyers. It’s basically a “how to actually use your pricey AI tool” guide. It pushes tight briefs (jurisdiction, facts, format), working in stages, and precise citations, plus the vital bits like confidentiality, humans accountable etc. Enjoy.

HWL Ebsworth is hunting a new chief executive after Russell Mailler abruptly resigned. Mailler, the public face during the 2023 ransomware saga, helped steer the firm’s growth to 280 partners. With a co-pilot model alongside non-lawyer CEO Kris Hopkins, the market will be watching who takes the wheel next: Capital Brief

The management consultant firm Alvarez & Marsal is plotting a massive Aussie expansion with eye-watering salaries. Co-founder Bryan Marsal says his firm arrived in Australia like “vikings taking no prisoners”, but bristles at the “eat what you kill” tag, calling it something “losers use to describe winners”: AFR

Addisons has named M&A partner Robert Kerr as Managing Partner, replacing Kieren Parker. Kerr will keep his corporate practice while leading the Sydney independent, which brands itself as a challenger to the traditional top-tier model: Addisons

PRACTICE POINTS

AI under WHS

⚖️ Employment/AI: NSW Parliament has passed the Work Health and Safety Amendment (Digital Work Systems) Bill, making NSW the first State to expressly regulate AI and digital work systems under work health and safety law. The changes clarify that if a business uses algorithms, automation or online platforms to allocate work or monitor staff, it must ensure those systems don’t create unsafe workloads, unreasonable performance metrics, excessive surveillance or discriminatory outcomes. The reforms also give WHS permit holders (usually union reps) conditional rights to seek reasonable access to inspect relevant digital systems, once SafeWork issues guidelines: KWM

⚖️ Consumer: The Federal Court has ordered Mobil Oil Australia to pay $16m in penalties after admitting it falsely marketed fuel at nine Queensland sites as “Mobil Synergy Fuel” when it was in fact standard unadditised petrol. The ACCC alleged years of signage and branding promising engine-cleaning additives and performance benefits that simply weren’t there. Mobil conceded the conduct breached the Australian Consumer Law. The Court also ordered corrective notices, a compliance program and costs: ACCC

⚖️ M&A: Mayne Pharma has launched fresh proceedings against former bidder Cosette Pharmaceuticals and PE backer Avista Healthcare, alleging breach of the $600m scheme implementation deed and seeking damages on behalf of shareholders. The claim reportedly centres on a “best endeavours” clause after the deal unravelled amid earnings downgrades and FIRB tensions. Dealmakers, like Daniel Natale from KWM and Greg Smith from Mills Oakley, say it could test whether a target can sue a bidder for shareholder loss in a public M&A scheme, a move described as “unprecedented”. If successful, the case could reshape risk allocation in Australian takeovers, hardening bidder obligations beyond break fees and amplifying downside exposure where deals collapse: Capital Brief

TALKING POINTS

CEO killing season

Did you hear…

“CEO killing season” is back, with 15 ASX300 chiefs departing since January 1 - including CSL’s Paul McKenzie, ASX’s Helen Lofthouse and Lendlease’s Tony Lombardo. That follows 45 exits in 2025, pushing average ASX200 tenure down to five years and nine months. Directors say it’s never been tougher at the top: activist pressure, hyper-volatile markets, heavier climate and regulatory burdens, and AI disruption: AFR

Also…

Australia risks losing its “low-debt” status, with combined federal, state and territory gross debt set to hit its highest share of the economy since WWII by 2028, according to the e61 Institute. Government spending has risen from 34.7% of GDP in the early 2000s to 38.2% in 2024, driven by social services, health and education. e61 warns that without tax reform or spending restraint, workers will bear the cost through higher income taxes: ABC News

DEAL ROOM

Mega-merger revival?

👀 Glencore isn’t done with Rio. After walking from month-long talks over a $320bn scrip mega-merger, CEO Gary Nagle says the door’s still ajar, with plans to meet with Aussie investors on their concerns about the failed deal. Meanwhile, Rio has tapped a handful of bulge-bracket banks to pitch on unlocking cash from the infrastructure underpinning its mines. That follows Simon Trott flagging plans to sell up to US$10bn of assets to fund growth and lift returns: AFR

🇦🇪 XRG is weighing a tilt at Shell’s 16.67% stake in Woodside’s North West Shelf, setting up a potential contest with Japanese bidders. The $2bn asset is strategically sensitive, with FIRB scrutiny looming for some suitors. The move comes just a year after the Abu Dhabi-backed investor walked from its $30bn Santos tilt: The Australian

WITH MADDOCKS

Watchdog Recap

The ACCC is bigger, bolder and better funded.

In 2025, it shifted from regulatory guidance to hard enforcement, doubled down on pricing and subscription “blitzes” in retail, and laid the groundwork for unfair contract terms test cases.

Maddocks’ specialists have dropped a special 10th anniversary wrap-up of the ACCC's high and low enforcement moments as part of their annual 12-article publication.

SECTOR SNAPSHOT

Instagram ban tested

DIGGERS

🚜 Santos will cut 10% of its workforce, around 400 roles, as annual profit slumped 33% to $818m and revenue fell to $4.9bn. With Barossa and Pikka nearing production, management is pivoting to cash generation and launching a strategic review of its Australian portfolio: The Australian

FIN

🏦 A NSW Supreme Court judge ordered Westpac CEO Anthony Miller to front court after the Westpac-owned St George bank refused to remove a $44.11 shortfall from a customer’s credit file. The bank reversed the listing only after the summons. But the judge labelled the stance “legally unjustifiable” and unconscionable. Miller did not end up appearing, given the information was removed: AFR

RETAIL + REAL ESTATE

🏠 Mirvac says “it’s a normal, fair housing market”, despite recent rate hikes. CEO Campbell Hanan pointed to a 38% jump in residential sales and steady demand across NSW, Victoria, Queensland and WA, with its operating profit seeing a 5% bump to $248m: AFR

TECH + STARTUPS

📱 Meta’s Mark Zuckerberg has told a US court it’s “very difficult” to enforce Instagram’s under-13 ban, saying a “meaningful number” of users lie about their age. Testifying in a social media addiction trial, he defended Meta’s age checks and privacy trade-offs, conceding the company could have moved sooner on safeguards: Bloomberg Law

JOBS

P.S.