👋 G’day

Today’s brief:

Record female partner highs

Monitoring rules may tighten in Vic

Aussie CEOs are more ruthless on layoffs

Here’s your latest, PB Sub #{{join_number}} 👇

WORD ON THE STREET

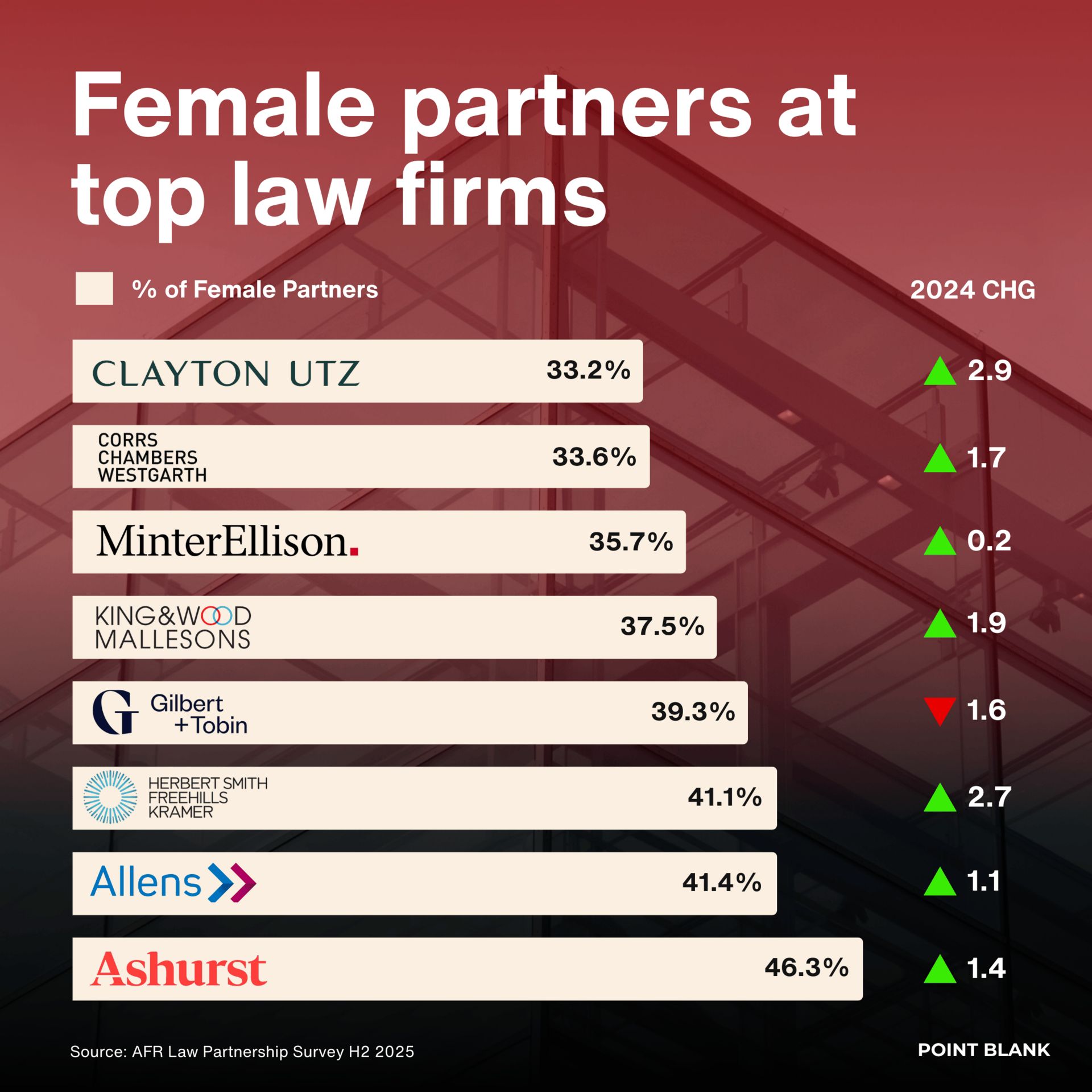

Partnership gap narrows

The gender leadership gap in law is slowly but surely closing. Female partners have hit record highs across top-tier firms. Ashurst leads at 46.3%, with Allens and HSF Kramer also clearing 40%. Lagging firms are moving fastest, Clayton Utz promoted six women from seven, while Corrs logged one of the biggest three-year jumps: Point Blank

Here’s a hot take. Former Allen & Overy boss David Morley says bans on non-lawyer ownership of law firms (like in America or Europe) should be scrapped. He argues they leave the profession hamstrung and ill-equipped for an AI future. Firms need capital to compete, and rules in Aus and the UK prove that ethics don’t collapse when outsiders invest in law: Law.com

Turns out AI may not eat into revenue. Accenture Australia’s $3bn revenue and 20% profit jump are being fuelled by AI. It’s a sharp contrast to sliding consulting revenues at Deloitte, EY, KPMG and PwC. More clients now want AI adoption like Westpac’s agent rollout, with Accenture also advising ANZ and NAB: AFR

The Day of the Endangered Lawyer, an annual event spotlighting risks to the profession, usually focuses on places like Belarus, Iran and Afghanistan. For 2026, it’s chosen the US, after concerns over attacks on lawyers and judges under Donald Trump. Looks like rule of law erosion isn’t just confined to developing countries: FT

PRACTICE POINTS

Vic backs crackdown

⚖️ Employment: The Victorian Government has backed sweeping workplace surveillance reforms, throwing support behind 15 of 18 recommendations from Parliament’s inquiry into modern monitoring practices. Employers will likely need to justify surveillance as reasonable and proportionate, consult workers in advance, maintain dedicated surveillance policies, tighten data security, and rein in covert and AI-driven monitoring. Tools like keystroke tracking, biometrics and remote monitoring are firmly in the firing line. While the detail, timing and legislative vehicle are still up in the air, this isn’t a wait-and-see moment. Employers with a Victorian footprint should audit current surveillance practices, stress-test justifications, and brace for higher compliance costs, greater IR friction, and tougher scrutiny of tech vendors and data handling arrangements: Corrs

⚖️ Inquiries: In case anyone asks, Royal Commissions sit at the pinnacle of inquiries in Australia. Armed with coercive powers under the Royal Commissions Act, the Commission can compel witnesses, force document production, override self-incrimination claims (with use immunity), and pierce privilege unless it’s properly established. While it can’t determine guilt, it can refer evidence to police and prosecutors, run public hearings, and make findings that carry serious reputational and regulatory consequences. Overlap with criminal proceedings is manageable but fraught, with fairness safeguards and private hearings likely where needed. The key takeaway is early preparation matters. Anyone receiving a notice should assume full compliance is expected, privilege will be scrutinised, and missteps can quickly escalate into criminal, civil or regulatory exposure: Landers & Rogers

⚖️ Interloctury / Caveat: The Federal Court has hit pause on a forced caveat withdrawal, granting an urgent stay pending appeal in a dispute over a mining lease and the reach of a DOCA. The fight turns on whether royalty payment obligations, and protections tied to a caveat, were extinguished by the DOCA or survived it. The respondents conceded the appeal raised arguable grounds, which was enough to get SCL over the line on interlocutory relief. The Court applied the orthodox test, asking whether there were serious issues to be tried and where the balance of convenience lay, and stayed the withdrawal order until May 2026. The practical takeaway is strategic leverage, caveats can remain powerful bargaining chips during insolvency appeals if there’s a credible argument they outlive the DOCA.

TALKING POINTS

AI bloodbath

Did you hear…

Aussie CEOs are more ruthless than global peers. 32% plan to cut mid-career roles versus 25% globally, and 50%+ expect junior jobs to shrink over the next three years (vs 49% offshore), per PwC. The pain’s already here: Big Four grad intakes are half their 2022 peak, and Accenture Australia axed 10% last year. Will law firms move the same way?

Also…

The NSW Government wants to criminalise leaving dogs in hot cars or on the back of utes, with penalties of up to $44k fines or one year in jail. The bill would also ban prong collars and tighten animal fighting laws. With 500+ reports of dogs locked in cars over six years, ministers say it’s about closing cruelty loopholes: TDA

DEAL ROOM

Post-block pivot

💊 Mayne Pharma is weighing a sale of its US business to unlock value after its $600m-plus Cosette takeover was blocked by Jim Chalmers. The US arm pulls $300m-plus in revenue and could juice a battered share price now below $2.90. The board’s been slimmed, and a $6.72m break-fee fight with Cosette is looming: Capital Brief

💾 Aware Super is doubling down on AI infrastructure, tipping US$300m into Vantage Data Centers’ Asia-Pacific arm for a minority stake. The platform runs 10 data centres across Australia and Asia, serving hyperscalers like Amazon Web Services, Microsoft and Google: AFR

SECTOR SNAPSHOT

Musk sues OpenAI

DIGGERS

🚜 Origin Energy will keep the country’s largest coal plant, Eraring Power Station running until 2029. That’s 2 years longer than planned, after renewables and transmission projects rolled out slower than expected. The move buys time for grid stability in NSW, where Eraring supplies ~20% of power, without shifting Origin’s 2030 emissions targets: AFr

FIN

🏦 Big super are tightening the screws on founder-led companies after boardroom blow-ups at MinRes and WiseTech. Updated guidelines from the Australian Council of Superannuation Investors now push for clearer founder succession plans, stronger checks on controlling shareholders, tougher pay disclosure: The Australian

RETAIL + REAL ESTATE

🏠 ACCC says it’s lost its bite on big airports, warning monopoly pricing is back in play. With $19bn in airport upgrades coming, higher airline charges look inevitable, and passengers will likely wear the costs: The Australian

TECH + STARTUPS

📱 Elon Musk is chasing up to US$134bn (A$200bn) from OpenAI and Microsoft, claiming he’s entitled to the “wrongful gains” they made off his early backing. Musk says his funding, credibility and know-how helped create US$65bn–US$109bn of value at OpenAI and up to US$25bn at Microsoft. OpenAI calls it “unserious”; a jury trial is slated for April.” Reuters

P.S.