👋 G’day

Today’s brief:

Firm rolls out Gen Z resilience workshops

Juniors bill 20% of their time to AI

ASX fights ‘embarrassing’ claim

Here’s your latest, PB Sub #{{join_number}} 👇

WORD ON THE STREET

Law firms train Gen Z’s

Freshfields is sick of Gen Z lawyers who can’t hack the BigLaw life. The UK firm is rolling out “resilience” workshops for Gen Z after a solicitor quit a few weeks in. Sessions include demonstrations on how to survive partner feedback and how to cut stress before difficult calls. The move comes as juniors test London law’s limits, after burnout exits at DLA Piper: RollOnFriday, Point Blank

Ropes & Gray is letting juniors bill 20% of their time to AI. Through its Trailblazers program, trainees and NQs in Europe get paid to test gen-AI tools, feed ideas back to partners and shape firm strategy. Innovation, but make it billable: NB

White & Case has rehired finance gun Will Stawell as a Sydney partner, pinching him from KWM. A former White & Case New York associate, Stawell brings deep PE and big-ticket debt chops, including $3.5bn+ financings: White & Case

McKinsey & Company is trialling AI-assisted interviews, asking grads to use its chatbot Lilli during case tests. The focus isn’t right answers, it’s how candidates prompt, challenge and adapt AI output. CEO Bob Sternfels says it reflects real consulting work now: FT

PRACTICE POINTS

Execution pages enough

⚖️ Enforceability: The Queensland Court of Appeal has confirmed that a person can still be legally bound by a document even if they did not receive or read all of its pages before signing. The Court upheld guarantees signed by company directors who had only been given the execution pages. While this was accepted on the evidence, the Court held the guarantees were enforceable. The signed pages clearly identified the documents as guarantees, referred to the underlying credit contract, and recorded that the guarantors would be liable if the borrower defaulted. The absence of fraud, misrepresentation or duress, the failure to see or read the full terms did not prevent the guarantees from being enforceable, and the appeal was dismissed: Bennett & Philip Lawyers

⚖️ Class Actions: The Federal Court recently approved a $110 million settlement of the shareholder class action against BHP Group Limited arising from alleged misleading disclosures and omissions before the 2015 Brazilian mine and dam collapse. The settlement was reached on a no-admissions basis, with no order as to costs. The Court approved deductions of $55 million for legal costs, disbursements and funding expenses — leaving 50% for applicants and registered group members — and made a common fund order so costs are shared pro rata across both funded and unfunded group members.

⚖️ Practice: The Attorney-General has issued Legal Services Directions 2025, which is a fairly meaty 75-page document, setting out the mandatory standards for top performance of Commonwealth legal work. These commence on 2 March 2026.

TALKING POINTS

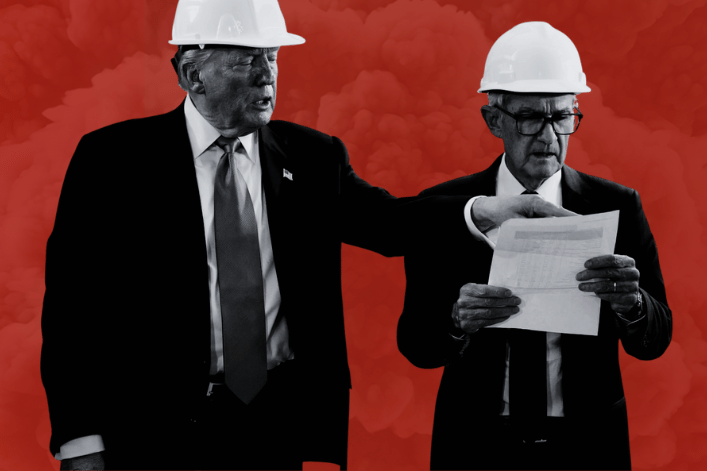

“F…ing idiot”

Did you hear…

Former RBA boss Bernie Fraser has gone nuclear on Donald Trump, branding him a “f…ing idiot” for threatening Fed chair Jerome Powell. The trigger, subpoenas over a $2.5bn Fed HQ reno, which has widely been seen as political pressure for the slow rate cuts. Global central bankers, including Michele Bullock, have closed ranks, warning that meddling with rate independence is a dangerous game with inflation and credibility: The Australian

Also…

Tom Silvagni has lodged an appeal against his rape conviction, after being jailed for 6 years, 2 months over an assault in 2024. The judge said the offence involved “planning, cunning and strategy”, with no remorse shown. Silvagni, son of AFL great Stephen Silvagni, must serve 3 years, 3 months before parole while the appeal runs: TDA

DEAL ROOM

IPOs stumble

😬 ASX IPOs have stumbled into 2026, with Unity Metals flatlining on debut and late-2025 floats like Carma, Epiminder and Saluda still underwater. Fundies say rate jitters spooked sentiment, but hope easing inflation revives appetite. Resources remain the bright spot, while bigger names like Firmus, I-MED and Greencross are waiting for clearer skies: AFR

🙅 BlueScope has doubled down on its takeover defence with a $1-a-share special dividend, returning $438m as it stares down SGH and Steel Dynamics. Four bids have already been knocked back. The payout now drags the latest $30 bid to $29, lifting the pressure on suitors to come back meaningfully higher. HSF Kramer is advising BlueScope: Capital Brief

SECTOR SNAPSHOT

ASX fights claim

DIGGERS

🚜 BHP is increasingly seen as staying on the sidelines as Rio Tinto pushes ahead with Glencore talks. Sources say it doesn’t see the same value in Glencore’s copper portfolio and has little appetite to gatecrash the deal. That leaves Rio with a clearer run at a potential merger as BHP reassesses its copper strategy after the failed Anglo bid: The Australian

FIN

🏦 The ASX has pushed back hard against an unfair dismissal claim by former employee Jamie Halstead, calling allegations that executives misled ASIC over a 2020 trading outage “vague” and “embarrassing”. The exchange and its CEO Helen Lofthouse deny bullying, underpayment and any wrongdoing, saying Halstead was well paid, lawfully made redundant after a restructure, and never asked to mislead the regulator. A first court date is set for February: The Australian

RETAIL + REAL ESTATE

🏠 Victorian pub owner Julian Gerner is suing over the $120m Sorrento InterContinental redevelopment, alleging he was promised a 20% equity stake but cut out after doing years of planning and feasibility work. He claims the Smorgon-linked consortium used his work to secure the project, then froze him out — and while he won’t block a sale tipped above $150m, he wants his slice: The Australian

TECH + STARTUPS

📱 Australia’s start-up exit market is back. Local founders and VCs offloaded US$3.5bn of companies in 2025, the strongest year since the pandemic boom, led by Accel-KKR’s $500m buyout of Phocas and United H2’s $400m GoZero deal. Valuations have reset, offshore buyers dominate, and IPOs are cautiously back — but most founders are eyeing the Nasdaq over the ASX: AFR

P.S.