👋 G’day

Welcome back to another day of insights

Today’s brief:

Trump tariffs threaten BHP exports

Harvey opens Sydney office

Goldman demands loyalty

Here’s your latest 👇

PRACTICE POINTS

PPSR typo tolerated

The Federal Court has clarified that a mistake in a secured party’s details on the PPSR won’t automatically invalidate the registration under s 165 of the PPSA. In AMAL Security Services v 452HM [2025] FCA 603, AMAL mistakenly registered a security in the wrong trust capacity. The Court said the error wasn’t “seriously misleading” under section 164(1) of the PPSA. That’s because the grantor’s ACN, security type and contact details were all correct and searchable. The upshot: not all registration slip-ups are fatal: Clayton Utz

*

The High Court has sided with Air Canada, ruling it did not waive its right to limit liability under the Montreal Convention after two passengers sought $240k for injuries on a turbulent 2019 flight. While the airline’s Tariff formed part of the contract, the Court said it didn’t clearly or unambiguously waive the ‘no negligence’ defence. The case is a sharp reminder that vague or declaratory wording won’t cut it: if a party wants to waive a valuable right, say so clearly. Especially when contracts sit alongside complex regimes like international treaties. Maddocks provides a rundown: Maddocks

*

ASIC is suing CashnGo for allegedly unconscionable debt recovery, unfair contract terms and failing to issue proper default notices to over 65,000 consumers. Between April 2022 and May 2025, ASIC alleges CashnGo ran over 227k small credit contracts and monitored borrowers’ bank balances hourly, auto-debiting accounts when funds appeared, sometimes leaving customers with less than $5. With $77m in revenue on the table, this could be a major test of how far fintech lenders can go in squeezing repayments: ASIC

WORD ON THE STREET

Golf > grind

EY’s solution to low morale? Midday games of celebrity heads, golf putting and paper basketball—complete with a weekly leaderboard and mystery prize. Staff are told to hold off client meetings to join in… It’s giving Harry Potter House Cup. All while EY posts the lowest junior pay and highest partner profits among the Big Four: AFR

*

Legal AI Harvey is opening a Sydney office in September, backing strong Aussie demand and partnerships with KWM, Ashurst and G+T. The move supports its push into the Australian legal market, with local teams set to bolster sales, customer success and ops. If you’re after a job in legal tech, now’s the time: Harvey

*

DLA Piper has promoted 6 to special counsel and 9 to senior associate across its Sydney, Melbourne, Brisbane and Perth offices. The round spans litigation, corporate, finance, employment and real estate, with the firm praising the group’s “depth of talent.” It follows the hiring of three new partners in Australia earlier this year: DLA Piper

TALKING POINTS

Goldman juniors locked down

Goldman Sachs will make junior bankers sign a quarterly oath swearing they haven’t accepted jobs elsewhere, as PE firms poach talent earlier than ever. It follows JPMorgan’s warning that grads caught job-shopping will be fired, and Apollo’s decision to delay interviews entirely. With juniors exposed to deal secrets, poaching is a conflict minefield: Bloomberg

*

A hacker used AI to impersonate Marco Rubio, duping foreign ministers and a US governor with fake emails, voicemails and Signal messages. The State Department says there’s no direct cyber threat, but warns partners to stay alert. A similar April campaign was traced back to Russia, but this one’s source is still unknown: Capital Brief

*

Ahead of Albo’s six-day trip to China, ex-diplomatic chief Dennis Richardson warned Beijing won’t hesitate to weaponise trade if Australia steps out of line. With Trump throwing tariff tantrums, Canberra’s caught in the crossfire. Albanese will pitch Australia as a steady partner on business, not geopolitics, but Washington is watching how cosy the PM gets with Xi: AFR

THE TREASURY

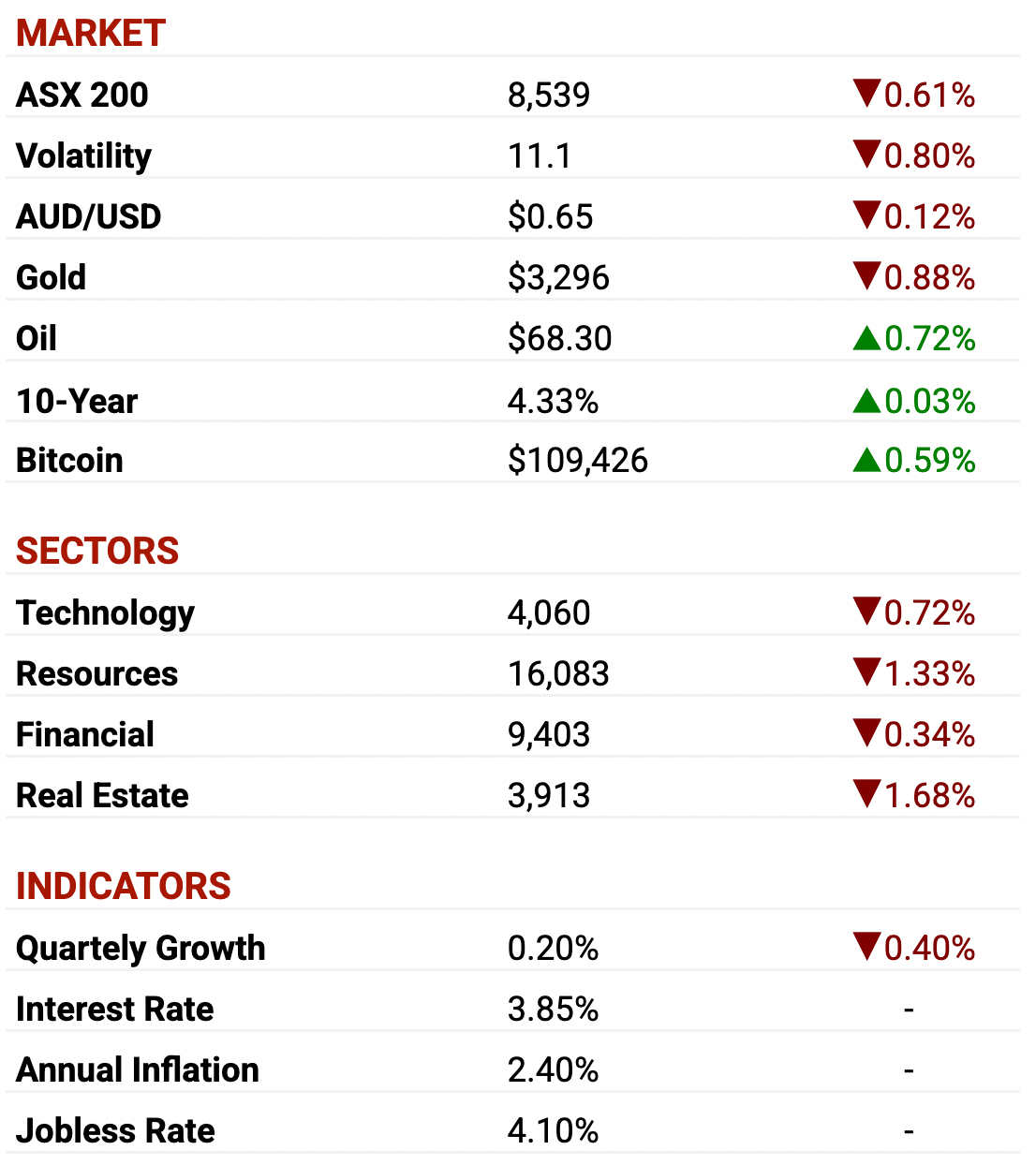

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

InStitchu draws suitors

InStitchu: has hit $1m in weekly sales and tapped Tiger & Bear Partners after offshore suitors came knocking. With no inventory risk, scalable ops and backing from Dayang and Aura, it’s tailor-made for PE. Tiger & Bear’s playbook includes Zimmermann, Aesop and Bondi Sands—and they’re betting InStitchu could be the next big label exit: AFR

*

Westpac: topped the debt capital markets league tables with $23.6bn in deals while Australia's DCM hit a 10-year high with $US199.3bn raised. Corporate bonds surged 13.5%, driven by super fund demand, higher yields and offshore appetite. Woodside and BHP led corporates for bonds, but the real stars were the banks, which returned to the bond market in force: The Australian

*

Acciona: is selling a 50% stake in its Kwinana Energy Recovery plant, with RBC running the process and sale docs now in play. The $40m-a-year waste-to-energy facility near Perth only launched in April but is already eyeing $75m+ earnings by 2034. Long-term waste contracts and 60%+ margins make it appealing for infra funds: AFR

SECTOR SPECIFIC

Miners brace for tariff blow

🚜 DIGGERS

BHP and Rio Tinto are bracing for impact after Trump flagged 50% tariffs on copper, hitting their Chilean exports from the Escondida mine, the world’s biggest. While Rio may benefit via its US smelter and Utah mine, both miners are watching for broader fallout as China still dominates global refining. Copper futures surged 17% on the news: AFR

*

Exxon and Woodside have slashed their Bass Strait gas discovery by nearly 70%, walking back hopes it might delay the east coast energy shortfall. Originally flagged as a gamechanger at 92 petajoules, it’s now just 27.3PJ. AEMO’s 2029 crunch point still looms, and LNG importers like Andrew Forrest’s Squadron say it’s proof we need backup now: The Australian

🏦 FIN

Mortgage brokers are now behind 76.8% of new home loans, with that figure tipped to top 80% soon. Banks are feeling the pinch, with CBA, NAB and Westpac trying to claw back control via branches and in-house channels to avoid the $4bn in broker commissions paid out each year: AFR

*

Mercer Super will add private equity to its default super fund for the first time, targeting a 5% allocation, mostly via secondaries and co-investments. CIO Graeme Miller says public markets are losing appeal, and the current lull offers a rare discount window. It follows moves by Colonial First State and AustralianSuper as supers hunt unlisted upside: Bloomberg

🏠 RETAIL & REAL ESTATE

Aware Super is set to snap up Brisbane’s Brunswick & Co for ~$300m, marking one of Australia’s biggest build-to-rent deals to date. The 366-apartment complex, part of QLD’s pilot scheme, includes 144 discounted units. The move signals major local super funds are ready to take the housing crisis seriously, and may just set a pricing benchmark for the sector: The Australian

*

Corval is buying most of Brisbane Technology Park from Dexus for $115m, locking in one of Brisbane’s biggest office plays this year. The move aligns with Dexus’ shift toward pure-play industrial, while Corval sees upside in a 7.7% yield, low vacancy (2.8%) and a 40% discount to replacement cost. A value-add flip is already in the works: The Australian

📱 TECH & STARTUPS

AMSL Aero, backed by Hostplus, TelstraSuper and the govt, is gearing up to launch its $5m electric aircraft by 2030. Its Vertiia model can land in backyards, costs a quarter of a helicopter to run, and has 26 pre-orders locked in. With CASA backing and rivals still in red tape, AMSL may beat flying car giants to the skies: AFR

*

Google says underinvesting in AI is riskier than overinvesting, with most of its AI spend going into technical infrastructure, according to APAC AI policy chief Eunice Huang. Despite trade tensions, Alphabet’s still tipping in $75bn for data centre expansion this year, banking on strong returns from its AI push: Reuters

Till next time,

-Team PB