👋 G’day

Welcome back to another day of insights

Today’s brief:

Grad pay hits fresh record

PwC offloads 84 staff to Teneo

IKEA calls for national packaging laws

Here’s your latest 👇

PRACTICE POINTS

Climate playbook

The AICD and ACSI have launched a first-of-its-kind guide to help boards oversee climate transition plans, just as mandatory climate reporting kicks in. Governing for Net Zero offers directors practical steps to embed climate planning into business strategy, understand transition planning in the context of directors’ duties, and oversee organisational responses to climate change. The guide includes red flags, case studies and key questions, backed by insights from both directors and institutional investors: AICD

*

The ACCC has launched Federal Court proceedings against Australian Gas Networks (AGN), alleging its ‘Love Gas’ ad campaign misled consumers by implying gas is becoming renewable. Ads ran in 2022–23 with unqualified lines like “It’s becoming renewable” and “For this generation and the next”, alongside a green flame logo. The ACCC says this was classic greenwashing, with no disclaimers or evidence to back the claims. It’s part of the regulator’s 2025 crackdown on misleading environmental claims, especially where they undermine informed consumer choices on energy: Maddocks

*

The Victorian Court of Appeal has ruled that directors are not criminally liable under s. 596AB(1) of the Corps Act merely by entering a transaction where employees are expected to receive entitlements via the Fair Entitlements Guarantee Act 2012 (FEG) rather than directly from the employer. The Court held that “recovery” of entitlements includes payment via the FEG scheme, and the law is agnostic about the source of recovery. While the DPP argued that only payments from the employer count, the Court disagreed, noting that once the liquidator passes FEG funds to employees, the entitlements are satisfied. The Court confirmed s. 596AB still applies in cases where the FEG doesn’t.

WORD ON THE STREET

Graduate pay pops

Top grads are now pulling $110k–$120k at HSF Kramer, G+T, White & Case and A&O Shearman, with Arnold Bloch Liebler leading at $118k to $130k. And to get some of that sweet money, we all know the firms’ playbooks - charm the receptionist, crush the cocktail night and pass the vibe check: AFR

*

Quinn Emanuel is suing Nano Dimension, claiming it’s owed US$30m for successfully forcing through Desktop Metal’s US$183m merger. Quinn says Nano, now in control of Desktop, is deliberately withholding payment despite sitting on US$845m in cash. This fee contest comes off the back of Elon’s US$90m fee dispute with Wachtell, Lipton, Rosen & Katz over the Twitter buy: Financial Times

*

Two of A&O Shearman’s top NY litigators, David Esseks and Gene Ingoglia, have walked to launch Esseks Ingoglia, a boutique focused on trials, white-collar defence and investigations. The duo join the 100+ partner exodus since the mega-merger, as New York becomes ground zero for talent turbulence post-A&O-Shearman tie-up: Global Legal Post

*

PwC has sold off its 84-person restructuring team to global advisory firm Teneo, as it continues to carve up its advisory arm post-tax scandal. The deal sees 14 partners and 70 staff jump ship, joining Teneo’s expanding local playbook across Sydney, Melbourne and now Brisbane. While PwC looks to double down on AI and biz transformation: AFR

TALKING POINTS

Unemployment rise

Unemployment just hit 4.3%, its highest since 2021, with 34k more Aussies out of work and full-time jobs taking a hit. Economists say it’s now almost certain the RBA will cut rates in August, unless inflation surprises. The data suggests the jobs market is softening - hours worked fell, and more people entered the labour market looking for work: AFR

*

Vaping’s no longer in with the kids. The Cancer Council says 85% of 14-17s have never vaped, up from 82.5% in 2023. TikTok vape ads halved, peer use is down, and fewer teens are buying their own. Following last year’s pharmacy-only vape laws, Health Minister Mark Butler says we’ve “turned a corner”: The Daily Aus

*

After a court ruled that the government can legally recoup overpaid welfare, the Albanese government is now mulling whether it should. Up to $1.1bn in paused debts, some dating back to 1979, could be forgiven instead. The debts stem from a now-banned “income apportionment” method used for decades. Labor’s weighing debt recovery against Robodebt-era fallout and Greens pressure to draw a line: AFR

THE TREASURY

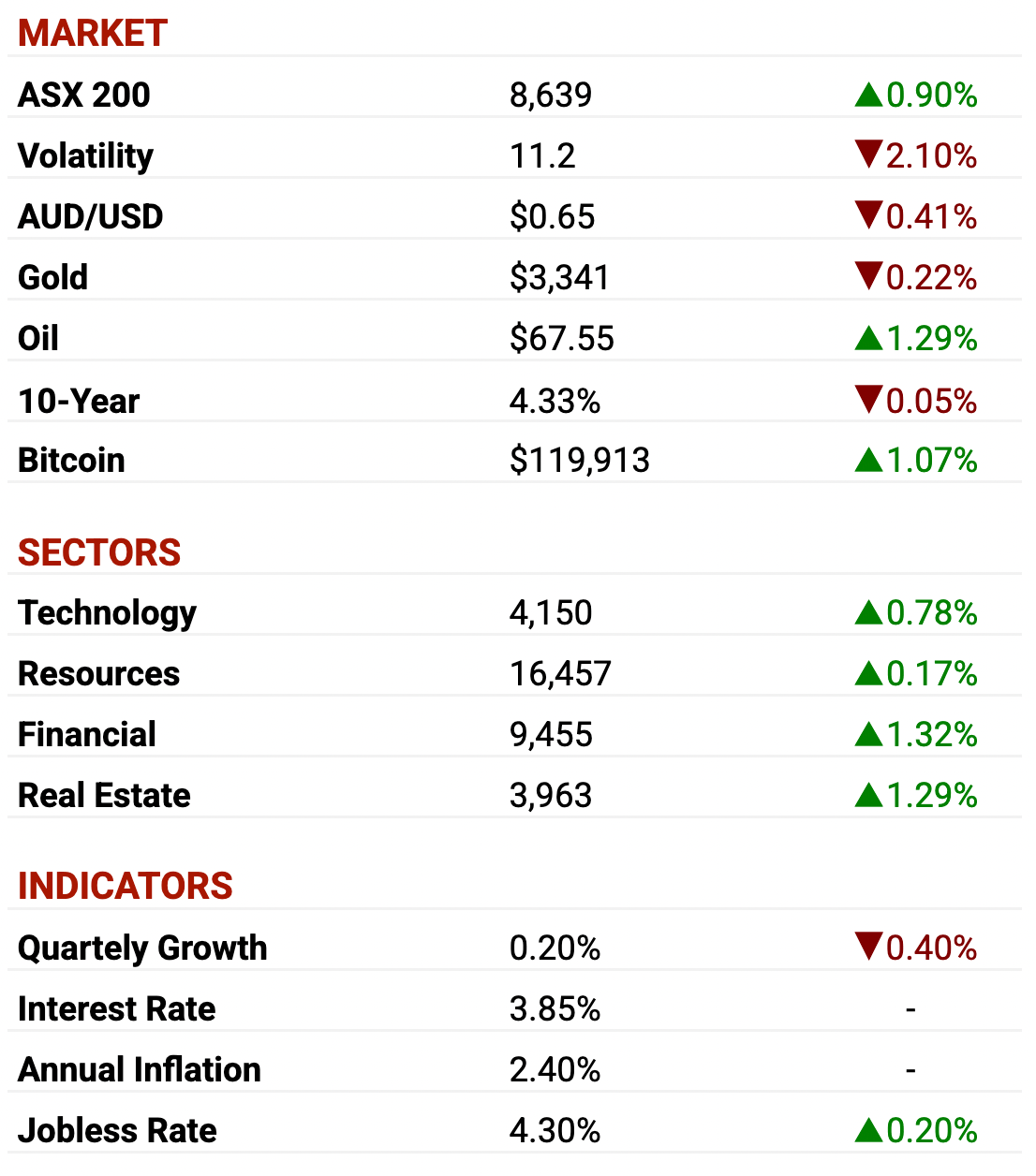

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

PointsBet battle

PointsBet: has backed a fresh $1.20 per share all-cash bid from Japan’s MIXI, telling shareholders to ignore rival Betr’s all-scrip $1.22 offer, which PointsBet says is really worth just $1.03 on a 20-day VWAP. MIXI already has 17.18% locked in, including board support: Capital Brief

*

CC Capital: is closing in on a binding offer for Insignia Financial, lining up lenders to fund a deal tipped to land above $4 a share. Investors are betting on an offer sooner rather than later, but it’s still unclear if it’ll match the earlier $5 bids. After years of underperformance, some fatigued shareholders are ready to deal and move on: The Australian

*

Nippon and Mitsui: may step in to help Peabody Energy complete its $5.8bn acquisition of Anglo American’s QLD coal assets, after fires and falling prices sparked a dispute over the deal. With court action looming, Japan’s steelmakers could be key to keeping the transaction alive: The Australian

SECTOR SPECIFIC

Bitcoin buys houses

🚜 DIGGERS

Santos is sticking to its timelines, confirming its $6.1bn Barossa gas project will start up by September and Alaska’s Pikka oil project is 89% done. Production dipped slightly from SA floods, but quarterly sales still beat expectations. No update yet on ADNOC’s $36.4bn bid, with due diligence due to wrap on 8 August: AFR

*

Despite joining Albanese in China to talk green steel, BHP’s Geraldine Slattery says Aussie-made green iron is just too expensive - double the cost of China or the Middle East, even with subsidies. Fortescue’s Andrew Forrest wants Pilbara to double down on green iron, while BHP says it won’t produce green iron itself: Mining.com

🏦 FIN

Block Earner says it’ll be the first in Australia to offer Bitcoin-backed home deposit loans, launching as early as October. Crypto holders could borrow up to 60% of their BTC’s value toward a house deposit. After beating ASIC in court, the startup is betting this new product stays regulator-proof and appeals to cashed-up crypto converts: Capital Brief

*

Merricks Capital’s $1.2bn flagship fund has paused redemptions, telling investors there’s no unallocated cash left. Redemptions may now drag out to mid-2027, though investors can opt into a dividend-only class of units. The fund’s exposure to troubled assets like the Halo tower shows the cracks forming in private credit’s red-hot run, and ASIC is watching: AFR

🏠 RETAIL & REAL ESTATE

Property tycoon Harry Stamoulis has snapped up 357 Collins St for $192m, marking his second office buy in Melbourne’s CBD downturn. The Singaporean seller blamed remote work and 18.6% vacancy rates, but Stamoulis sees value in the dip. It’s a rare premium sale (+0.6%) in a flat market, showing proof there’s a long-term play: The Australian

*

IKEA has taken aim at Australia’s “patchwork” of plastic packaging laws, saying state-by-state rules are jacking up retail costs and delaying supply chains. It’s backing the Productivity Commission’s push for harmonised national rules, arguing the current maze of compliance “challenges” its ability to offer low prices or meet sustainability goals: AFR

📱 TECH & STARTUPS

Meta’s board is under fire for allegedly overpaying a US$5bn settlement in 2019 to shield Mark Zuckerberg from personal liability over the Cambridge Analytica scandal. A Delaware court heard that directors offered the payout on one condition: Zuck walks free. The case, brought by investors, could trigger governance changes at Meta or even a Delaware exit: AFR

*

With only 37 VC-backed IPOs last year but 189 mega-raises, employees are getting desperate. A $30bn grey market for startup shares has emerged, trading equity without company consent via offshore swaps and shadow contracts. Canva, OpenAI and Revolut say these trades are void, but Aussie platforms like FloatX are still listing them: Capital Brief

P.S.

Till next time,

-Team PB