👋 G’day

Welcome back to another day of insights

Today’s brief:

McKinsey, BCG and Big Four hold grad pay flat

NSW Supreme Court makes historic appointment

Allens boosts lawyer count despite automation

WORD ON THE STREET

Grad pay freeze

Top consultancies are freezing grad salaries for a third year as AI reshapes the industry and slashes demand for junior analysts. Firms like McKinsey and BCG are holding offers flat for 2026, while Big Four execs expect grad hiring to drop by half. With AI automating routine work, firms are rethinking the old pyramid and shifting toward more specialised, mid-career talent: Financial Times

*

Justice Natalie Adams will become the first woman to lead NSW’s Common Law Division when she steps in as Chief Judge in February 2026, replacing Justice Ian Harrison. Adams, a former Crown Advocate and silk, is a key figure in the court’s criminal and admin work: Point Blank

*

Allens now runs about six AI tools across its practice, but instead of cutting heads it’s lifted non-partner fee-earners 11% to a record 1,078. Courts’ strict rules and hallucination risk mean outputs must be checked by humans, while KWM is pitching AI as a “cognitive sparring partner” for juniors: AFR

*

KPMG quietly investigated staff who used AI to cheat on mandatory training, just years after regulators fined the firm for widespread exam dodging. A handful were warned and forced to resit tests, while one later left. EY, PwC and Deloitte wouldn’t deny similar cases. The irony? Deloitte’s own AI scandal showed its consultants couldn’t use the tech properly anyway: AFR

PRACTICE POINTS

Deal litigation returns

M&A/Disputes: Corrs has done a review, and deal litigation is back in black. Market volatility has seen bidders increasingly try to walk away during the pre-completion period — and targets are fighting back. In Mayne Pharma v Cosette, the NSW Supreme Court rejected Cosette’s attempt to terminate a A$600m scheme on MAC grounds, marking Australia’s first judicial look at MAC clauses in a public deal. Anglo American and Peabody are now in arbitration after Peabody claimed a mine ignition triggered a MAC under a A$5.9bn coal sale. And in Dexus v APAC, a breach notice tied to alleged confidentiality leaks has put JV pre-emptive rights and sale-process behaviour under scrutiny. Expect 2026 deal terms to become tighter. We’re talking heavier negotiation on MACs, termination rights, and JV restrictions as parties’ scenario-test draft to avoid (or prepare for) litigation: Corrs

*

Employment: Victoria’s new regulations on psychological hazards kicked in yesterday, 1 December 2025. The regulations impose strict duties on employers, labour-hire providers and anyone managing a workplace to identify psychosocial hazards and eliminate or minimise risks so far as reasonably practicable. The accompanying Code lists hazards like bullying, high job demands, poor organisational change management and exposure to traumatic content, but the duty extends to any factor in work design, systems, management or interactions that could trigger harmful psychological responses. Employers must conduct risk assessments, implement controls that extend beyond training alone, and regularly review these controls. Breaches can attract penalties of more than $360k for individuals and $1.8m for companies: Mills Oakley

*

Privilege: The FWC has warned that privilege will not protect a workplace investigation unless its dominant purpose is to obtain legal advice. In James Crafti v Cohealth, the Commission held that engaging a law firm to brief a barrister did not make the investigation privileged, because the primary purpose was disciplinary: assessing alleged misconduct under internal policies. Even if it had, the employer waived privilege by disclosing the evidentiary basis and specific witness statements in the outcome letter. Employers should clearly record the purpose of any external investigation, keep communications tightly aligned to that purpose, and avoid disclosing material that may waive privilege: Hall & Wilcox

TALKING POINTS

Holiday points rush

Can’t wait for the Christmas closure and craving an impromptu holiday? Qantas is handing out an early Christmas bonus, dropping 100,000 reward seats for 2026, including 1000 business-class seats to Paris and a stack of Jetstar “points planes” to Bali. That’s Melbourne to Bali for 20k points. The airline is also rebooting Sydney–Port Moresby flights from March: The Australian

*

Have you spent the whole year nodding along at corporate jargon? Yeah, same. Well, next year will be different because we now have AFR’s latest edition of #REF!, which decodes the latest jargon professionals love to use. If we took a shot every time we heard ‘bifurcate’, silly season would be far too big. Hit reply to this email and tell us your favourite: AFR

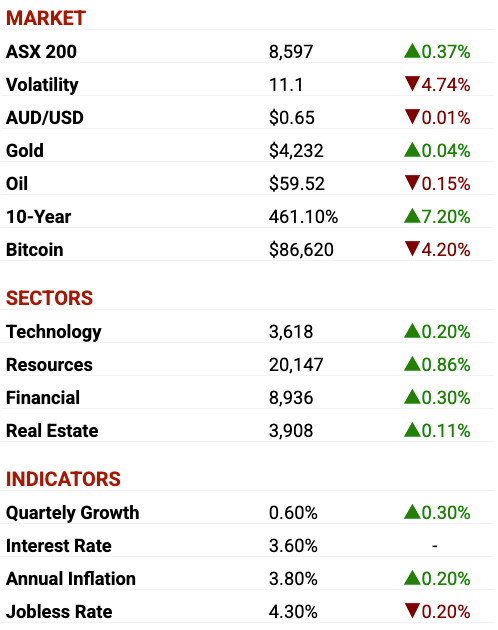

TREASURY TUESDAY

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Seven-year hunt

Brookfield: has been stalking National Storage REIT for seven years, with “Project Knox” finally landing as a $6.8bn enterprise-value bid — the biggest real-estate take-private in Aus. Brookfield first offered $2.40 in 2021 before walking away, but returned in tandem with GIC to table a far richer proposal. Ashurst’s Anton Harris is acting for the bidders, while Clayton Utz steers National Storage: AFR

*

EMR Capital: is back in deal talks for its 52% stake in the $US3bn Kestrel coking coal mine, with an Indonesian suitor now at the table. It’s unclear whether that is it’s co-owner Adaro using its pre-emption rights or another Indonesian heavyweight. With Kestrel the only coal asset currently for sale, EMR holds the leverage: The Australian

SECTOR SPECIFIC

ANZ swings ESG axe

🚜 DIGGERS

Minerals 260 has rocketed from $30m to nearly $900m this year after Tim Goyder’s bet on the Bullabulling mine paid off, with new estimates showing 4.5m oz of gold, more than double prior assumptions. Central-bank demand and record gold prices have the stock surging, pushing Goyder close to billionaire status again as MI6 cements itself as a top-tier Aussie gold play: AFR

*

PwC says 124 critical minerals projects are stuck between discovery and production, starved of private capital while gold soaks up the investment flows. Critical minerals market cap slid 20% and cash flows fell 71%. Government support helps, but PwC warns Australia must move fast if it wants to turn its resource advantage into real production: The Australian

🏦 FIN

ANZ is swinging the axe again, with ESG and climate roles on the chopping block. The bank’s top climate lead exits in two weeks, with his role folded and no guaranteed replacement. Only a third of 3,500 cuts are done under Matos’ restructure: Capital Brief

*

Big super is talking green while upping its fossil fuel exposure to $33bn, says Market Forces, accusing funds of “industrial-scale greenwashing”. Just 7 of 30 funds cut holdings in companies expanding coal, oil and gas since 2021. AussieSuper, Mercer and Team Super lifted exposure the most, raising fresh questions about policy versus practice in the net-zero era: AFR

🏠 RETAIL & REAL ESTATE

Lendlease has pulled off a double win, securing Tokyo Tatemono as a partner on its $500m Docklands build-to-rent tower while offloading a $360m Darling Square office to Barings. Japanese capital keeps flooding into build-to-rent, while the Sydney sale signals renewed appetite for prime offices: The Australian

*

Centuria is leaning hard into ag, taking over Arrow Funds Management and its $444m primary infrastructure fund. That lifts its agriculture exposure to $1.3bn. The 22-asset portfolio spans poultry, orchards and glasshouses, aligning with Centuria’s push into tech-heavy, low-risk farming. It’s a big step in diversifying away from traditional commercial real estate: AFR

📱 TECH & STARTUPS

Atlassian’s Mike Cannon-Brookes says the Sydney-Melbourne tech rivalry is pointless, urging Australia to unite and compete globally instead. With 30k tech jobs lost last year and the nation falling behind in R&D, he argues Australia should take the fight against Germany, Ireland and Singapore for talent: The Australian

*

Nvidia has taken a US$2bn stake in chip software maker Synopsys, buying in at US$414.79 a share as the pair lock in a deeper engineering partnership. The deal boosts agentic AI, cloud access and chip-design tools, adding to Nvidia’s growing list of AI-era investments: Capital Brief

JOB OPPORTUNITIES

P.S.

Till next time,

-Team PB