👋 G’day

Welcome back to another day of insights

Today’s brief:

Minters tops grad list

ASIC trims IPO timelines

iOS skipped, iPhone glow up

Here’s the latest 👇

PRACTICE POINTS

ASIC eyes IPO revival

ASIC has kicked off a two-year trial to speed up IPOs, letting companies with market caps over $100m submit draft prospectuses 2 weeks early, cutting a week from the usual timeline. It’s a bid to revive a listings market that’s raised just $187m in 2025—the weakest start since COVID. The trial also allows companies to accept retail investor apps early. While prospectus forecast rules remain unchanged (for now), ASIC is chasing greater deal certainty to lure more companies to list locally: AFR

*

Two recent FWC cases show employers must tread carefully when refusing flexible work requests.

In Naden v Catholic Schools Broken Bay, a teacher returning from parental leave sought to return part-time in her executive role. The school said no—she could return part-time, but only as a classroom teacher. The FWC Full Bench overturned the refusal, finding the school failed to properly consider and document the consequences of its decision for Ms Naden.

In May v Paper Australia, Mr May’s formal request to vary his hours for parental duties was rejected. The company said granting it would breach their enterprise agreement. But the FWC ruled that enterprise agreements can’t override the National Employment Standards, which include the right to request flexible work.

Employers: document your reasoning and consider the employee's circumstances when dealing with flexi work requests: Allens

*

M&A deals are now staring down real geopolitical risk with Trump tariffs, testing material adverse change (MAC) clauses that entitle a party to walk from a deal. Aussie courts haven’t yet tested whether a tariff qualifies as a MAC, but overseas case law offers clues. The English High Court held that COVID disruptions didn’t trigger a MAC for the Premier League football. Similarly, in another decision, a geotechnical issue affecting a mine was too minor to constitute a MAC, costing just 5% of the purchase price. With current volatility and judicial uncertainty, clear drafting is crucial. Hamilton Locke thinks parties should spell out:

quantitative triggers (eg, 20% EBITDA drop),

specific events that qualify as a MAC, and

clear carve-outs.

WORD ON THE STREET

Grad rankings revealed

MinterEllison has taken the top grad spot in the AAGE Top Graduate Employers list for 2025, now holding the crown for both grad and clerkship programs. HSF Kramer came second, with Ashurst in third, while Allens slipped to 7th. The survey of 4,000+ grads rated employers across 31 categories, from mentoring to career progression. How did your firm go?

*

Legal AI startup Harvey has inked a tech partnership with iManage, bringing its legal reasoning tools straight into the document platform used by 80% of Am Law 100 firms. The integration lets users pull docs from iManage, generate output with Harvey, and send it right back—no more downloads, uploads or data risks. What a game-changer.

*

Boston Consulting Group has fired two unnamed partners for not working on the Gaza Humanitarian Foundation. BCG says the pair misrepresented the project during its vetting process and broke internal policies. The consultancy has since withdrawn from the project, won’t accept payment, and has engaged outside counsel to investigate. The GHF has drawn global criticism and was recently suspended after Israeli troops allegedly shot 27 civilians waiting for aid: AFR

TALKING POINTS

Indigenous hiring ignored

A new audit reveals 1,475 Commonwealth contracts were exempted from Indigenous employment rules, often citing vague reasons. That's $70bn in contracts that didn’t have to hire a minimum number of Indigenous people or use Indigenous businesses. Of the 870 contracts where rules applied, only 20% were checked, and 28% failed compliance. Auditors say systems allow “potentially invalid” exemptions, undermining the policy’s goal to boost Indigenous employment and procurement: ABC

*

It’s tax time, so let’s slash your tax bill. High earners put a dent in their taxable income by over $121k this June, thanks to a suite of deductions, some vanishing after June 30. Strategies include topping up super, prepaying investment loan interest, instant asset write-offs, and car logbooks. One tip: prepaying next year’s super contributions could supercharge deductions. With the right moves, tax refunds north of $40k are on the table: AFR

*

Global uncertainty is rising. A Chinese aircraft carrier has entered Japan’s exclusive economic zone, marking one of its deepest moves into the Pacific yet. Meanwhile, Trump escalated his clash with California, saying he’d support Governor Newsom’s arrest over immigration protest fallout. Newsom plans to sue, accusing Trump of illegally federalising the National Guard to crack down on the LA unrest: Bloomberg, AFR

THE TREASURY

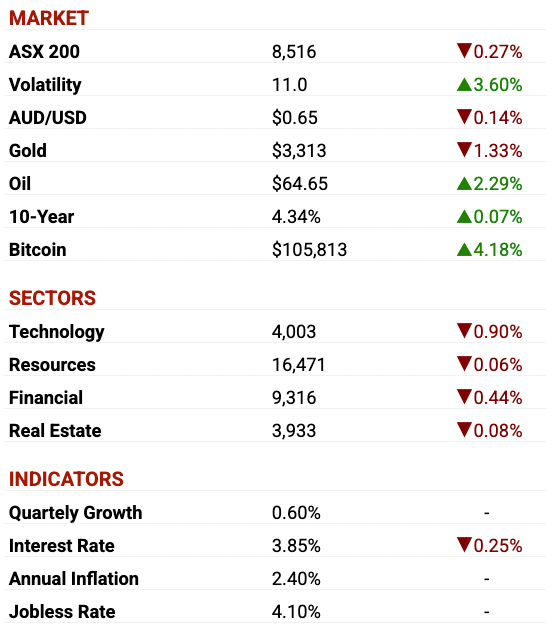

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Rex rescue

Anchorage Capital: has lobbed a bid for collapsed airline Rex, nearly a year after it nosedived into administration. The US distressed debt giant is no stranger to Aussie turnarounds, with past plays in Alinta, I-MED and Slater & Gordon. Courts must be convinced by June 30, or the government could step in as buyer of last resort: AFR

*

SkyCity Entertainment: has hired Jarden to explore options for its $1.85bn property portfolio, including its Auckland carpark—NZ’s largest—and hotel assets across Auckland, Hamilton and Adelaide. The move comes amid $NZ722m in debt, ongoing litigation with Fletcher Building, and a tough trading outlook. A sale or restructure could be SkyCity’s next roll of the dice: The Australian

*

Ryan Reynolds and Hugh Jackman: are now co-owners of Australia’s SailGP team, joining forces with skipper Tom Slingsby. Gibson Dunn advised the celeb duo on their stake. The Deadpool & Wolverine stars say they're “incredibly excited”—and yes, Ryan’s tagging along as Hugh’s emotional support human: ABC

*

Pacific Equity Partners: has locked in exclusivity on a potential take-private of Johns Lyng Group, after the ASX-listed property services firm’s stock halved this year. PEP have been circling since 2023: AFR

SECTOR SPECIFIC

iPhone glow up

🚜 DIGGERS

It’s not about yoga or gourmet food. According to a Monash study surveying 2,000+ miners, the top concern for FIFO workers is sleep (relatable). Noise insulation trumps luxuries, with bed placement and room construction flagged as key. With turnover over 20% and union pressure mounting, miners like MinRes and Rio are now investing in quiet, comfort-focused camps to keep workers sane: AFR

*

Cybersecurity specialist Matt Breuillac says many tier two and three miners are a decade behind in cybersecurity and ripe for attack. In recent hits: Rio Tinto leaked staff data on the dark web, Copper Mountain Mining Corp was forced to shut a mill because of an attack, and Northern Minerals had internal files dumped on the dark web: Mining.com

🏦 FIN

HESTA’s seven-week account lockdown has backfired. Its 1.1m members are now facing hours-long call waits and delayed payments. Some members reported urgent payment requests for house and car deposits were left hanging, while others said staff couldn’t even locate their details: The Australian

*

ASIC and global watchdogs have joined the UK’s FCA in a coordinated blitz on rogue 'finfluencers', who promote dodgy financial products via Insta and TikTok. In the UK alone, 3 arrests, 50+ warnings, and criminal charges. Regulators' message? If you're you’re flogging investments without authorisation, your next #ad could land you in court: FinExtra

🏠 RETAIL & REAL ESTATE

After losing an estimated $400m in sales to Chemist Warehouse, Amazon, Bunnings and Temu, Coles is overhauling its health, beauty and home game. Suppliers have been asked to gear up for 12-month promo campaigns as Coles looks to retake ground in everything from skincare to laundry: The Australian

*

Sydney’s first skyscraper, sitting pretty at 33 Alfred Street, is back after a mega-dollar-multi-year overhaul by Dexus and Mirvac. The Circular Quay icon has been modernised into a 32,000sqm premium office with 5.5-star NABERS and 6-Star Green Star creds. The golden façade’s been refreshed with 5,000 custom panels, wrapping up the Quay Quarter precinct alongside the award-winning Quay Quarter Tower: COMMO

📱 TECH & STARTUPS

Apple’s iOS is skipping ahead to iOS 26, bringing a glassy, Vision Pro–style redesign to your iPhone. Think translucent icons, floating tabs, and AI-assisted battery longevity. But Apple’s still playing AI catch-up. Analysts are watching WWDC closely for proof Siri’s long-promised AI glow-up is finally coming: AFR

*

Superhero just banked $11m from existing backers, lifting its post-money valuation to $150m. The fintech’s gearing up to go beyond DIY trading, launching managed portfolios and tools for the “mass affluent” — those stuck between doing it themselves or paying for full-blown advice. Investors include Zip co-founder Larry Diamond and Afterpay co-founder Nick Molnar: SmartCompany

Till next time,

-Team PB