👋 G’day

Welcome back to another day of insights

Today’s brief:

Grad roles defy AI fears

UK law grad sues Clyde & Co

Jail population hits unprecedented numbers

Here’s your latest 👇

PRACTICE POINTS

Intention statements under scrutiny

In Dropsuite Limited [2025] ATP 10, Topline Capital told the market it would vote all Dropsuite shares it held or controlled in favour of a scheme, subject to no superior proposal and a favourable expert report. But on the same day the scheme was announced, Topline started selling, eventually dumping two-thirds of its 31% stake. The kicker? No timely Form 604s — it waited 21 and 19 days to disclose the trades, breaching s. 671B of the Corps Act. The Panel said its ambiguous statement plus delayed disclosure misled the market, especially given its status as the largest shareholder. Topline was ordered to stop selling and vote its remaining shares in line with the original commitment: Clayton Utz

*

The Federal Court’s National General Protections List (NGPL) pilot has been extended to September 2025, giving the program a full 12-month run. Launched in September 2024, the NGPL is designed to streamline case management for general protections matters under the Fair Work Act. The extension gives the Court more time to assess its impact on efficiency and access to justice.

*

The NSW Supreme Court confirmed that a director’s resignation is effective once they sign and deliver it to the company, even without formal acceptance, so long as no special resignation process is set out in a constitution. Interestingly, the company had a registered constitution, but its contents were not available to the court, and so the replaceable rules didn’t apply. Black J concluded that the authorities suggest nothing further is required beyond a signed and delivered resignation letter. His Honour also clarified that s. 201A of the Corps Act requires at least one statutory (not de facto or shadow) director.

WORD ON THE STREET

Grad roles defy AI fears

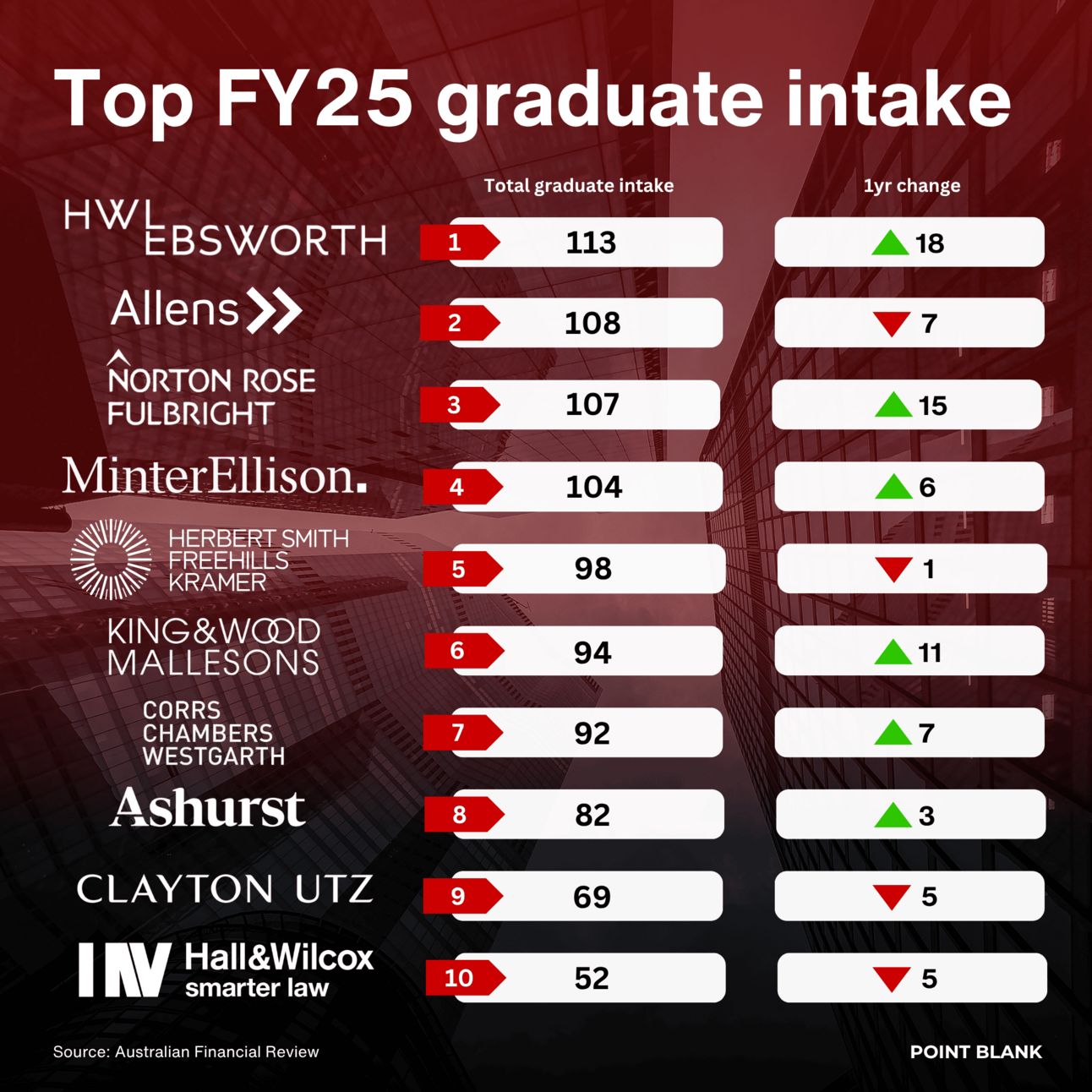

Despite fears that AI would wipe out junior roles, graduate hiring is up 6% across top firms to nearly 1,700 grads, per the AFR Law Partnership Survey. Firms say AI is doing the grunt work—not replacing jobs, but freeing up time for training, client work and more meaningful tasks. As Gadens, KWM, and Minters see it, AI-savvy juniors are now more valuable than ever. Meanwhile, HWLE, Allens and NRF have topped graduate intake in 2025: AFR

*

Thomson Geer has poached partners Rachel Drew and Rose Dimitrious plus a 15-strong team to its Brisbane workplace relations practice, including migration specialists and senior counsel. The move builds on recent hires from Ashurst and Adrian Wong’s team in Melbourne, as TG continues to scale nationally in employment, WHS and regulatory work: Thomson Geer

*

A law graduate has been given the green light to pursue a discrimination claim against Clyde & Co after missing out on a UK training contract — seriously. She alleges the firm unfairly required in-person assessments, making it impractical for her as she lived 3,000 miles away in Nigeria. Some claims were struck out, including rejecting her attempt to add senior partners to the claim. The Tribunal described the late-stage claim as “not entirely straightforward”: Legal Cheek

*

Rebecca Hanrahan has been promoted to partner at Clayton Utz, effective 1 July. Starting as a graduate of the firm in 2011, she’s since built a strong R&I practice with experience spanning High Court matters, cross-border workouts, and WA’s resources sector. CU says the move strengthens its national R&I bench amid rising insolvency pressures: Clayton Utz

TALKING POINTS

Harassment fines

The AHRC wants fines for employers who don’t take “reasonable steps” to stop sexual harassment, like training and reporting systems. It also wants limits on NDAs, saying they’re often used to silence victims. The move follows a six-month review of workers’ stories and pushes the government to finally put teeth behind the Respect@Work reforms: The Daily Aus

*

Aussie subs deal might be on the chopping block. The US is pushing us to lift defence spending to 3.5% of GDP, and might withhold Virginia-class subs if we can’t promise to back them in a Taiwan clash. A Pentagon review is underway, led by a sceptic of the deal. Pressue is now mounting for Albo to get face time with Trump, with the AUKUS hanging in the balance: The Economist

*

Australia’s prison population just hit a record 46,081, with 42% still awaiting trial. Experts say stricter bail laws and reactive sentencing are driving the surge, especially for First Nations people, who make up 37% of prisoners. We now have the seventh-highest rate of imprisonment of the G20 nations. The kicker? It’s costing us $6.5bn a year: ABC News

THE TREASURY

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Goldman Sachs, JP Morgan clean up

Goldman Sachs: has claimed the Aussie M&A crown with $97.1bn in deals for FY25, led by the $36bn Santos bid and $16bn AirTrunk buyout. On the ECM side, JPMorgan topped the tables with $2.8bn in raisings, including Xero and Goodman. ECM volumes are up 21%, and with M&A momentum rebounding, bankers say the best is yet to come: The Australian

*

ASIC: is making inquiries into the PointsBet scheme vote debacle, after Computershare wrongly excluded Betr’s 19.9% stake, briefly green-lighting Mixi’s $402m deal. The mix-up sent Betr shares tumbling 5% before the correction. ASIC’s focus? Whether investors were misled, and if trading occurred on faulty info: AFR

*

Shein: is making a third tilt at going public, filing confidentially for a Hong Kong IPO in a rare move that lets Shein keep its financials under wraps. After failed UK and US bids, the fast-fashion giant is banking on the China Securities Regulatory Commission's blessing to land what could be HK’s biggest float of 2025: Reuters

SECTOR SPECIFIC

Gold rush

🚜 DIGGERS

Gold’s set to overtake met coal as Australia’s third-biggest export, tipped to pull in $56bn next year as prices soar past $5k an ounce. A surge in demand from jittery investors and central banks has sparked a flurry of M&A deals, with Northern Star, Gold Fields and Ramelius all diving in. The gold rush is back: AFR

*

Mineral Resources has offloaded its loss-making Yilgarn Iron project, wrapping up a 14-year chapter in WA’s Goldfields. The buyer, Yilgarn Iron Investments, takes on all environmental liabilities, while MinRes keeps gold and lithium rights —sounds not so shabby for MinRes. The sale is confidential and “immaterial”, but 800 jobs were already redeployed after exports ceased last year: Capital Brief

🏦 FIN

After a decade-long legal slog, a UK tribunal has ruled Visa and Mastercard’s multilateral interchange fees, charged to retailers on card transactions, breach competition law. The case, brought by hundreds of merchants, sets a major precedent. Both companies plan to appeal, but the decision paves the way for fresh compo claims: Reuters

*

CBA’s share price has soared nearly 50% this financial year, adding $319bn in market cap and dominating the ASX. But active fund managers are fuming, calling it overvalued and unbuyable, yet impossible to ignore. Passive flows and APRA’s YFYS test are fuelling the rally, while some warn rate cuts could unravel the whole thing: Capital Brief

🏠 RETAIL & REAL ESTATE

Woolies is shutting down MyDeal, copping a $100m hit to kill off the underperforming marketplace it bought for $243m just 3 years ago. New boss Amanda Bardwell is tightening the screws on costs after a 20% profit slump, with analysts praising the move as a win for financial discipline amid brutal e-commerce competition: AFR

*

Blackstone wants a hand in fixing Australia’s housing crisis, but says foreign investor taxes make the numbers tough. Global real estate boss Kathleen McCarthy flagged build-to-rent as a key growth area, alongside logistics and data centres. With $180bn in dry powder, Blackstone’s ready to pounce. Only if the tax math adds up: The Australian

📱 TECH & STARTUPS

Australia produces more unicorns per VC dollar than any other country, per new AWS/Side Stage data. With 1.22 unicorns per $1bn invested, we beat the US, Israel and NZ. But with fewer early-stage funds than Scandinavia, investors say we’re desperate for seed capital to keep feeding the Atlassians and Canvas of tomorrow: Capital Brief

*

Donald Trump says he's found "very wealthy people" to buy TikTok, just weeks after a federal law mandated its sale or ban. While Trump delayed the law's enforcement after taking office, he's now promising to name the mystery buyers within weeks. No word yet on who’s behind the bid. Or if China will play ball: Reuters

P.S.

Till next time,

-Team PB