👋 G’day

Today’s brief:

Suits star fronts AI platform Harvey

In-house ditch firms over fee hikes

The $15bn bid, plus Mayne sues

Here’s your latest, PB Sub #{{join_number}} 👇

WORD ON THE STREET

Harvey hires Harvey

Legal AI heavyweight Harvey has inked its first brand deal with Gabriel Macht, aka Harvey Specter from Suits - the namesake of the company. The move, alongside the launch of @askharvey on Instagram, signals a shift from enterprise-only focus to mainstream brand building. As rivals like Legora ramp up visibility too, legal AI is fast becoming a branding battle: NB

Watch out law firms - a new Axiom report says over 80% of global in-house leaders plan to shift work away from traditional law firms to internal departments or alternative legal services providers within two years. Why? Rising rates, near-universal AI adoption and relentless efficiency pressure. Four in five say law firm fees are simply too high: PR Newswire

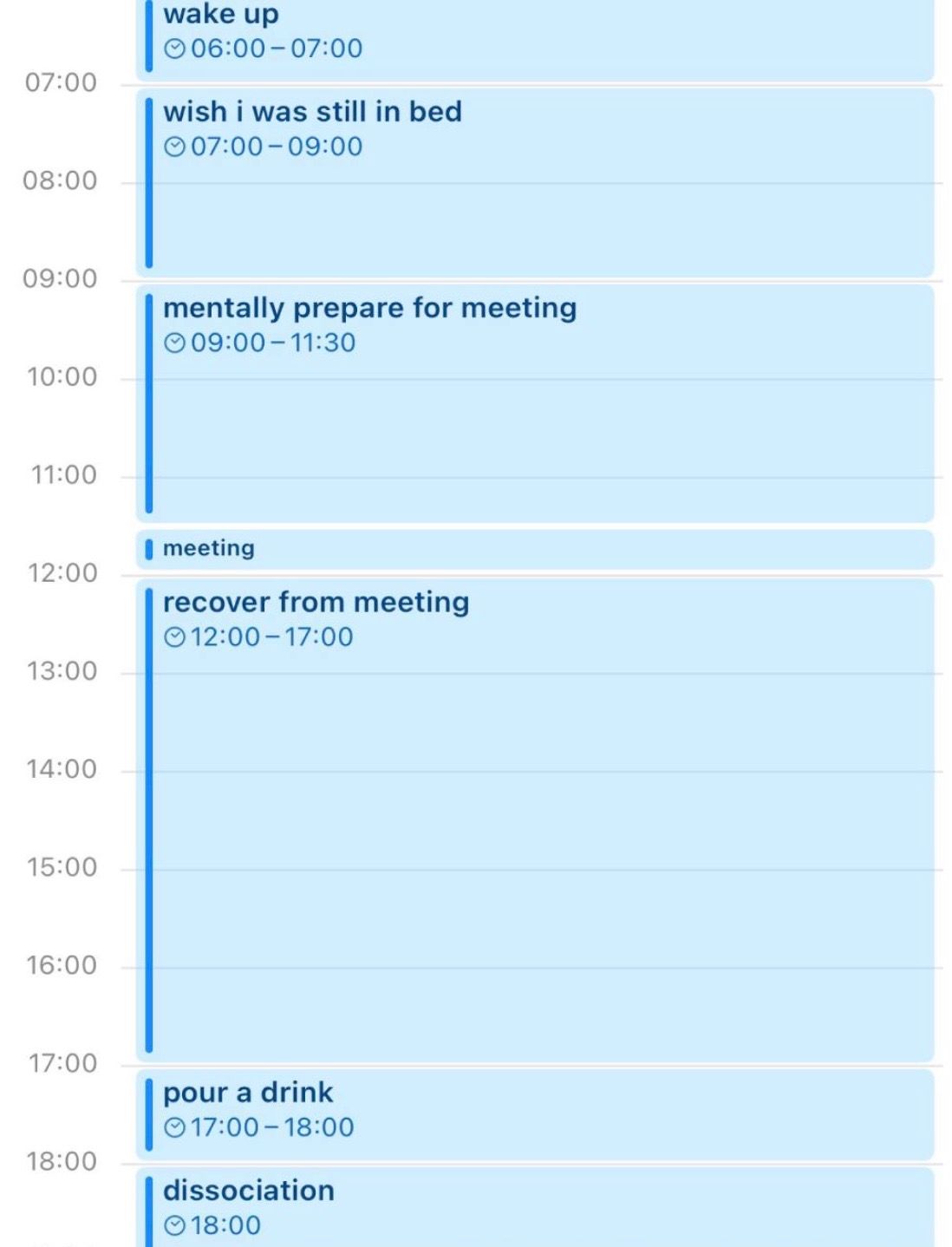

Juniors are under pressure. UK Mental health charity LawCare supported a record 753 people last year, higher than pandemic levels, with trainee solicitors making up 13% of contacts. Stress, career worries and anxiety topped the list. Callers rated wellbeing 2.2 out of 10 before reaching out: Legal Cheek

Newly released US Justice Department files reveal a draft Latham & Watkins engagement letter offering to retain Jeffrey Epstein as a consultant in 2015, signed by then-partner Kathy Ruemmler. It’s unclear if the engagement proceeded, but the correspondence is already raising eyebrows across the profession: Law.com

PRACTICE POINTS

ACCC shifts gears

⚖️ Competition/Consumer: The ACCC wrapped 2025 in full enforcement mode, pivoting from consultation to courtroom in franchising, retail and mergers, while quietly reshaping digital and data oversight. Maddocks’ 10th Watchdog Recap tracks infringement notices under the revamped Franchising Code, a $1.5m contempt penalty against Ultra Tune, sharper action on subscription traps and pricing claims, and steady pressure on supermarkets and energy retailers amid cost-of-living scrutiny: Maddocks

⚖️ Disputes/Tort: The High Court has clarified the law of private nuisance, reinstating liability against Transport for NSW and drawing a bright line between nuisance and negligence. In Hunt Leather Pty Ltd v Transport for NSW, the Court confirmed the starting point is substantial interference with land. Once that’s shown, the onus shifts to the defendant to prove its use was “common and ordinary” and “conveniently done.” Even reasonable care won’t be enough if the interference wasn’t minimised with proper regard to the plaintiff’s interests. The Court rejected any need for plaintiffs to prove a counterfactual construction plan, and dismissed statutory authority arguments where the nuisance flowed from planning choices and delay, not inevitability.

⚖️ Regulatory: The Albo Government has tabled the Corporations Amendment (Digital Assets Framework) Bill 2025, marking Australia’s most concrete move yet to pull digital asset intermediaries within the Corp Act. The Bill creates two new financial products, Digital Asset Platforms (DAPs) and Tokenised Custody Platforms (TCPs), capturing exchanges, brokers, custodians and tokenisation models, without automatically deeming crypto itself a financial product. Operators would face tailored licensing, asset-holding standards, platform rules with contractual force, and mandatory disclosure guides, alongside ASIC-set custody and reconciliation standards: Ashurst

TALKING POINTS

Office lunches win

Did you hear…

As layoffs bite and wellness perks disappear, one indulgence is thriving - and getting fancier. From Mediterranean lamb and pear mousse at Meta to smoothie bars and rotating menus at KKR, corporate catering is booming as firms use food to lure talent and drive return-to-office compliance. Consultants say it’s a cheap morale win compared to bonuses, while studies show workers prefer food perks over gym memberships: Business Insider

Also…

Aussie metro universities, including the USyd, have over-enrolled domestic students ahead of the Albo’s hard caps kicking in from 2027. Sydney’s undergrad intake is up 5%, with law surging 25%, driven by higher acceptance rates and guaranteed ATAR entry pathways: AFR

DEAL ROOM

$15bn bid, Mayne sues

🔧 Steel Dynamics/SGH sweeten BlueScope tilt to $15bn. Steel Dynamics and SGH have lobbed a “best and final” all-cash offer of $32.35 per share, valuing BlueScope Steel at ~$15bn. The board is reviewing the revised bid after rejecting an earlier $29 per share proposal: The Australian

💊 Mayne fires back over $600m bust-up. Mayne Pharma has sued Cosette Pharmaceuticals, backer Avista Healthcare Partners, and Avista CEO David Burgstahler in the NSW Supreme Court, alleging breaches of the $7.40-a-share scheme deed and the inducement of those breaches. Mayne is seeking substantial damages after the takeover collapsed, where Treasurer Jim Chalmers ultimately blocked the deal on national interest grounds: Capital Brief, ASX

WITH MADDOCKS

Watchdog Recap

The ACCC is bigger, bolder and better funded.

In 2025, it shifted from regulatory guidance to hard enforcement, doubled down on pricing and subscription “blitzes” in retail, and laid the groundwork for unfair contract terms test cases.

Maddocks’ specialists have dropped a special 10th anniversary wrap-up of the ACCC's high and low enforcement moments as part of their annual 12-article publication.

SECTOR SNAPSHOT

Greenwashing dismissed

DIGGERS

🚜 The Federal Court has dismissed a landmark ‘greenwashing’ case against Santos, finding its decarbonisation statements were not misleading. The suit challenged claims that gas is a clean fuel, blue hydrogen is zero emissions, and Santos’ net zero plan was feasible. Detailed reasons are due Monday: Capital Brief

FIN

🏦 ASIC cracks down on super lead gen. The corporate watchdog has put advice licensees on notice over the use of lead-gen services that may inappropriately steer consumers to switch super funds following the fallout of Shield and First Guardian funds. ASIC has launched a review, published a list of known lead generators and referral partners, and flagged potential enforcement action where it detects breaches: The Australian, ASIC

RETAIL + REAL ESTATE

🏠 Mirvac lifted its operating profit by 12% and raised its interim dividend as home settlements jumped 22% and residential EBIT rose 9% to $110m. While Dexus launched an on-market buyback of up to 10% of its securities: AFR

TECH + STARTUPS

📱 Atlassian has paused hiring engineers and related roles as its Nasdaq share price remains down ~75% from its peak. Vacancies have shrunk to a handful of engineering roles, with some candidates reporting cancelled interviews. The software giant is tightening recruitment amid broader SaaS and AI disruption fears: AFR

JOBS

P.S.