👋 G’day

Welcome back to another day of insights

Today’s brief:

ASIC slams Macquarie’s controls

Apple threatens Google’s search reign

Junior works 24hr shifts, watches hockey

Here’s the latest 👇

PRACTICE POINTS

Ransomware clock ticking

From 30 May 2025, businesses with over $3m turnover and operators of critical infrastructure must report ransomware payments within 72 hours under the new Cyber Security rules. The report—lodged via an upcoming ASD portal—must detail the cyber incident, extortion demand, payment made, and any comms with attackers. There’s no grace period, and failure to report can lead to civil penalties up to $19.8k.

*

In the most recent corporate finance update, ASIC reminds companies to include clear disclosure in the NOM where a buy-back could boost a shareholder's voting power. And it expects even greater disclosure where it's a meaningful shift in control (e.g. 40% to 60%). ASIC may block relief or even seek a declaration of unacceptable circumstances if shareholders weren’t properly warned.

*

The Federal Court has approved a $180m class action settlement for thousands of Aboriginal and Torres Strait Islander workers underpaid in the NT between 1933 and 1971. But in handing down reasons, Chief Justice Mortimer took aim at Shine Lawyers’ fees—labeling them “excessive”, especially for tasks billed by law clerks that could’ve been done by admin staff. The Court also rejected Shine’s $8m ask for an outreach program, finding it should be handled by local Indigenous organisations to cut costs. Big win for claimants—but a clear reminder that legal costs still face close scrutiny.

WORD ON THE STREET

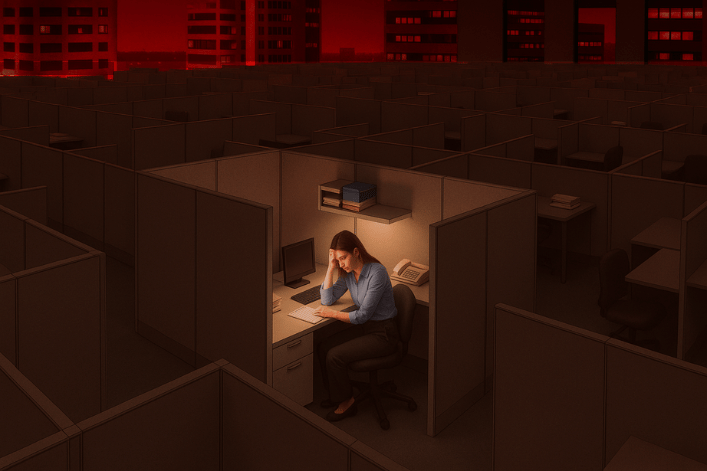

24-hour shifts exposed

Melbourne’s Erudite Legal has been fined $51k for forcing a junior lawyer to pull 24-hour shifts, work 79-hour weeks, and watch an ice hockey at 1am to grasp her boss’ “philosophy”. She was paid just $1k for 225 hours, made to share a bed with the office manager, and worked through her ex’s funeral. The firm is now deregistered: AFR

*

Regulators have greenlit Garfield.Law—the UK’s first pure AI-run law firm, co-founded by ex-Baker McKenzie lawyer Philip Young. The firm, offering £2 debt recovery letters, will serve small businesses under solicitor supervision. The SRA says it’s a “landmark moment”, with guardrails in place to prevent hallucinations and protect clients: Legal Cheek

*

Mark Bennett has jumped from Hogan Lovells to join DLA Piper as a partner in Sydney, bringing 25+ years of tech and real estate expertise across Asia, the UK and Australia. His arrival follows Hogan Lovells’ exit from the Aussie market last year, and marks DLA’s third partner hire in 2025 as it builds out its tech bench.

*

Promo season is in full swing. Pinsent Masons has followed its 24-partner blitz with 12 new promotions across APAC. Meanwhile, Clyde & Co has promoted five to special counsel, hired two more, and welcomed back Jenny Thornton—ex-barrister and former partner—as Perth managing partner: Lawyers Weekly

*

🚶♂️ Know who’s on the move? Hit reply.

TALKING POINTS

Double jobs, double pay

Meet the “over-employed”, remote workers like Nadia juggling two full-time jobs in secret, pocketing double pay while praying they don’t slip up. The trend’s booming post-COVID, especially in IT and corporate roles, but it’s not without risk. One Brit earned $1.49m juggling 13 remote roles… AFR

*

After days of counting, Adam Bandt is projected to lose his seat of Melbourne to Labor’s Sarah Witty, blindsiding the Greens. Bandt told supporters he’d hold on Saturday night, but a 4.4% swing and preference flows from One Nation and Liberals tipped it to Labor. He now joins Peter Dutton in the rare club of party leaders losing their seats. The Greens didn’t see it coming—now they’re leaderless: ABC News

*

In other green news, councils in the UK are getting creative with carbon offset projects. Islington is turning tube tunnel heat into power for 1,350 homes. That’s not all, Hackney's solar microgrid lets tenants buy cheap solar power directly. And Kensington & Chelsea is retrofitting schools so old they're leaking heat (and emissions). There’s a slight caveat. Offset funds rarely cover the full bill… so councils may be mixing funding pots: The Guardian

THE TREASURY

ASX as at market close. Commodities and crypto in USD.

A MESSAGE FROM DEELIGENCE

Ready to revolutionise your DD?

Deeligence lowers the cost and increases the accuracy of your DD workload, bolstering project margins and letting your team focus on strategic work.

Harness AI and clever collaboration technology to review contracts 75% faster while reducing human error.

A 30 minute demo could save you weeks.

DEAL ROOM

IPO hopes, M&A fears

ASX: says the IPO pipeline's healthy, but market volatility is spooking issuers. Helen Lofthouse is still bullish on offshore companies seeking a secondary listing, as well as the likes of Virgin and Greencross lining up IPOs. But big exits like Boral and Sydney Airport are still outpacing new floats: AFR

*

Reuters: on the other hand is saying M&A has hit an all-time low. The number of M&A contracts globally fell to the lowest level in 20+ years in April, per Dealogic data for Reuters—widely seen as a health check for the world economy. Only 555 deals were signed in the US, the weakest since May 2009. Trump’s tariff war is spooking CEOs and stalling deal flow across the board: Reuters

*

Guild Insurance: has hired UBS to explore a sale, with Suncorp and Employers Mutual tipped as early suitors. The pharmacy-backed insurer covers over 80,000 healthcare pros, making it a juicy niche player. It’s the latest in a string of insurance M&A plays, as Guild Group looks to trim down after offloading Guild Super last year: AFR

*

MedAdvisor’s in play, with a mystery multinational circling the pharmacy tech firm. The offer is “materially higher” than its 10c share price — a welcome boost after a 69% slide over the past year. A binding deal could land within 7 weeks, as exclusivity kicks in and DD ramps up. Shares spiked 30% before a trading halt: Capital Brief

SECTOR SPECIFIC

Macquarie’s licence risk

🚜 DIGGERS

Fleet Space has inked a four-year deal with Saudi miner Ma’aden to roll out what it’s calling the world’s biggest mineral exploration program. The $150m-backed Aussie startup is fusing AI with satellites to fast-track resource finds—putting Adelaide at the centre of a Saudi minerals push worth watching: Mining.com

*

Spheria Asset Management has been privately lobbying Deterra CEO Julian Andrews for months to ditch acquisitions, warning they’ll just erode shareholder returns. After getting nowhere, co-founders Matt Booker and Marcus Burns sent a blistering letter to the chair in Feb and have doubled down this month. The trigger? Deterra’s $273m Trident deal, which they say has underdelivered: AFR

🏦 FIN

ASIC’s slammed Macquarie over “weak compliance and control management” in its derivatives arm, citing 375,000 dodgy OTC trades and weak controls that could mask market manipulation. Macquarie must now bring in an independent expert, draft a full remediation plan, and fix deep-rooted governance issues — or risk licence breach: AFR

*

NAB CEO Andrew Irvine wants the bank to be the Toyota of Aussie banking, rolling out 20 “must win” battles across business deposits, direct home loan sales and customer satisfaction. NAB posted a $3.58bn half-year profit — up 1% year-on-year and just beating expectations. Investors are backing its tight margins, cost control and steady business banking lead: Capital Brief

🏠 RETAIL & REAL ESTATE

JB Hi-Fi copped a 6% share slump after Q3 sales growth came in softer than hoped, with analysts warning The Good Guys dragged. But over at Temple & Webster, it was all smiles—sales surged 23% since March and lower inbound shipping costs (thanks to Trump’s tariffs) have juiced margins: The Australian

*

Wesfarmers looks to flip its Bunnings blocks. The ASX-listed behemoth will offload six Bunnings Warehouses for $300m, dubbing them “last mile infrastructure” to entice global buyers. The sale-and-leaseback deal offers CPI-linked rents, 10-year leases, and potential rezoning upside. It’s part of Wesfarmers’ BPI property structure unwind, expected to generate up to $130m in pre-tax profit: Realcommercial

📱 TECH & START UP

God is dead said Nietzsche. Perhaps he was talking about the end of Google’s dynasty. Because Apple’s sniffing around AI search engines, eyeing a Safari revamp that could sideline Google —its $31bn/year current default partner for Apple’s browser. Testimony from Eddy Cue revealed Apple’s had chats with Perplexity and others as it preps for an AI-first future. Cue reckons traditional search is on borrowed time. Yeah, the markets didn’t love that.. Alphabet dropped 8.7%, Apple 2.7%: AFR

*

UNSW and VC firm Luminary are dropping $3.6m into 18 startups from its Health, Climate and Defence 10x accelerators. Each startup gets $200k on founder-friendly SAFE terms – with a 20% discount and $3.5m post-money cap. It’s Australia’s biggest uni-VC tie-up yet, targeting physical product founders doing the hard stuff. Think batteries, defence tech, med devices—where capital’s still tough to raise: Capital Brief

Till next time,

-Team PB