👋 G’day

Welcome back to another day of insights

Today’s brief:

Mid-tiers offer cash & balance

NSW Bar announces silk line-up

Cboe is the new home for Aussie IPOs

Here’s your latest 👇

WORD ON THE STREET

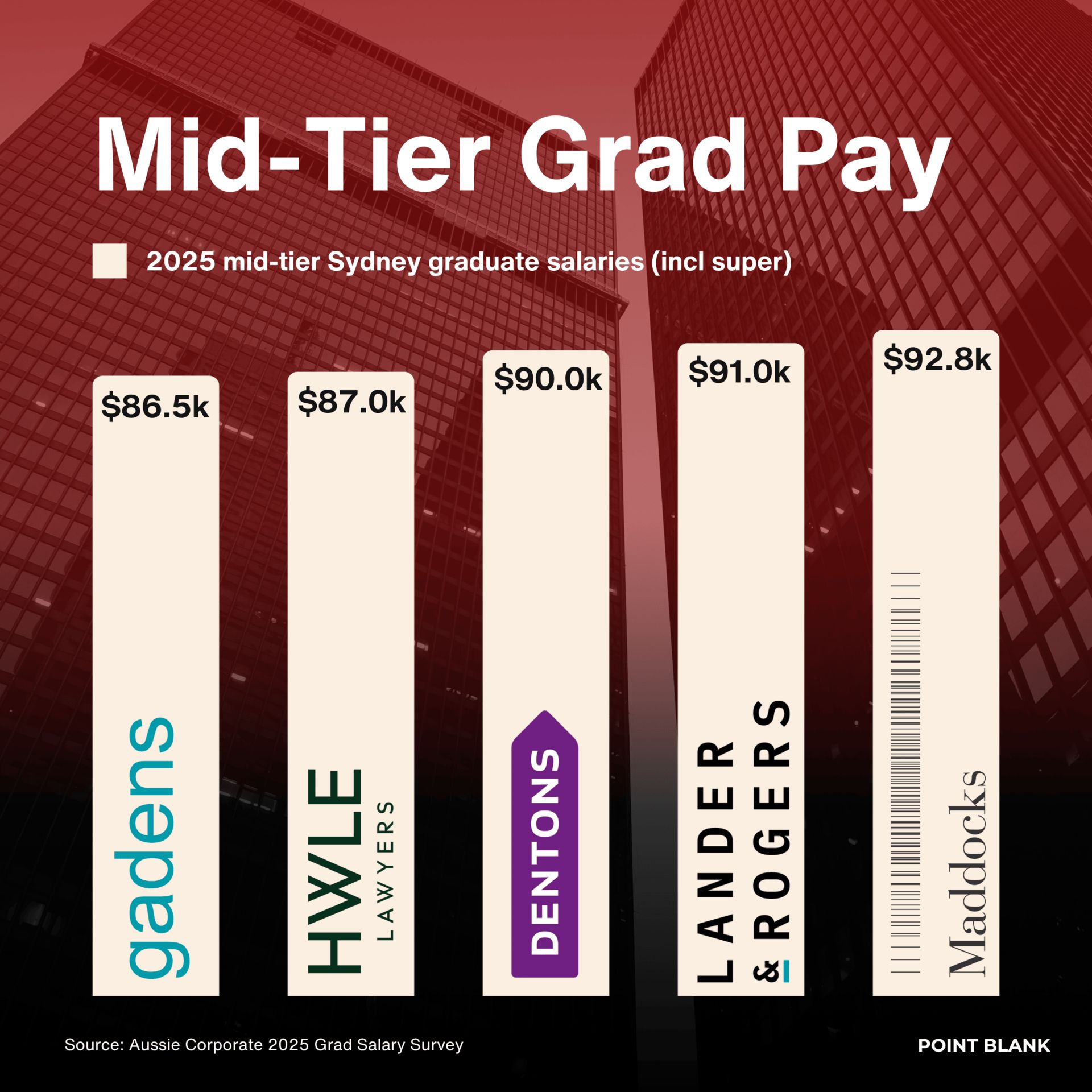

Mid-tier grad pay

Sydney grads at mid-tier firms are pocketing $85k–$95k, with Maddocks ($92.8k), Landers ($91k) and Dentons ($90k) leading the pack. That’s about a $20k gap to HSF Kramer and G+T on $117k. But mid-tiers offer more flexibility, lighter targets and fewer late nights. The real question — is balance worth the pay cut? Check out our full post here.

*

23 NSW barristers have taken silk, with Dominic Toomey SC announcing this year’s appointments. Women made up nearly one in three, with 29% of female applicants successful versus 17% of men. There are now 404 senior counsel in NSW, with women accounting for 16.3% of the total — a small but steady climb for the Bar: Point Blank

*

After fessing up to using AI, Deloitte will partially refund the federal gov for a $440k report it produced. The report included three fake academic references and a made-up court quote. The revised version deleted more than a dozen bogus citations and typos. Awks for a firm that makes $107bn globally advising clients on AI… AFR

PRACTICE POINTS

ASIC’s greenwashing streak

ASIC has launched civil penalty proceedings against Fiducian Investment Management Services, alleging governance failures and misleading conduct in managing its Diversified Social Aspirations Fund. The watchdog claims FIMSL’s PDS promised “ethical” investments avoiding harmful industries, yet the fund held stocks like BHP, Rio Tinto and Woodside. ASIC says FIMSL failed to review underlying holdings, identify ESG risks, or engage an ESG expert. Deputy Chair Sarah Court called it a case study in “how not to run an ESG fund”: Point Blank

*

A director’s attempt to rely on the Covid-19 safe harbour for insolvent trading has failed in Preiner v Shin, marking one of the first tests of s 588GAAA of the Corps Act. Gibson DCJ held that s 588GAAA doesn’t rewrite the test for insolvency — it merely suspends civil liability during the relief window (which was 25 Mar–31 Dec 2020). The company had been insolvent since mid-2019 and had ceased trading, so the safe harbour didn’t apply. The director also failed to give evidence, leaving the evidential burden unmet. The Court entered judgment for the liquidator, confirming the Covid relief wasn’t a “free ride” for companies already underwater before the pandemic.

*

ASIC has approved Cboe Australia’s application to operate a listing market, allowing it to list new companies and compete directly with the ASX. The move gives investors more IPO and dual-listing options, while offering companies another home exchange. ASIC Chair Joe Longo said the decision aims to boost competition, innovation and access in Australia’s capital markets. Formerly Chi-X, Cboe already handles 20% of daily equity turnover (around $2bn) and is now the 4th licensed listing market alongside ASX, NSX and SSX. The approval builds on ASIC’s broader push to diversify clearing, settlement and listing platforms, marking a major shift in how and where Australian companies can go public: ASIC

TALKING POINTS

“Uptober” crypto rally

October’s apparently the best month to bet on crypto. Bitcoin has smashed a new record, hitting US$125k (A$190k) as the so-called “Uptober” rally takes hold. The token has now gained in nine of the past ten Octobers. Renewed inflows into Bitcoin ETFs, upbeat US equities, and Trump’s pro-crypto stance have helped push it up 30% this year: Bloomberg

*

We’ve heard about Erin Patterson’s appeal plans, but the prosecutors have their own appeal agenda. Victoria’s DPP will appeal Erin Patterson’s life sentence, arguing the 33-year non-parole period is “manifestly inadequate”. The DPP is taking no prisoners, seeking life without parole: AFR

*

Tony Mokbel has had two of his drug convictions quashed by Victoria’s Court of Appeal, with judges ruling his guilty pleas were tainted by Lawyer X / Nicola Gobbo’s secret work as a police informer. Mokbel was acquitted in one case and faces a retrial in another over alleged MDMA trafficking. The court found the failure to disclose Gobbo’s conduct “impugned the integrity” of his convictions: ABC

DEAL ROOM

Bankers cash in

IBs continue to rake it in even with slower deal flow. Despite investment banking fees jumping 14% to US$2.1bn, the value of Aussie M&A plunged 16.7% to US$64.2bn — the lowest in five years. Barrenjoey led the pack with 7.2% share. Meanwhile, buyout and growth fundraising fell to just US$310bn globally, down from US$399bn a year earlier: The Australian

*

Igneo: has sealed the long-awaited $NZ2bn (A$1.77bn) sale of Clarus Group to Brookfield, ending a decade-long hold. Brookfield grabs Clarus’ gas pipelines, while Powerco takes the electricity lines. Keppel came second in the bidding: AFR

*

Heidi: the Melbourne AI start-up that cuts admin for doctors, backed by Blackbird Ventures, has landed a US$65m (A$98m) raise led by Point72 Private Investments, lifting its valuation to US$465m. It’s the fastest-growing company in Blackbird’s portfolio — outpacing Canva. Headline and Latitude also rejoined the round: Sky News

SECTOR SPECIFIC

NAB faces nature revolt

🚜 DIGGERS

Did someone say cultural refresh? MinRes chair Malcolm Bundey has appointed Sarah Standish as joint company secretary, continuing his push to reset company culture and repair the miner’s governance woes. Standish, ex-De Grey Mining and St Barbara, joins amid an ASIC probe into founder Chris Ellison’s dealings and a board exodus earlier this year: AFR

*

Anglo American has launched arbitration against Peabody Energy after the US miner walked away from its $3.8bn deal to buy Anglo’s Aussie coal assets. Peabody blamed a Moranbah North mine fire, calling it a “material adverse change.” Anglo’s refunded $29m of a $75m deposit, but the stoush could drag into late 2026 as coal prices cool: Mining.com

🏦 FIN

NAB will be the first major bank hit with an AGM resolution on nature risk, after 100+ activist shareholders backed a motion over deforestation-linked lending. Led by the Australian Conservation Foundation and investors like Melior and Australian Ethical, the push demands NAB disclose and phase out loans tied to land clearing: AFR

*

Treasury may let 55 small lenders quit Australia’s open banking regime, sparking concern it’ll hurt competition and push customers back to risky screen-scraping. The move would exempt banks with under $5bn in loans, removing data-sharing rules built to help borrowers compare mortgage and savings deals. Brokers warn it risks a two-speed banking system: AFR

🏠 RETAIL & REAL ESTATE

Supermarket wars are back. Aldi and Costco are now raking in a combined $17.5bn in Aussie sales, eating into Coles and Woolies’ turf. Aldi’s $12.5bn haul and Costco’s $5.1bn bulk-buy boom have pushed the majors to slash prices: The Australian

*

Greystar plans to more than double its Aussie student beds to 10,000 by 2027, after last year’s $1.6bn buyout of GIC’s 4,084-bed portfolio. The US giant’s new Accolade platform is live, and it’s eyeing UniLodge’s 38,000-bed network next. Australia’s undersupply has Greystar calling it “one of the best markets globally.” AFR

📱 TECH & STARTUPS

Chipmaker AMD has struck a multibillion-dollar deal with OpenAI to deploy 6GW of GPUs, a pact it says could generate tens of billions in revenue. AMD shares jumped 21%, with CEO Lisa Su calling it a “massive-scale” AI partnership. The deal gives OpenAI a hedge against Nvidia: Bloomberg

*

Sydney venture builder Nakatomi has raised $3.5m, backed by Leonardo.ai’s founders, Gannet Capital and Scalare Partners, to grow “human-first” AI ventures. Co-founders Ben Bray and Andy Timms reject the Silicon Valley push for one-person empires, with a goal of launching 3–4 “soulful” startups a year and redefine how AI meets design: The Australian

JOB OPPORTUNITIES

Till next time,

-Team PB