👋 G’day

Welcome back to another day of insights

Happy Monday!

We just gave our referral program a shiny new makeover - yep, fresh rewards are up for grabs! Know a friend, colleague or enemy who’d love Point Blank? Send ’em our way and you get some seriously good stuff. No pressure, just perks.

Today’s brief:

Here’s your latest 👇

PRACTICE POINTS

Ex-CEO banned

iSignthis (now Southern Cross Payments) has copped a $10m penalty for disclosure breaches. The Federal Court found iSignthis misled investors about its Q4 2018 revenue, hid $3m in one-off revenue and $2.85m in costs, and failed to disclose that VISA had terminated its relationship with iSignthis. Ex-CEO Nickolas Karantzis also copped a $1m fine and six-year director ban for breaching his duties, misleading the ASX, and downplaying the seriousness of his conduct. Justice McEvoy said the market and investors were left misinformed for “significant periods”, stressing the need for deterrence: ASIC

*

The Fair Work Commission has confirmed that lifestyle preference alone won’t secure a flexible work order under the FW Act. In Collins v Intersystems Australia, a principal technical specialist asked to keep WFH two days a week, citing parental duties for two school-aged kids. The Commission found no evidence he needed both days at home—he had no caring tasks during core hours and could manage drop-offs/pick-ups via adjusted hours. Even if the request was valid, the employer had reasonable business grounds to refuse. Flexible work requests must be tied to legislated criteria, not just employee preference: Holding Redlich

*

When should directors walk away? Directors remain liable under the Corporations Act even if they weren’t involved or did not know of the impugned conduct. Timely resignation may be necessary to mitigate liability if the director finds themselves without access to financial records, excluded from key decisions, witnessing unlawful conduct by other directors, or even a refusal by the other directors to put the company into external admin when insolvent. Courts, including in Daniels v Anderson, reject ignorance as a defence – directors must actively supervise and inquire into the company’s affairs. Improperly executed resignation won’t shield liability, so ensure statutory notice, ASIC lodgement and record-keeping obligations are met: worrels

WORD ON THE STREET

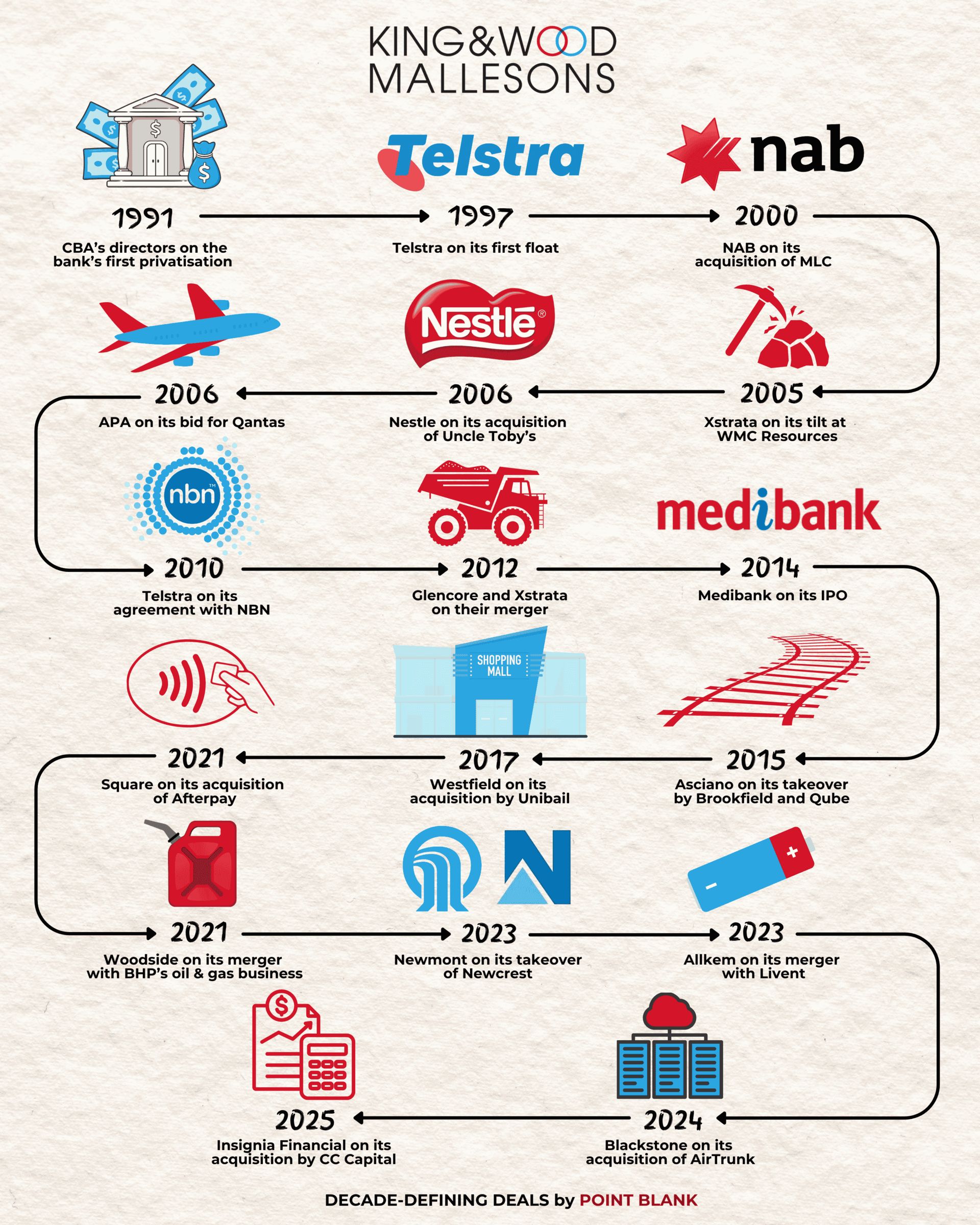

KWM’s deal hall of fame

From the CBA’s $1.6bn privatisation in 1991 to Afterpay’s $39bn buyout and Newmont’s $26bn Newcrest takeover, KWM has sat at the table for Australia’s most era-defining deals. Its M&A resume reads like a corporate history lesson — spanning privatisations, IPOs, contested battles and record-breaking mergers. Check out the full history here.

*

In other not-so-spectacular KWM news, the AFR revealed that KWM’s China arm quit the firm’s global professional indemnity scheme 2 years ago after lawsuits and regulatory probes sent premiums soaring. The move, a core plank of the 2012 Sino-Australian merger, leaves the Chinese practice with reduced cover and fuels speculation about the alliance’s future ahead of a 2026 review: AFR

*

The Queensland Supreme Court has frozen a lawyer’s assets after Clive Palmer alleged he stole up to $30m by “doctoring” legal invoices. Hindman J called the claims “extremely serious,” citing examples where charges were tripled or billed for free services. The lawyer has surrendered his practising certificate, and police and the Queensland Law Society are investigating: The Australian

*

On $7m a year and locked in until 2033, Corrs’ CEO Gavin MacLaren has still found time to kick-start his side hustle, Garran Advisory alongside Liberal heavyweight Tom Harley. Targeting government consulting, Garran’s registered to Corrs’ Melbourne office and staffed by Corrs talent—raising a few eyebrows over potential conflicts, given Corrs already pockets millions in federal and state legal work: AFR

TALKING POINTS

NSW outlaws deepfakes

The NSW Government will make it a crime to create or share sexually explicit deepfake images or audio of an identifiable person without consent. The law closes a gap in existing image-based abuse laws and carries up to three years’ jail. Both Government and Opposition say the move targets AI-driven sexual exploitation: The Daily Aus

*

A UK Law Commission paper has floated the radical idea of giving AI systems legal personality, meaning they could be sued or held liable for harm. While no reforms are proposed yet, the Commission warns of future “liability gaps” as AI acts more autonomously, and says now’s the time to debate whether the law should treat machines like legal persons: Legal Cheek

*

The RBA is expected to drop rates by 25 bps to 3.6% on Tuesday, marking its third cut this year and 75 bps of easing in the current cycle. With inflation pressures easing, Governor Michele Bullock is set to keep a cautious tone on the path for further monetary policy moves: Bloomberg

DEAL ROOM

Mayne-Cosette clash deepens

Mayne Pharma: has pushed its NSW Supreme Court clash with US suitor Cosette to 22 September, after Cosette moved to add claims that Mayne breached continuous disclosure over an FDA letter. Mayne is already challenging Cosette’s MAC notice and June termination of their $672m merger, and says the new claim is baseless and oppressive. G+T is on Mayne’s side and Corrs is repping Cosette: Lawyerly

*

Lactalis: has beaten Meiji and Bega/FrieslandCampina to exclusive talks for Fonterra’s Mainland Group, a revenue cheese, butter and dairy brand portfolio tipped to fetch up to $4bn. The ACCC’s already waved it through, finding minimal overlap. If sealed, the deal would mark a major shakeup in Aussie dairy: AFR

*

Santos has now extended its exclusive due diligence with XRG, the ADNOC-backed consortium eyeing its $30bn takeover, to 22 August. XRG’s US$5.76-a-share offer stands after finding no deal-breakers in its review, and the parties are now working towards a binding SID for one of the year’s biggest energy M&A plays. Allens reps the consortium, while HSF Kramer reps Santos: Capital Brief

SECTOR SPECIFIC

Macquarie’s tech blowout

🚜 DIGGERS

With gold above $5200/oz, Northern Star, Westgold and Gold Road are scrapping their hedges to ride the rally. Producers say hedging now risks locking in lower margins, with some, like Bellevue Gold, even paying millions to unwind old deals. The shift signals miners are betting the bull run will last, despite bank pressure for revenue certainty: AFR

*

Just weeks after Fortescue axed US and local hydro projects, the miner is back on its decarb game. It’s locked in a $3bn syndicated loan from Chinese, Australian and global banks to fund its decarbonisation push. Chair Andrew Forrest hails China’s backing while the US “steps back” from green tech investment: Mining Weekly

🏦 FIN

Macquarie’s $2.3b annual tech splurge is under shareholder fire, with critics questioning if it’s delivering returns or just bloated central costs. ASIC’s short-selling probe has fuelled doubts about its tech governance. With ROE slipping to 11.2%, pressure’s mounting for the board to tighten risk, spend and performance alignment: AFR

*

Westpac boss Anthony Miller is driving a Goldman-style culture shift, cutting 790 jobs in two months, culling long meetings, and even holding weekend sessions. Over at ANZ, CEO Nuno Matos has banned long slide decks and is pushing a strategic review. Both are chasing sharper, faster, more aggressive banks after years of post–royal commission caution: AFR

🏠 RETAIL & REAL ESTATE

Charter Hall has launched a $2.5bn convenience retail fund, kicking off with $1.35bn in assets and backing from 12 super funds. The Charter Hall Retail REIT sold $294m of shopping centres into the fund, keeping a 22% stake. The move cements Charter Hall’s dominance in convenience retail as big institutions circle the sector again: The Australian

*

Anyone want to go halves on some vineyards? John Casella is selling eight vineyards spanning 458ha in McLaren Vale and Adelaide Hills, in a move tipped to fetch up to $80m. The Yellow Tail billionaire’s portfolio, planted to shiraz, cab sav, grenache, pinot gris, sauv blanc and chardonnay, is pitched as “premium”: AFR

📱 TECH & STARTUPS

OpenAI’s GPT-5 wasn’t exactly as much of a hit as GPT-4’s 2023 debut, with rivals Anthropic, Google, xAI and Deepseek now crowding the field. The model reportedly had rocky development, with OpenAI struggling to leap ahead as progress slows. The launch leaned heavily on consumer, chatbot and voice features, underscoring its push to become a major consumer brand: Capital Brief

*

Google is splashing $1bn over 3 years to give US universities and nonprofits AI training, cloud credits, and a souped-up Gemini chatbot for students. 100+ unis have signed on. The plan could go global, but for now, it’s about locking in future users before rivals like Microsoft and OpenAI get there first: Reuters

P.S.

Till next time,

-Team PB