👋 G’day

Welcome back to some post-election legal insights

Today’s brief:

Shell may buy BP

Buffett retires at 94, with a new Berkshire chief

Woodside defends Scarborough project in Court

Here’s the latest 👇

PRACTICE POINTS

Deepfakes hit boardrooms

ASIC is warning that deepfake scams are no longer sci-fi—they’re a real threat. It flagged two major cases: a UK exec duped by a fake CEO voice ($243k loss), and a Hong Kong firm hit for $25m by a deepfaked CFO. ASIC wants companies to tighten up verification protocols, implement multi-factor authentication and raise employee awareness.

*

From 1 March 2025, Queensland employers must have a formal sexual harassment prevention plan—or risk serious penalties (even if no incident occurs). The plan must:

be in writing

set out identified risks

identify control measures and reporting procedures

describe the consultation process undertaken with workers

be accessible and understandable to all workers

The plan must also be reviewed ASAP after a sexual harassment incident, following a request for review or every 3 years: Colin Biggers & Paisley

*

Treasury’s overhaul of FIRB tax conditions scraps the old “standard conditions” model from a tax perspective. From now on, all foreign investment approvals will come with bespoke, deal-specific tax conditions—meaning transaction CPs may need a redraft. Expect extra scrutiny for PE deals, restructures and related party financing, and every application now cops the same info demands, no matter how small the investment: HSF

WORD ON THE STREET

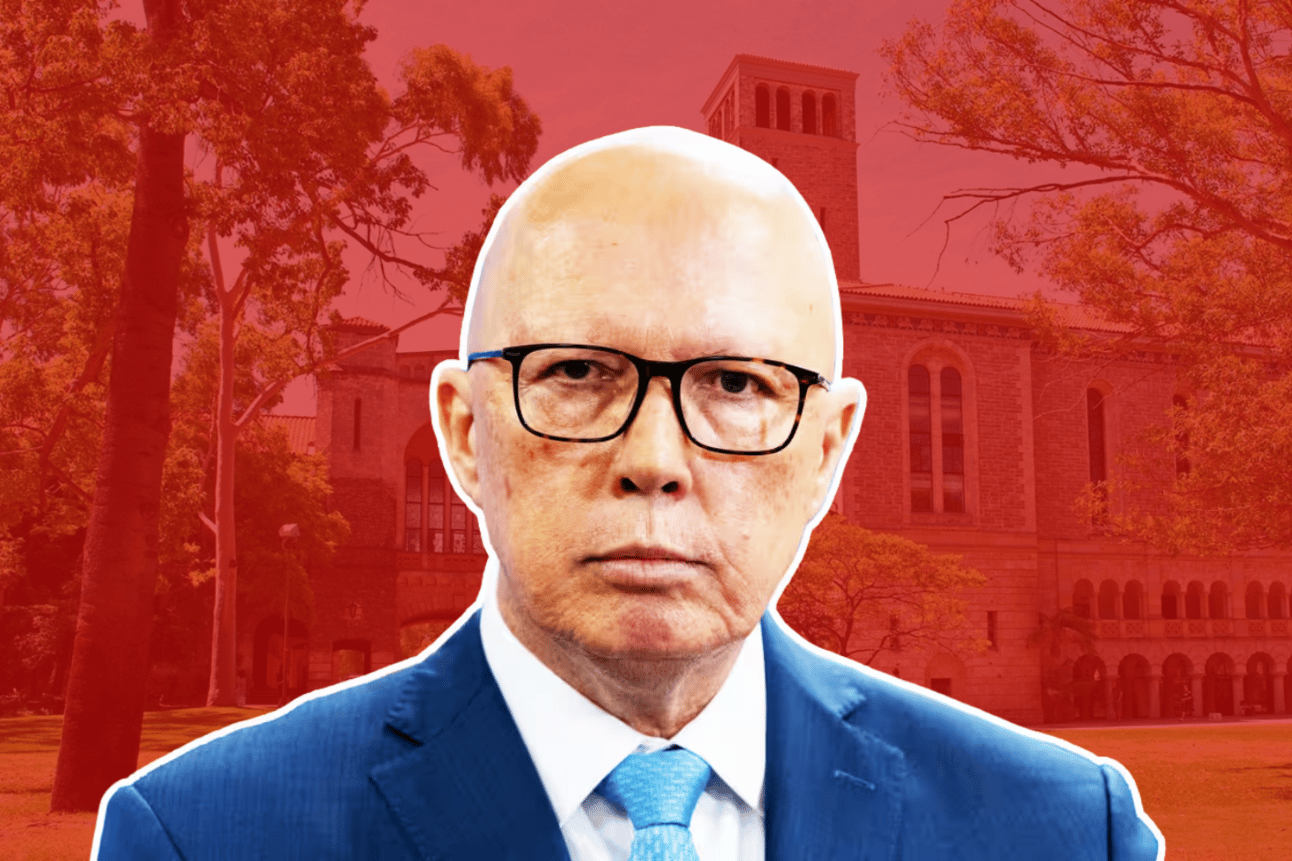

Dutton diss at UWA

A UWA law lecturer is under fire after wearing a “good morning to everyone except Peter Dutton” T-shirt during class while walking students through Labor’s tax, HECS and housing policies. Critics say the lecture crossed into political advocacy. UWA defended it as balanced and protected under academic freedom, but some parents are calling it “indoctrination and intimidation”: The Australian

*

Microsoft ditches Trump-aligned firm. Microsoft has dropped Simpson Thacher, one of the firms that struck a US$125m deal with the Trump admin, in favour of Jenner & Block, which is actively suing Trump over retaliatory executive orders. The switch comes in a Delaware shareholder case tied to Microsoft’s US$69bn Activision Blizzard deal—the biggest in gaming history: Reuters

*

Justice waits 850 days. Federal Court judge Bernard Murphy has yet to deliver judgment in a major Domino’s wage theft class action, more than 850 days after trial wrapped. The case—potentially affecting 30,000 workers—has cost Domino’s $11m in legal fees and counting: AFR

*

Singapore’s proving a popular pick for secondments. HSF’s Mark Khouri swapped Sydney for the tropics to ride the region’s digital infrastructure boom (think data centres and satellites). And it's not just for the travel. With a top tax rate of just 24% (which only kicks in at $1m), a mid-level lawyer can be $40k better off after just 2 years: AFR

*

🚶♂️ Know who’s on the move? Hit reply.

TALKING POINTS

Labor’s landslide victory

In case you're living under a rock, Anthony Albanese pulled off a landslide over the weekend, becoming the first PM since Howard to win a second term. Labor’s up to 86 seats, while the Coalition crashes to 39—booting out Dutton in his own seat of Dickson to Ali France. Big swings in Queensland and outer Melbourne helped, while the Liberals were wiped from Tassie. And Labor's also set to dominate the Senate—it might be even be able to sidestep key crossbenchers like David Pocock and Jacquie Lambie when parliament returns: Guardian, ABC

*

A US judge has permanently overturned Trump’s executive order targeting law firm Perkins Coie, slamming it as unconstitutional retaliation. The EO barred the firm’s lawyers from federal buildings and labelled it a national security risk over its ties to the 2016 Clinton campaign. Judge Howell called it “viewpoint discrimination, plain and simple”, warning other firms against caving to similar political pressure: Guardian

*

After nearly 60 years at the helm, Warren Buffett’s stepping down from Berkshire Hathaway by year’s end. The 94-year-old announced his retirement in Omaha, tapping Greg Abel as successor. Abel already runs the non-insurance side of the biz and has long been tipped for the top job. Expect Wall Street to keep a close eye on the handover: Guardian

THE TREASURY

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Shell tosses up BP bid

Shell: is reportedly weighing up a bid at struggling rival BP, but only if its share price dips further. BP’s Q1 profit halved to US$1.38bn, missing estimates and deepening investor pressure after Elliott took a 5% stake. Shell’s CEO has talked down a deal for now, preferring buybacks over bold M&A, but advisers are quietly doing the maths: Capital Brief

*

Peabody’s: feeling the heat. After buying Anglo’s QLD coal assets for $5.8bn, it's now fielding approaches to sell parts of the portfolio, with groups like Nippon Steel circling. Since Jan, Peabody’s share price has slumped 40% in line with the decline of the met coal price. Now, Peabody’s under pressure to plug the funding gap—even if it means selling at a loss: The Australian

*

The ACCC: kicked off an informal review into Lactalis’ proposed acquisition of Fonterra’s Aussie and global consumer units—a deal that could be valued at NZ$4bn. While no agreement’s signed yet, the French dairy giant has lodged a clearance request as NZ’s Fonterra preps to divest 19% of its earnings base. The ACCC will assess whether the deal hurts local comp: Reuters

*

Ravenswood: bidding war thins. A few Indonesian bidders have backed off the race for the Queensland goldmine, leaving United Tractors, Regis Resources and one other still swinging. Final bids are due May 20, with UBS and Azure Capital steering the sale, tipped to fetch over $2bn: The Australian

SECTOR SPECIFIC

EDO reignites gas war

🚜 DIGGERS

The Environmental Defenders Office is backing a last-minute Federal Court bid to block Woodside’s $16bn Scarborough gas project, now 82% complete. The move, led by Doctors for the Environment, has reignited calls from the Coalition to axe the EDO’s taxpayer funding, accusing Labor of fuelling “environmental lawfare”. Woodside says it will fight on: The Australian

*

Alinta’s CEO says Labor’s $1.8bn energy rebates must be the last, warning handouts won’t fix the real issue: high costs and unreliable supply. Jeff Dimery wants a long-term fix—faster grid upgrades, fewer approval delays, and a mix of renewables backed by gas. With major players like Woodside and Fortescue demanding regulatory certainty, Labor’s next big test is turning policy into projects: The Australian

🏦 FIN

The FCA in the UK wants to ban crypto buys on credit, after a YouGov poll found 14% of users now fund purchases with borrowed money, up from 6% in 2022. The watchdog fears mounting unsustainable debt, especially if crypto values tank: FinExtra

*

The $29bn Nasdaq-listed tech giant SS&C wants a bigger slice of our $3.7tn super pie. With contracts up for grabs, SS&C is pitching itself as the reliable alternative for third-party administrative sector, which is dominated by Japan’s MUFG. The firm looks to deloy 200 people in Australia to bolster its efforts to secure contracts due to renew with next 18 months: AFR.

🏠 RETAIL & REAL ESTATE

Woolworths beat sales forecasts with 3.6% growth, helped by price cuts and a Minecraft collectibles program. But the shine faded fast as Big W’s losses blew out to $70m, fuelling talk of a potential sale. Analysts tip a $250m–$400m valuation, but CEO Amanda Bardwell says no deal yet: AFR

*

Shared kitchens are easing the property squeeze. With kitchen fit-outs hitting $800k, rising rents and razor-thin margins, food entrepreneurs are turning to shared kitchens to dodge brutal overheads. These setups offer flexible, low-commitment access—no long leases, no full team required. As closures hit 1 in 11 venues, it’s becoming the go-to model to test before you invest: Realcommercial

📱 TECH & START UP

TikTok’s been hit with a US$600m fine by Ireland’s privacy watchdog for failing to shield EU user data from potential Chinese surveillance. Despite promising that only limited user data would be sent to China, regulators say it’s still not enough—giving TikTok six months to stop all user data transfers or face more heat: The Australian

*

Apple says new US tariffs will add A$1.4bn in costs this quarter. It's not all doom and gloom. The tech giant beat Q2 expectations on services and iPhone sales, while its China revenue fell 2.3%: Capital Brief

P.S.

Till next time,

-Team PB