👋 G’day

Welcome back to another day of insights

Today’s brief:

NY juniors earn 3x more than Aussies

DLA Piper poaches Clayton Utz tax trio

G+T says lawyers must justify not using AI

Here’s your latest 👇

PRACTICE POINTS

Forced roster trumps right to disconnect

The FWC has sided with Ampol in a dispute over its right to assign employees to an emergency on-call roster, despite union claims that workers must "commit" first. Deputy President Lake found the enterprise agreement does not require prior employee consent to be rostered, so long as staff are notified and paid the $600 weekly allowance. The clause, he said, allows assignment where needed to ensure the minimum five-person coverage and equitable distribution. He rejected union concerns over the right to disconnect, noting that on-call work is common, workers are compensated, and the company had consulted over the roster. He also warned employees not to refuse shifts, as the agreement remains in force.

*

The International Court of Justice has issued a landmark advisory opinion: countries must take climate action to meet their human rights obligations. While not legally binding, the opinion says emissions targets must align with limiting warming to 1.5C. Expect this to shape future climate litigation and treaty negotiations: The Conversation

*

Remember the proposed ban on non-competes? Now, the government is officially consulting on the ban on non-compete clauses for low and middle income workers, plus no-poach and wage-fixing agreements. Also up for debate: whether high earners should get similar protections. The Government is looking to boost job mobility and pay by curbing restrictions that lock workers in: Treasury

WORD ON THE STREET

Sydney v NY pay

Anyone considering an NY move, well this is your sign. Sydney lawyers are on A$105k, while New York juniors are on $343k. By year 5, it’s $170k vs $557k, plus bonuses. What’s with a crazy gap? The Cravath lockstep scale, higher US billing rates, and no write-offs. But the trade-off is 2,200+ hours a year. Check out our full insight here.

*

DLA Piper has lured Clayton Utz’s national tax head Angela Wood, deal-side expert Brendon Lamers, and junior partner Andy Bubb in a major play for high-end tax work. Lamers will lead DLA’s tax team. All three have AirTrunk pedigree, continuing DLA’s trend of snapping up top-tier talent from headline deals: AFR

*

Gilbert + Tobin CEO Sam Nickless says the firm’s fast becoming a place where not using AI needs justifying. With ChatGPT Enterprise and Harvey rolled out to 650 lawyers, G+T is targeting a hybrid model where lawyers and AI work side-by-side: Capital Brief

*

Holding Redlich nabs ex-Moray & Agnew’s Louise Hogg and Lilian Zhou to launch a Brisbane-based employer-side workplace practice. Hogg brings nearly 20 years of experience in high-stakes FWC litigation, while Zhou adds coverage across employment disputes and enterprise bargaining: Holding Redlich

TALKING POINTS

HECS discount lands

This will be sure to brighten your day. Labor’s 20% HECS discount bill has hit Parliament, with backdating to 1 June and automatic processing by the ATO. It also lifts the repayment threshold from $56k to $67k. Independent Monique Ryan wants indexation timing fixed too, so students don’t cop interest on already-paid amounts. The Coalition’s softened its stance, saying it won’t block the bill. Expect it to pass by year-end: The Daily Aus

*

Australia and the UK have signed a 50-year defence treaty to lock in support for building nuclear-powered submarines, regardless of what happens with AUKUS. Both governments say it won’t interfere with the US-led pact, which is currently under Trump administration review. It's a big move to de-risk Australia's sub strategy, especially if Washington cools on the deal: Bloomberg

*

You're probably sick of the plethora of hot girl Euro summer stories infiltrating your social media. Well, there’s a reason why Euro summer seems never-ending. More Aussies are flocking to Europe during shoulder season, in May and September, for cheaper prices, better weather, and smaller crowds. Webjet says spring and autumn bookings now rival peak summer, with 1 in 4 travellers booking 6+ months ahead: The Australian

THE TREASURY

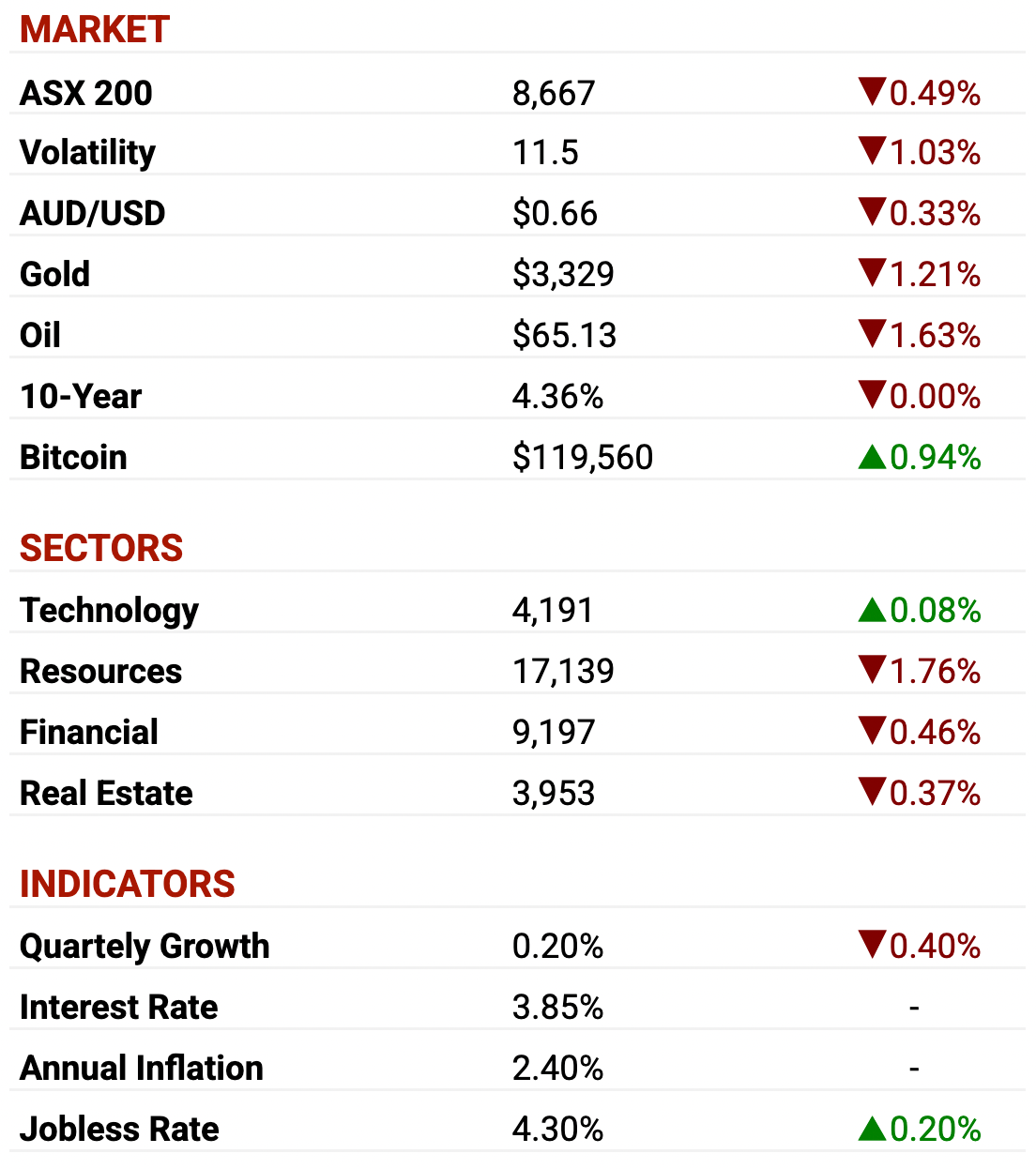

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Bain walks

Bain Capital: has walked, leaving Oaktree-backed AZ NGA the last suitor standing for Perpetual’s $21.5bn wealth unit. A deal could fetch $550m–$700m, but talks are stuck on price, adviser retention, and whether the Perpetual brand name comes with the sale. If no deal’s struck, analysts warn a rights issue may be next: AFR

*

Lendlease: is closing in on the sale of its 25% stake in Keyton, one of Australia’s biggest retirement village operators, as it scrambles to hit its $2.5bn capital release target. Bidders include AustralianSuper, GIC, Scape and Nippon Steel Kowa. If the sale and other deals land, a $500m share buyback could be on the cards next month: AFR

*

KKR: is dropping $500m into CleanPeak Energy, backing rooftop solar and battery rollouts across shopping centres and industrial sites. The Sydney-based start-up now has $1bn in firepower to scale “behind the meter” assets that cut grid stress and energy bills. Igneo keeps control of the main assetco, while KKR bets big on distributed decarbonisation: AFR

SECTOR SPECIFIC

TikTok hiring spree

🚜 DIGGERS

After Jim Chalmers launched a $2bn hydrogen fund, Twiggy Forrest led the charge—but now Fortescue, BP and Stanwell have all walked. The dream's cost taxpayers $600m and counting, and the feds are chasing refunds. Critics say hydrogen hype duped governments, with Twiggy’s grand vision now looking more like hot air: AFR

*

Northern Star’s ditched its forward hedging policy to cash in on gold’s record highs, scrapping plans to hit 2m oz by 2026 due to cost blowouts and delays at Kalgoorlie’s Super Pit. With $6bn De Grey now folded in, all eyes are on Hemi, where native title challenges could delay Australia’s next top-tier gold mine: AFR

🏦 FIN

APRA’s giving mid-tier lenders a leg up, promising looser rules on capital and reporting. Under pressure from Jim Chalmers and small banks, APRA will formalise a three-tiered system, letting players like BoQ and Bendigo access the same capital-light model the big four use, with the goal to level the playing field without ditching consumer protections: AFR

*

Digital wallets processed $160bn last year, smashing the number of ATM withdrawals 11 to 1, according to the ABA. Mobile banking is now the default, with 99.3% of transactions done digitally. But with big tech dominating wallets, the ABA’s doubling down on its call for regulation to level the payments playing field: Finextra

🏠 RETAIL & REAL ESTATE

Online e-tailer New Aim is prepping a $100m IPO, joining the ranks of GemLife, Greatland Gold and Virgin in a surprisingly active second-half market. Backed by $350m+ in revenue and double-digit EBITDA growth, its pitch? A proprietary tech platform and booming bulky goods sales. Fung Lam’s keeping skin in the game after 20 years of bootstrapped growth: AFR

*

Lendlease is teaming up with Mitsubishi Estate and Nippon Steel Kowa to bankroll a $2.5bn luxury apartment project at 175 Liverpool St, Sydney. The JV adds to Lendlease’s $18bn capital tie-ups with Korean and Japanese funds, as Tony Lombardo leans hard into early-stage offshore funding to turbocharge local developments: The Australian

📱 TECH & STARTUPS

TikTok’s Aussie headcount surged from 500 to 777 in just six months — and it’s not slowing down, with 80+ open roles and 1,000 employees in sight. The growth reflects booming ad revenue (up 3x to $31.1m profit) and rising political heat as the platform fights Labor’s under-16 age restrictions: Capital Brief

*

Atlassian’s major Trello update that was meant to turn it into a “personal productivity companion” has bombed with users. The revamp overhauled the UI, hid key buttons and removed features, making everyday tasks clunkier. One user called it “an act of self-sabotage.” Atlassian’s advice? Try its other product Jira instead. Bold move when growth’s already slowing and user patience is thin: AFR

P.S.

Till next time,

-Team PB