👋 G’day

Welcome back to another day of insights

Today’s brief:

Vic pushes for WFH legal right

Firms fight for energy boom

UK NQs near senior pay

Here’s your latest 👇

PRACTICE POINTS

Court backs implied notice

The Federal Court has confirmed that if an employment contract lacks a termination clause, the law may imply a ‘reasonable notice’ term, and s 117 of the Fair Work Act doesn’t override it. Energy Action argued that providing the minimum notice required under s 117 was enough to terminate an agreement with 14-year IT employee, Mr Cropper, without further notice. The Court disagreed. Since Cropper’s contract didn’t contain a termination clause, a term of reasonable notice was implied. Based on his age (nearly 70), tenure, and salary ($130k), the Court set it at 3 months.

*

ASIC has launched a sector-wide review into debt management and credit repair firms, citing concerns about dodgy practices targeting financially vulnerable consumers. Complaints include high fees for minimal service, firms ghosting clients, and even pushing clients toward bankruptcy without explanation. With about 100 licensees part of the sector, ASIC will probe compliance, review business models and publish findings in 2026: ASIC

*

The Federal Court clarified how directors must approach their duty to act in good faith, in the latest round of Special Gold v Dyldam. After closely examining the elements of director duties, Jackman J said the fiduciary duty to act bona fide in the interests of the company still holds, even if fiduciary duties are generally seen as proscriptive. Under s 181(1)(a) of the Corporations Act, it's not enough for a director to just say they believed their conduct was right. That belief must be honest and rational, meaning a reasonable director in their shoes could have made the same call. The Court also warned against calling the test “subjective” or “objective”.

WORD ON THE STREET

UK junior pay outpaces seniors

It’s a great time to be a junior lawyer in the UK. Shoosmiths has bumped London NQ salaries to £105k, up £8k, with regional NQs getting a 6% lift to £67k. But the firm’s also confronting the awkward aftermath — salary bunching, where NQ pay is catching up to more senior lawyers. In a nod to the issue, Shoosmiths says it’s reviewing salaries firmwide: Legal Cheek

*

US law grads smashed records, with 93.4% of the class of 2024 landing jobs within 10 months—the highest since tracking began in 1974. Unemployment also dropped to a record-low 5.1%, defying fears that a bigger cohort would crowd the market. Median pay jumped to US$95k, up from US$90k last year: Reuters

*

Boutique consultants like heyProcurement say generative AI is saving them 4+ hours per contract, by auto-pulling key obligations, building task lists, and proofreading at scale. But don’t expect fewer late nights; consultants are just using the time to do more work. Clients are starting to wise up too, asking for discounts when they hear AI’s doing the heavy lifting: AFR

*

Ashurst, Allens, HSF Kramer and Baker McKenzie say energy transition work is surging, with Ashurst up 50% alone. But there's a talent crunch. Allens, Clayton Utz and Corrs are retraining infrastructure teams and hunting for laterals, while Ashurst has set up an in-house “Energy Industry Academy” to upskill its lawyers. With M&A, regulatory and disputes work set to boom, firms say the race is on for sector specialists: Law.com

TALKING POINTS

Defence recruitment surges

Defence recruitment just hit a 15-year high, with almost 3,000 new full-time personnel joining in the past year. The turnaround follows $600m in bonuses, housing perks, and a relaxation of enlistment rules in preparation for a potential showdown with China. Ads are also going viral on TikTok, with submariner clips racking up 840k views. Meanwhile, only 1 in 10 applicants are being accepted: AFR

*

NSW Police say 90,000 turned out for Sunday’s pro-Palestine rally, but organisers claim up to 300,000 marched in the rain across the Harbour Bridge. The crowd included Julian Assange, Craig Foster, Mehreen Faruqi and Ed Husic, with chants of “We are all Palestinian” echoing across the CBD. While in Melbourne, protesters were blocked by police in riot gear, trying to prevent a bridge blockade: The Guardian

*

In Victoria, Premier Jacinta Allan wants to make two days of WFH a legal right for all Victorians who can “reasonably” do their job from home. The proposed laws, flagged ahead of next year’s election, would apply to both public and private sector workers. Business groups are bracing for a fight, but Allan says it’s about productivity, participation and gender equality, not employer control: ABC

THE TREASURY

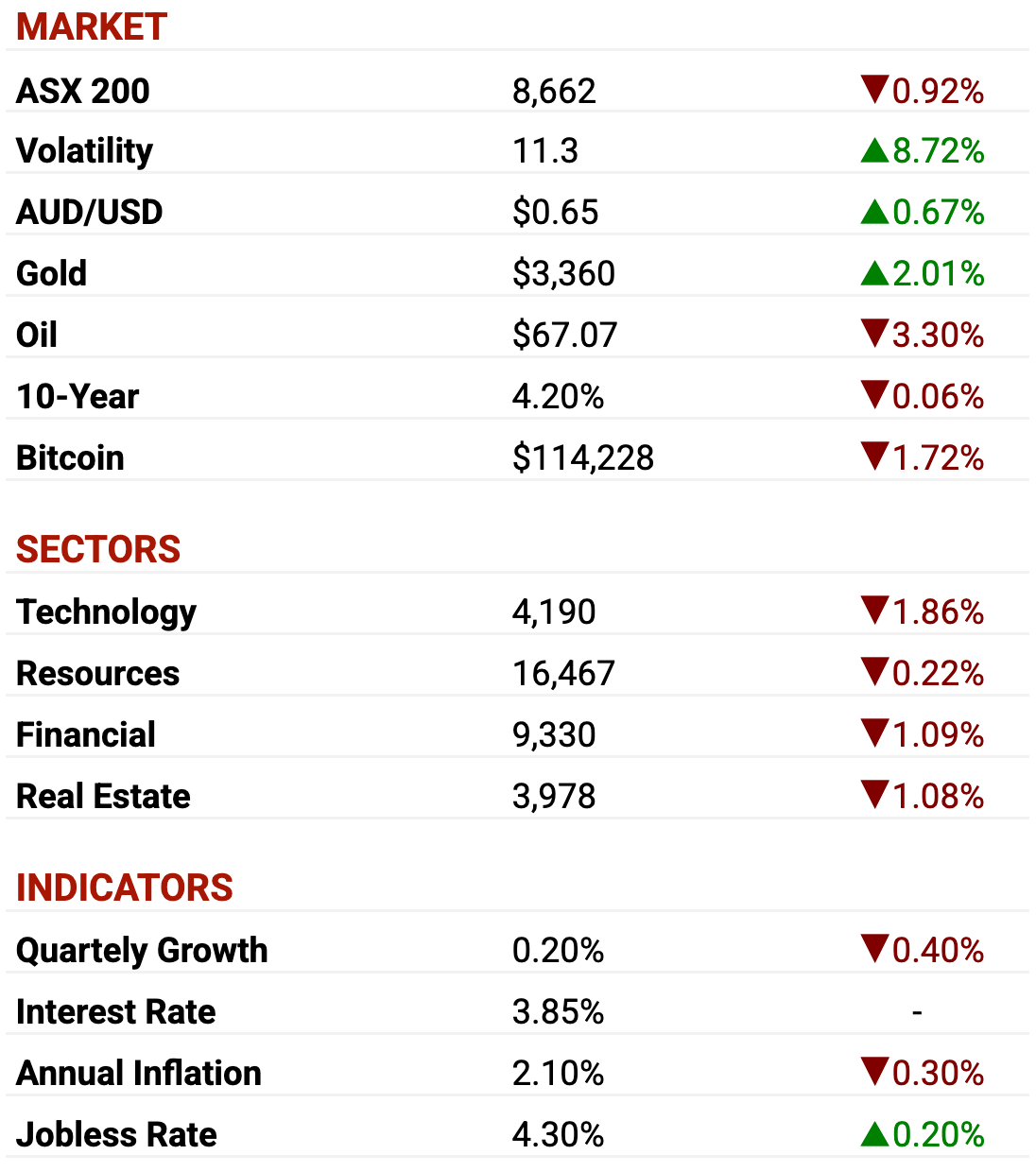

ASX as at market close. Commodities and crypto in USD.

A MESSAGE FROM MADDOCKS

The modern Australian law firm

Since 1 August 1885, Maddocks has been a law leader in Australia.

That’s 140 years of building a legacy of legal excellence and making a difference for our clients, each other and the community. From our offices in Melbourne, Sydney and Canberra, we’ve delivered premier legal services to corporations, businesses and governments locally and internationally – with a commitment to a future of legal practice that grows with our nation’s challenges and opportunities.

DEAL ROOM

Anglo, Peabody stand-off

Peabody: is threatening arbitration to escape its $5.8bn buyout of Anglo American’s Queensland coal mines, citing an underground fire at Moranbah North as a material adverse change. Anglo’s not backing down, insisting there’s no resource damage. The standoff could derail the deal and reopen the door to other suitors circling Anglo’s Bowen Basin assets: AFR

*

Perpetual: is tipped to name a preferred bidder for its wealth management arm at full-year results. Oaktree’s AZ NGA is seen as the front-runner, but EQT is rumoured to be back in the mix. The sale, run by Barrenjoey, would help cut Perpetual’s $740m+ debt and reshape the business post-KKR tax saga: The Australian

*

Figma: soared 250% on debut, hitting a $US65bn valuation and lighting a fire under Canva’s long-awaited IPO. With an ARR of $US3.3bn (A$5.1bn) and over 240 million users, Canva is now under pressure to move. Founders say there’s no rush, but investors are circling as the IPO window bursts wide open. Could Airwallex and SafetyCulture follow close behind? AFR

SECTOR SPECIFIC

Greatland under fire

🚜 DIGGERS

Greatland Gold’s bankers all looked like heroes when the stock soared on ASX debut in June, but Greatland’s under fire from investors and ASIC after it ditched production guidance just weeks later. The stock has tumbled from $7 to $5.18, raising questions about what advisers Barrenjoey, BofA and Canaccord knew at the time of the float: AFR

*

Peabody Energy is ready to go to arbitration to exit its $5.87bn acquisition of Anglo’s Queensland coal mines, citing a damaging fire at Moranbah North. Anglo insists the asset is intact and says the fire doesn’t trigger a material adverse change. If Peabody pulls out, Anglo may pivot to new suitors: AFR

🏦 FIN

Barclays has quit the Net Zero Banking Alliance, joining HSBC and a wave of US banks exiting under political heat. The UN-backed group has seen mass departures since early 2025. It insists its US$1tn climate finance targets remain, but Standard Chartered’s CEO didn’t hold back, saying: “Shame on them”: FinExtra

*

Macquarie scrambles to dodge pay strike. In the days before the AGM, it contacted proxy advisors and mobilised staff in a bid to avoid embarrassment. Critics, including Glass Lewis and Ownership Matters, said execs faced light consequences for repeated regulatory breaches, while CEO Shemara Wikramanayake’s future remains under watch: AFR

🏠 RETAIL & REAL ESTATE

Woolworths, Coles, Aldi, and Macca’s have all ruled out selling US beef, despite Albo lifting a 20-year import ban. Their firm stance keeps 85% of Aussie beef sales local. Guzman y Gomez and top-end butchers are also staying loyal to Australian producers, shrugging off Trump’s tariff rhetoric: AFR

*

Lendlease’s $3bn+ sale of a 25% stake in Keyton is in overdrive, with AustralianSuper, GIC, Scape, and Nippon Steel in the final mix. The asset’s being pitched as bigger and cheaper than Aveo, with 13,300 units and a 1,200-unit pipeline. A winner was expected by now, but valuation updates forced a round 2: AFR

📱 TECH & STARTUPS

Optus hiked executive pay by 23% to $18.9m last year, even as it posted a $155m net loss. New CEO Stephen Rue handed out sign-on and exit packages amid a leadership shake-up, while number of employees fell 8%. Rue is betting on new hires from Vodafone, Woolworths and Singtel to steer the telco’s turnaround: AFR

*

Meta is offloading US$2bn (A$3.1bn) in data centre assets to co-fund its massive AI infrastructure build, marking a shift from fully self-funded growth. With capex forecast hitting up to US$72bn, Meta is now eyeing external partners to co-develop facilities. CFO Susan Li says the move offers flexibility as Meta pursues AI “superclusters” and scales up generative AI infrastructure: Reuters

P.S.

Till next time,

-Team PB