👋 G’day

Welcome back to another day of insights

Today’s brief:

A lawyer’s daily spend in 5 major cities

Victoria clamps down on NDAs at work

UQ, UNSW slip behind Uni Melb

WORD ON THE STREET

The cost to live in 5 major cities

It’s no secret Aussie lawyers can make serious money overseas. But the real question is how much of it do you actually get to keep? We ran the numbers on what a “normal” day might cost you if you have lived in either Sydney, London, New York, Dubai, or the Caymans — and the differences are anything but small: Point Blank

*

Linklaters has launched a 20-lawyer “AI Lawyers” group as a firmwide signal that it’s going all-in on legal AI. The team blends former practising lawyers with tech specialists, backed by a bespoke AI bootcamp and Legora’s platform rollout. It’s a clear play to reassure clients the firm is building real AI capability: Artificial Lawyer

*

HopgoodGanim is upgrading its HQ. The firm is moving its 250-person Brisbane headquarters to 360 Queen Street — a brand-new, first-class precinct with a wellness centre and outdoor terraces. HopGood are the first tenant in the building, ending a 23-year stint at Waterfront Place.

*

Walker Wayland has quietly become one of accounting’s fastest movers on gender equity, nearly doubling its female partners to 27% in five years. Partner Kate Douglass says the “secret sauce” is flexible parental leave — from full-year breaks to a few hours a week. The model is now outperforming big-name rivals, still lagging behind: AFR

PRACTICE POINTS

NDA clamp down

Employment/NDAs: Victoria will heavily restrict NDAs in sexual harassment settlements from 20 May 2026, marking the first reform of its kind in Australia. NDAs won’t be enforceable unless the complainant expressly requests one, is given the new information statement, gets 21 days to review, and both parties formally acknowledge the preconditions. Employers can’t pressure complainants or trade higher payouts for silence. Even when enforceable, NDAs can’t stop disclosures to police, regulators, doctors, lawyers or trusted supporters. Complainants can also terminate NDAs after 12 months, and breach-notice rules make non-compliant NDAs easy to unwind. Employers also can’t use NDAs to block internal investigations or hide a respondent’s conduct from future employers: KWM

*

Contracts/AI: Agentic commerce is here, with AI agents negotiating deals and binding humans without real-time oversight. Courts have treated earlier software as a mere “tool”, but autonomous AI pushes that logic to breaking point. Two models are emerging: treating AI as a constructive agent or treating deployment of AI as an “open offer” to contract on whatever terms the AI offers. UNCITRAL suggests humans shouldn’t be liable for AI actions they couldn’t reasonably expect — but with AI’s unpredictability, “reasonableness” is a slippery standard. Treasury says existing consumer laws may suffice for now, but agentic AI may soon force Australia to build a dedicated framework for AI-to-AI contracting: Gilbert+Tobin

*

Greenwashing: Here’s a little refresher on greenwashing — courts aren’t shying away from imposing steep penalties where sustainability claims don’t reflect reality. Recent cases against Active Super and Mercer found that broad ESG promises—like excluding fossil fuels or gambling—were misleading when underlying investments said otherwise, attracting fines over $10m each. The ACCC’s win against Clorox shows the same applies outside financial services. The message is clear: any environmental or ethical claim must be precise, verifiable and backed by evidence. Regulators don’t need new laws. Existing consumer and financial regimes are more than enough to bring actions: Lexology

TALKING POINTS

Uni rankings revealed

It’s the battle of the unis. The UniMelb has taken the top spot in the AFR’s Best Universities Ranking. UQ and UNSW are equal second, after a couple years of UQ taking the crown. Monash and ANU placed 4th and 5th. It comes as unis face falling enrolments, AI disruption and funding pressure, making 2025 a defining year for sector reform: AFR

*

It’s a bad time to be out of a job. Job hunting in the US is so bleak you’re now statistically more likely to get into Harvard than land a role. The average role pulls 242 applicants, giving you an 0.4% success rate, while Harvard’s acceptance rate sits at 3.6%. The cause? AI-fuelled mass applications that are swamping employers: Business Insider

TREASURY TUESDAY

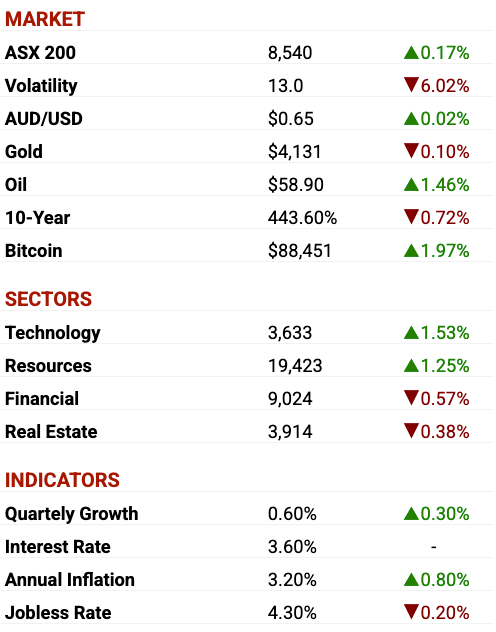

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Macquarie’s $11bn play

Macquarie Asset Management: has gone exclusive on an $11.6bn tilt at Qube, offering $5.20 a share — a chunky 28% premium. MAM is working with Macquarie Capital and Gilbert + Tobin, while Qube has UBS and Allens in its corner: Business News, AFR

*

Monash IVF: has swatted away an 80c-a-share bid from Genesis Capital and Soul Patts, calling it “opportunistic” and well below sector multiples. The consortium already owns 19.6%. Monash is backed by Macquarie Capital and Clayton Utz: Capital Brief

SECTOR SPECIFIC

Bendigo uncovers breaches

🚜 DIGGERS

Rio Tinto has kicked off its non-core asset sale, with advisers from UBS and JPMorgan sounding out buyers for a single-line divestment spanning its global mineral sands, borates and iron–titanium units: The Australian

*

Gold is still in play, and Northern Star keeps popping up as a possible takeover target, with Agnico Eagle quietly keeping tabs as gold trades above US$4k/oz. But a bid isn’t simple. Northern Star’s Hemi build-out and Super Pit upgrades mean heavy capex ahead. For now, it stays on the wish list: The Australian

🏦 FIN

Bendigo Bank has uncovered sweeping AML failings, after a Deloitte probe into one branch ballooned into bank-wide gaps in customer checks, risk ratings and transaction monitoring. The board says it is “very disappointed” and will fully fund a major compliance uplift as Austrac and APRA circle: AFR

*

Revolut has hit a US$75bn valuation, after a share sale backed by NVentures, a16z, Coatue and Fidelity, with staff cashing out in its fifth employee sell-down. Revenue jumped 72% to USD4bn and profit surged 149%, as the fintech pushes toward its goal of becoming a truly global bank with 65 million customers and new licences in Mexico and Colombia: Capital Brief

🏠 RETAIL & REAL ESTATE

SQM Research says Perth, Darwin, Brisbane and Adelaide are all primed for double-digit gains in property prices for 2026. Melbourne is set to finally outpace Sydney, while the base case assumes one or two rate cuts late next year: The Australian

*

UBS has poached JPMorgan’s Solomon Zhang to co-head its real estate research team, partnering with long-time UBS analyst Cody Shield from early 2026. It marks another talent raid after UBS nabbed JPM’s deputy research chief: AFR

📱 TECH & STARTUPS

Blackbird says Canva is “ready” for a 2026 IPO, telling LPs the design giant now has 260 million monthly users and US$3.5bn revenue, up 39% year on year. After a US$42bn secondary valuation, investors will get the option to sell into the float or hold on as Canva finally heads toward the public markets: Capital Brief

*

Palo Alto Networks has snapped up Aussie-founded Chronosphere for more than $5bn, one of the year’s biggest tech deals. Built by ex-Uber engineers Martin Mao and Rob Skillington, the observability platform now used by Snap, Walmart and CBA gives Palo Alto a sharper edge in cloud security as AI drives demand for faster, smarter system monitoring: AFR

JOB OPPORTUNITIES

P.S.

Till next time,

-Team PB