👋 G’day

Welcome back to another day of insights

Today’s brief:

London juniors clock hefty workdays

Aussie startup posts Albo’s number online

Zuckerberg lures Aussie top AI talent to US

WORD ON THE STREET

London’s 10pm club

Milbank tops London’s long-hour league, with juniors clocking 13-hour days— starting at 9:03am and leaving at 10:06pm. Kirkland & Ellis and Winston & Strawn follow close behind on 12-hour averages, with Weil, Paul Weiss and Linklaters rounding out the top six. Fourteen firms now finish 9pm or later, as burnout deepens despite record £180k NQ pay. Check out the full breakdown here: Point Blank

*

Lander & Rogers has added Louise Parry as partner in its Canberra corporate team. The ex-Clayton Utz special counsel is a contracting specialist with 12+ years’ experience advising government and private clients on procurement, outsourcing and tech projects: Point Blank

*

Paul Weiss has taken office perks to a new level, unveiling an in-house sushi restaurant at its Soho HQ on Air Street. Run by a “market-leading sushi chef,” it’s part of the firm’s bid to boost office attendance. It’s a full circle moment - back in 2003, a NY partner enlisted a paralegal to research the best sushi in NY, which resulted in a three-page memo with eight footnotes… NB

*

Perth criminal lawyer has been fined $12.5k and reprimanded after wrongly advising a client facing a 15-year mandatory term he’d get just four to six years if he pleaded guilty. The SAT said Barber failed to grasp sentencing laws. He’s since apologised: The Australian

PRACTICE POINTS

Policy pitfalls

The Fair Work Commission found unfair dismissal after an employer terminated an employee who refused a breath test following a work lunch. The company argued it was serious misconduct - a refusal to follow a lawful direction and a breach of its drug and alcohol policy. But the Commission disagreed. It held that the direction wasn’t reasonable or lawful, as it wasn’t made in line with the policy. The employee was entitled to ask why she was being tested, yet was never shown the policy or told what provision justified the test. The policy also didn’t specify any penalty for refusal, making the employer’s threat of suspension or dismissal baseless. In the circumstances, the employee’s refusal was justified, and the dismissal was harsh, unjust and unreasonable. She was awarded $63.5k in compensation: Lexology

*

WA Court of Appeal has fired a warning shot: agree to reasonable extensions or risk personal costs. In a new decision, the Court granted a one-business-day extension to file the appellant’s case and said the application “should never have been necessary”. No prejudice was shown, the delay was minor, and the reason was that counsel’s mediation went over. The Court reminded practitioners of their duty under O 1 r 4B to help achieve efficient, proportionate and just outcomes. Refusing consent without reasons burdens the court and parties. The bench even considered a show-cause for personal costs, deciding against it only because costs weren’t sought.

*

ACT Supreme Court held that a special report prepared by the ACT Integrity Commission didn’t attract parliamentary privilege, so it was admissible in judicial review even though the challenge ultimately failed. The Court said s 16(3) of the Parliamentary Privileges Act didn’t bite because the report wasn’t a “proceeding in Parliament”. It wasn’t created or published for Assembly business under s 16(2)(c), it fulfilled the Commission’s statutory functions, and it wasn’t ordered or authorised for publication by the Assembly under s 16(2)(d), and it was even posted to the Commission’s website. Just because the evidence comes from parliament, doesn’t mean it will be automatically shielded by privilege.

TALKING POINTS

PM’s phone number leaked

Aussie-founded startup, ContactOut is up to no good. The startup sparked outrage after publishing the private phone numbers of Albo, Sussan Ley, and top execs like CBA’s Matt Comyn and News Corp’s Michael Miller. The San Fran-based firm, backed by local VC accelerator Startmate, scrapes data using AI. The AFP is now pushing to have the PM’s details removed: AFR

*

Linda Reynolds has launched bankruptcy proceedings against Brittany Higgins to recover damages and costs after her August defamation win. Higgins owes $315k plus interest and 80% of costs, and has filed an appeal. Reynolds is also pursuing Higgins’ husband David Sharaz. Reynolds called the move “unfortunate,” but said she’s “committed to seeing this through to the end”: The Guardian, ABC

A MESSAGE FROM HEADNOTE

7am. Coffee. Headnote. You’re ready.

Headnote is a free 2-minute daily email digest of key Australian legal news.

It’s the newsletter your colleagues already read to stay ahead.

Like Point Blank? You’ll love Headnote.

DEAL ROOM

Carma races to IPO

Carma: is speeding ahead with its $300m ASX float, kicking off an early bookbuild on Wednesday led by Canaccord Genuity and E&P Capital. The online used-car dealer is seeking up to $95m in fresh capital and a $270m–$300m valuation. HSF Kramer have historically advised Carma on its previous cap raises: AFR

*

Quadrant Private Equity: has locked in a $600m debt refinancing for QMS Media, led by HPS Investment Partners, ahead of a likely sale or IPO. The deal includes fresh funding for growth as QMS posts $500m revenue and $120m earnings, buoyed by its Auckland Transport win and expanded City of Sydney network: AFR

SECTOR SPECIFIC

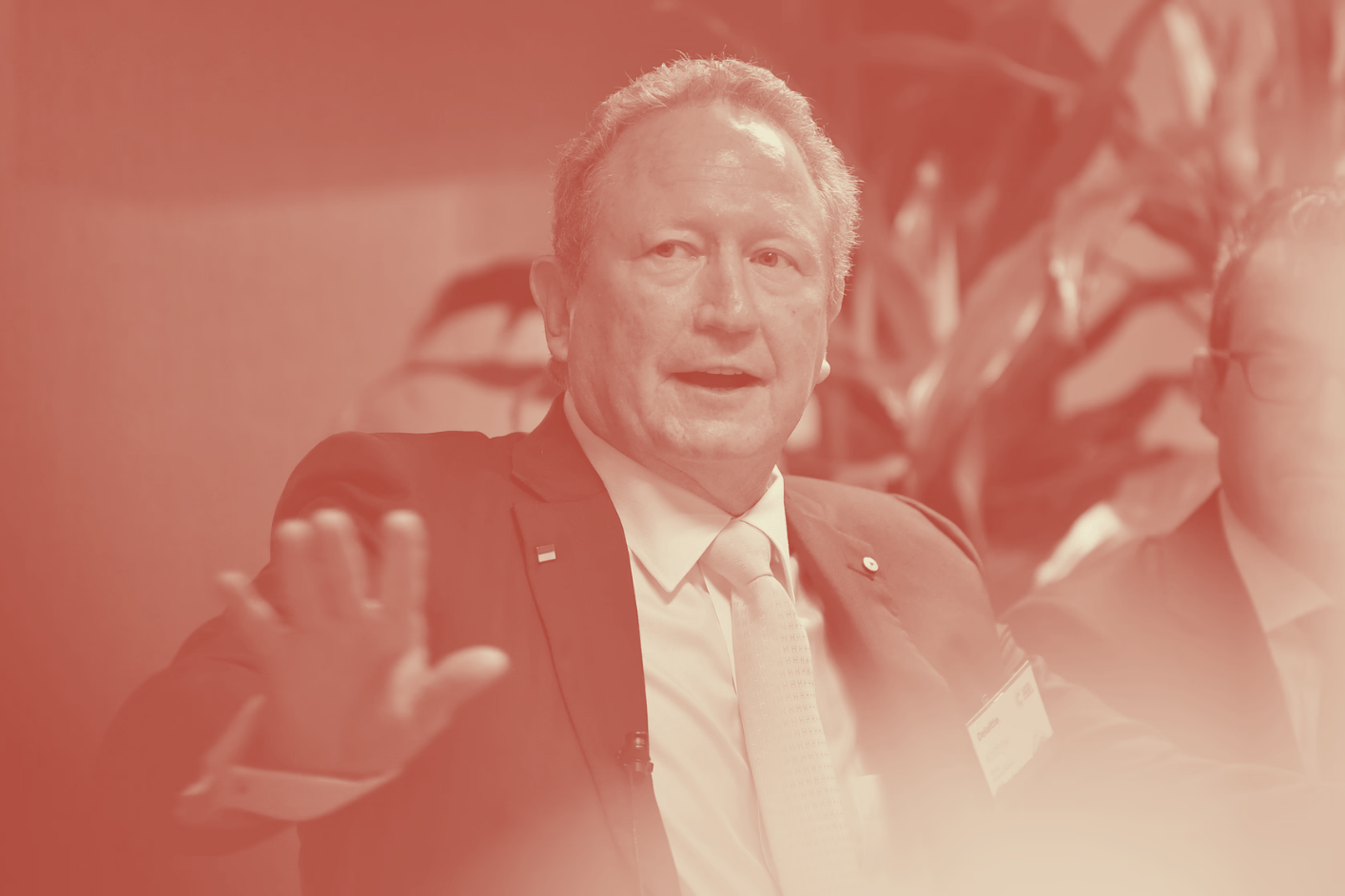

Fortescue axes staff

🚜 DIGGERS

Fortescue is axing hundreds of UK and Aussie staff as its clean-energy pivot unravels. The cuts hit its Fortescue Zero arm after scrapping plans to build haul trucks in Oxfordshire and shifting production to China. The unit, once touted as key to Twiggy’s green revolution, will now shrink to a research and development hub after $1bn in losses: The Australian

*

Aussie miners are soaring as US interest in equity stakes sends stocks into overdrive. Resolution Minerals jumped 56% and Nova Minerals 16% after news that they’ll brief the Albo government ahead of talks with Trump in Washington. The US is eyeing direct investments in key mineral players as it races China for control of rare earth supply chains: Bloomberg

🏦 FIN

ASX looks set to avoid another pay revolt and board spill, with proxy advisers backing its revamped remuneration plan after last year’s 26% strike. CEO Helen Lofthouse gave up her bonus, and the short-term pool was halved, appeasing investors still furious over the $250m CHESS fiasco: AFR

*

Bank of Queensland lifted its dividend to 20c and posted a 12% jump in annual profit to $383m, fuelled by 14% growth in commercial lending despite a weaker mortgage book. CEO Patrick Allaway says the bank’s transformation is on track, though warns margins could tighten if rates fall: AFR

🏠 RETAIL & REAL ESTATE

Treasury Wine Estates has scrapped its earnings targets and $200m buyback, warning that Penfolds won’t hit profit goals until at least 2027. Shares plunged 14% to a decade low as the group battles a fallout with its US distributor and a slump in China’s wine market. New CEO Sam Fischer may have to rethink or even break up the business: The Australian

*

Blackstone is offloading Sydney’s Top Ryde City mall to Keppel REIT and MA Financial for $525m, marking Keppel’s first pure retail play in Australia. Keppel will take 75%, with MA holding 25% and managing the asset. The deal, struck on a 6.7% yield, shows institutional money flowing back into Aussie retail: Mingtiandi

📱 TECH & STARTUPS

Mark Zuckerberg has poached Andrew Tulloch, an Australian AI specialist and co-founder of $12bn start-up Thinking Machines Lab, in a major win for Meta’s superintelligence team. Tulloch, who once built Meta’s PyTorch framework, was courted with a reported $US1.5bn (A$2.3bn) offer after Meta failed to buy his start-up outright. His exit is a blow to Mira Murati’s AI venture and its Aussie backers: AFR

*

Australia’s cyber chief Abigail Bradshaw says it’s time to ditch password-only logins, calling employees the “weakest link” in cyber defence. After the Qantas-Salesforce leak hit 6 million customers, the ASD revealed 42% of hacks still exploit basic credentials. Bradshaw wants multi-factor authentication across all accounts, warning “passwords alone must be over” as AI turbocharges phishing attacks: Capital Brief

JOB OPPORTUNITIES

P.S.

Till next time,

-Team PB