👋 G’day

Welcome back to another day of insights

Today’s brief:

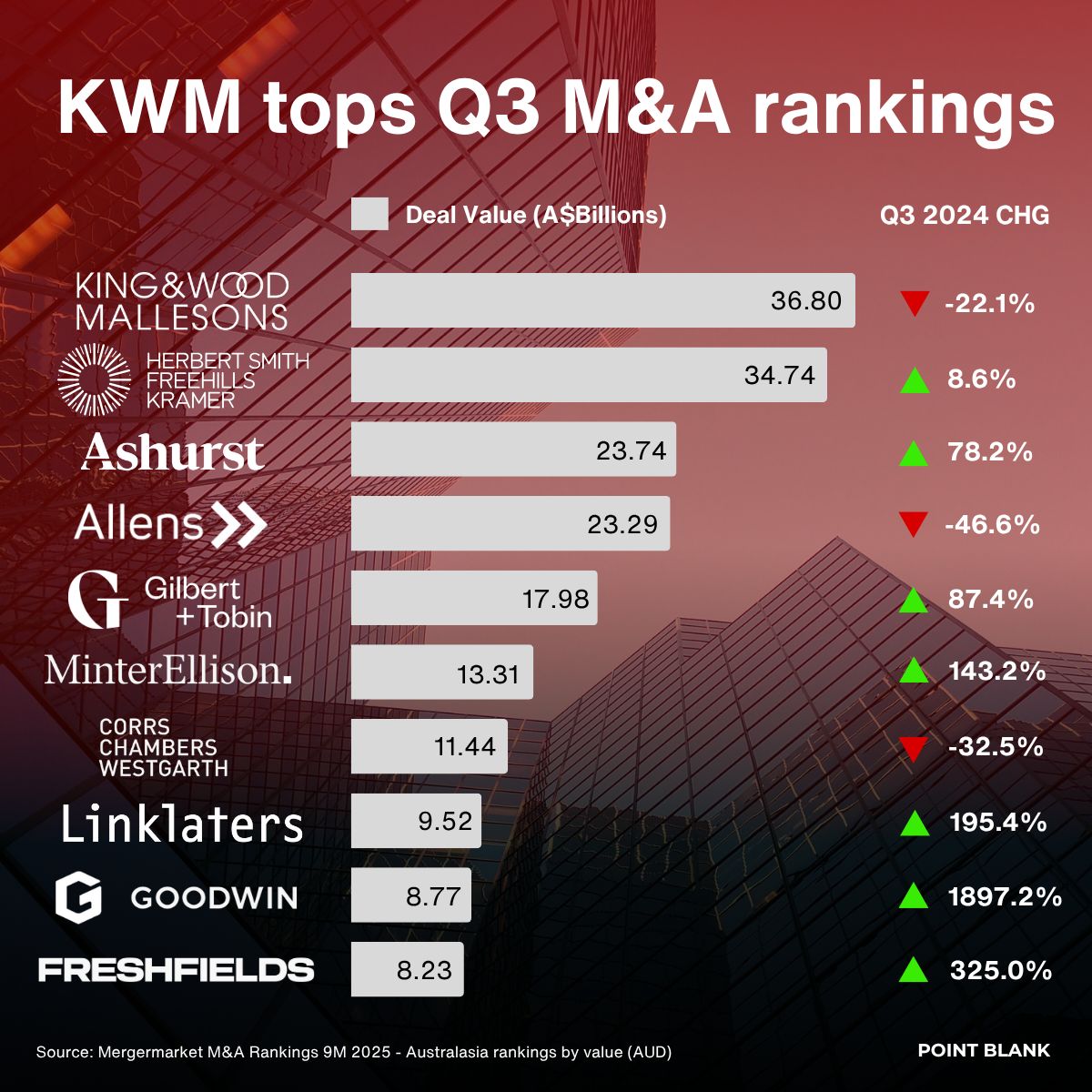

KWM reigns over M&A charts

Partner moves at Piper, Corrs, TG

Aussie first penalty under Privacy Act

WORD ON THE STREET

KWM reigns supreme

King & Wood Mallesons has topped Australasia’s M&A charts again, ranking #1 by deal value and count. The firm advised on $36.8bn across 82 deals, securing M&A Legal Adviser of the Year at the 2025 Mergermarket Awards. HSF Kramer followed at $34.7bn, with Ashurst third. Check out the full breakdown here: Point Blank

*

Corrs Chambers Westgarth has lured Costa Koutsis, Ashurst’s Global Co-Head of Tax, as partner in Sydney. A stamp duty and GST specialist with 20+ years’ experience, he’s advised on Scape’s $3.85bn Aveo deal and TPG’s $5.25bn fibre sale. Corrs CEO Gavin MacLaren called him one of Australia’s foremost indirect tax lawyers: Point Blank

*

Thomson Geer nabs Chuong Nguyen and Ellen Adianto to its banking and finance team in Melbourne, both joining from Baker McKenzie. Nguyen, a veteran in corporate and structured finance, teams up with Adianto, who specialises in property, construction and acquisition finance: Point Blank

*

Piper Alderman has hired Hannah Brown as partner in its dispute resolution and litigation team. Brown, who’s qualified in NZ, the UK and Australia, joins from Mills Oakley and JWS with experience across class actions, litigation funding and major commercial disputes: Point Blank

PRACTICE POINTS

Aus’ first privacy penalty

Australian Clinical Labs (ACL) has been slapped with a $5.8m fine in the first-ever civil penalty under the Privacy Act, after a ransomware attack exposed data of 223k patients. The Federal Court found ACL failed to secure data, respond promptly, or report within the expected 72-hour window, leaning too heavily on flawed consultant advice. Firms can’t outsource responsibility - boards must test and verify cyber responses themselves. And the kicker for dealmakers? ACL inherited Medlab’s weak systems post-acquisition, showing cyber due diligence isn’t optional: Point Blank

*

Everyone’s talking about the C word — climate. Three big climate developments are reshaping Australia’s green law landscape. First, in Pabai v Commonwealth, the Federal Court refused to find a duty of care requiring the government to protect communities from climate harm, calling emissions targets and adaptation funding matters of core policy, not negligence. Next, EnergyAustralia settled with Parents for Climate, acknowledging that its “Go Neutral” marketing overstated the impact of carbon offsets and promising clearer disclosure. Finally, the ACCC is ramping up greenwashing enforcement, warning that vague sustainability claims and unverified offset promises won’t cut it: KWM

*

For startups short on cash but big on ambition, employee share option plans (ESOPs) are a go-to for attracting and keeping talent. Well, law firm Addisons gives you the rundown on how to implement an ESOPs that is set for growth. To access the ATO’s start-up concession, options must be priced at least at market value, held for three years, and issued by a company that’s <10 years old and earns under $50m. The ATO’s safe harbour instrument helps here, providing two approved valuation methods for determining the market value of ordinary shares. On the Corps Act front, startups usually rely on the senior manager or 20/12 exemptions to avoid the prospectus rules. Get the structure wrong, and that “equity incentive” can quickly turn into a compliance headache: Addisons

TALKING POINTS

China hijacks home wifi

Chinese state hackers are now breaking in through the front door - your home Wi-Fi. The ASD says they’re hijacking routers and smart devices to slip into corporate networks, turning WFH setups into attack hubs. With 96% of edge-device hacks succeeding and average losses topping $200k, cyber-spies are proving your couch is the new battleground: AFR

*

Jim Chalmers has reworked Labor’s superannuation tax hike, bowing to pressure by adding indexation so thresholds rise with inflation. The new plan also scraps taxes on unrealised gains and sets a 30% rate above $3m and 40% above $10m. The Greens say Labor’s gone soft on the rich, while Paul Keating backed the change as restoring “equity and certainty” to super: ABC

TREASURY TUESDAY

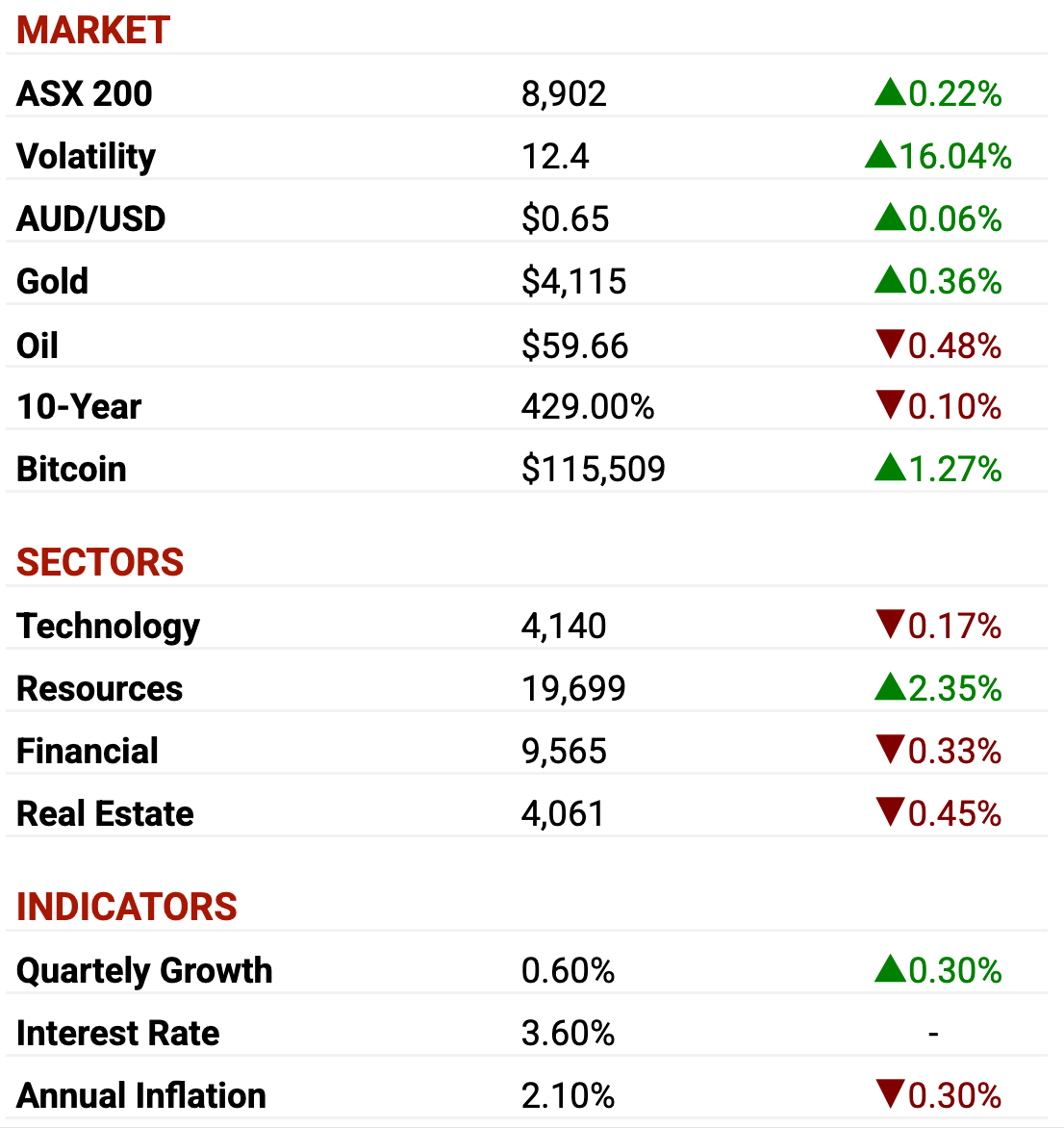

ASX as at market close. Commodities and crypto in USD.

DEAL ROOM

Next stop Kinetic

TPG: is set to acquire Kinetic Group, Australia’s biggest bus operator and owner of SkyBus (what a bus), in a deal worth just under $4bn. The buyout will mark the first Aussie investment for TPG’s $10bn Rise Climate fund. UBS and Azure advised TPG, while Macquarie Capital acted for sellers OPTrust and Foresight: AFR

*

Brookfield: is taking full control of Oaktree Capital Management in a A$4.6bn deal, buying the remaining 26% stake it doesn’t own and valuing the distressed-debt giant at A$17.7bn. The move cements Brookfield’s push into credit, with Oaktree’s co-CEOs to lead its global credit arm. Completion is slated for early 2026: Capital Brief

SECTOR SPECIFIC

Smiggle’s survival

🚜 DIGGERS

Gina Rinehart’s Hancock Prospecting has invested $22.5m in St George Mining, boosting its stake as the explorer raised $72.5m to advance its Araxá rare earths-niobium project in Brazil. The move lifts Rinehart’s rare earths exposure to $3.4bn, amid rising US-China trade tensions over critical minerals: The Australian

*

The Pentagon will buy up to $1bn in rare earths and strategic metals to cut US dependence on China. Backed by Trump’s One Big Beautiful Bill Act, the Defense Logistics Agency plans major purchases of cobalt, antimony, tantalum and scandium. The move follows Beijing’s new export bans and Trump’s 100% tariff threat, escalating the minerals arms race: Mining.com

🏦 FIN

During ANZ’s rate-rigging probe, then-gen counsel Bob Santamaria told ANZ’s CEO and chair that trader Etienne Alexiou fabricated whistleblower claims to gain protection, calling him “quite calculating.” Alexiou, later fired for misconduct, says he was punished for exposing ANZ’s BBSW manipulation. He’s now seeking $30m compo: AFR

*

ANZ’s former top lawyer Bob Santamaria told then-CEO Mike Smith and chair David Gonski that trader Etienne Alexiou fabricated a whistleblower claim to gain protection during the bank’s interest rate-rigging probe. Alexiou, later sacked for misconduct, says he was fired for exposing ANZ’s BBSW manipulation, which cost the bank $50m in penalties. He’s now suing for $30m, alleging the bank denied him procedural fairness: AFR

🏠 RETAIL & REAL ESTATE

Once the ultimate schoolyard status symbol, Smiggle is fighting for survival as Temu and Amazon crush Aussie retailers. Global sales have plunged 10.7% to $264m, forcing 56 store closures and shelving plans for an ASX spin-off. With cost-of-living pressures hitting young families and ex-CEO John Cheston gone, Solomon Lew’s Premier Investments faces the tough task of reviving its fading stationery empire: Real Commercial

*

Commercial property firm JLL is being sued by ousted industrial agents, who claim they were scapegoated in the firm’s cultural clean-up after a misconduct scandal. The agents allege a flawed investigation and no procedural fairness, saying they were fired before law firm Clyde & Co’s independent report was finalised. JLL has denied wrongdoing but admitted to “significant shortcomings” and pledged to rebuild trust: The Australian

📱 TECH & STARTUPS

OpenAI will partner with Broadcom to build custom AI chips and networking gear, aiming to deploy 10GW of data centre capacity by 2029. The move lets OpenAI embed its model learnings directly into hardware, boosting performance and independence from third-party suppliers: Capital Brief

*

Salesforce will pour $15bn into San Francisco over five years to speed up AI adoption and cement its edge over Microsoft, Oracle and ServiceNow. The investment will fund a new AI incubator hub and rollout of Agentforce 360, its global AI platform: Reuters

JOB OPPORTUNITIES

P.S.

Till next time,

-Team PB