👋 G’day

Welcome back to another day of insights

Today’s brief:

Gadens, Mills and Landers outpace top-tiers

Vic to outlaw NDAs in harassment cases

HSF Kramer names new global AI chief

WORD ON THE STREET

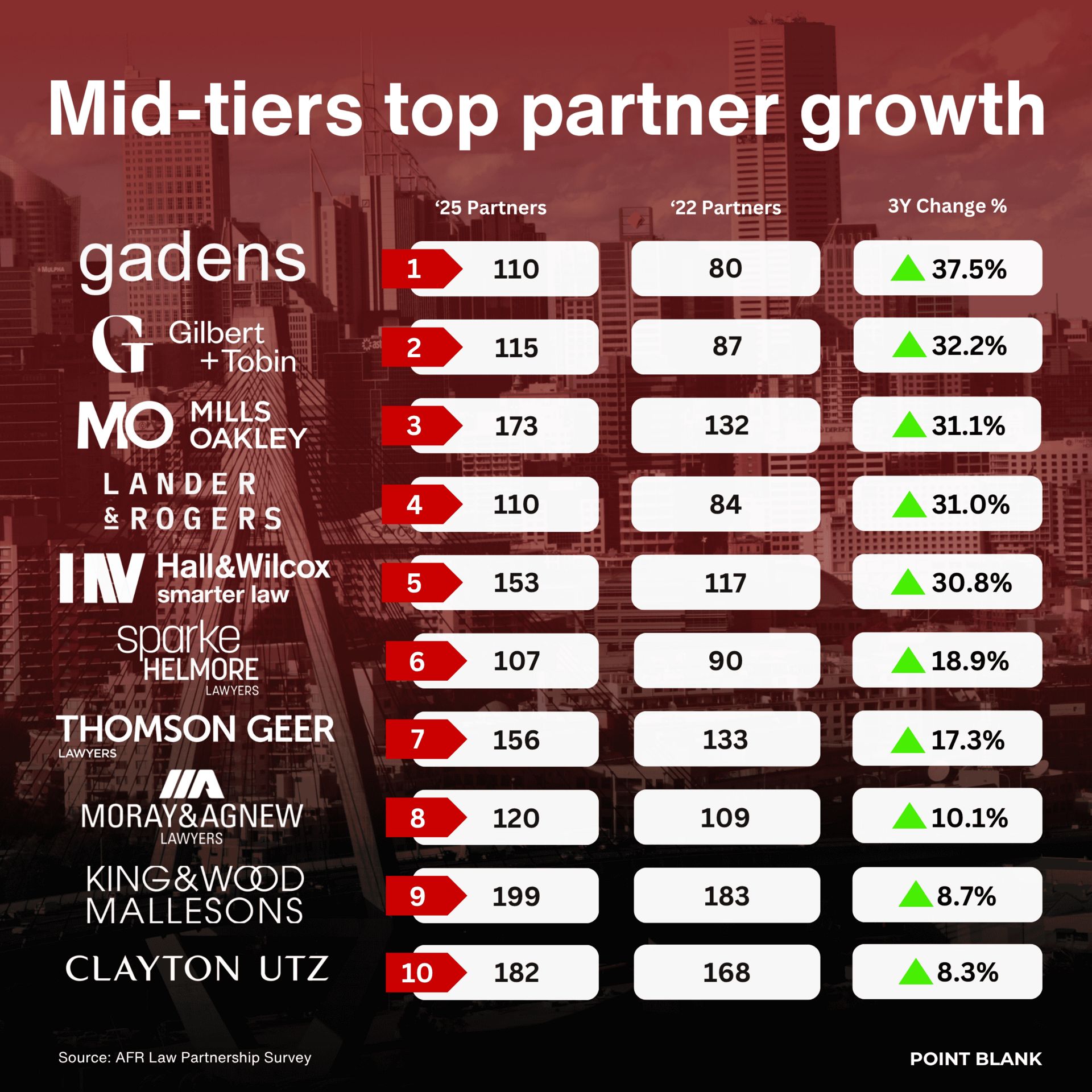

Mid-tier momentum

Australia’s mid-tier firms are growing fast, with Gadens, Mills Oakley and Lander & Rogers all lifting partner ranks by around 30%+ in three years. Meanwhile, top-tiers like HSF Kramer, Allens, Minters and Corrs barely moved, or even shrank. Mid-tiers are now muscling in on domestic market share once ruled by the big end of town. Check out our full article here: Point Blank

*

Baker McKenzie has added two new partners, Sarah Birrell (Energy, Melbourne) and Victoria Lanyon (Tax, Sydney), as it expands its energy and tax benches. Birrell, ex-Allens, brings 20 years in mining and energy deals, while Lanyon, from KWM, strengthens the firm’s corporate tax expertise: Point Blank

*

HSF Kramer has named Ilona Logvinova (Cleary Gottlieb’s former innovation lead) as its first Global Chief AI Officer. A former McKinsey and Mastercard lawyer, Logvinova led Cleary’s Springbok AI acquisition earlier this year. Global CEO Justin D’Agostino says the goal is clear: have “the best people using the best technology”: Point Blank

*

Sparke Helmore has hired Sophie Pennington from HWL Ebsworth as a partner in its Specialty Lines Insurance team, joined by two lawyers. A medical negligence and malpractice specialist, Pennington brings experience across civil claims, inquests and disciplinary matters: Point Blank

PRACTICE POINTS

FWC reverses misconduct sackings

Employment: The FWC has reinstated two Uber drivers accused of sexual misconduct, ruling the company relied on hearsay and untested complaints. The drivers, accused of non-consensual kissing and public masturbation, were reinstated with back pay under Labor’s new unfair deactivation laws. Commissioner Damian Sloan said Uber’s allegations were “extremely serious” but unsupported by direct witness evidence, noting customer statements alone were “a fragile base” for dismissal. Uber argued it must protect rider safety, but the FWC found it hadn’t properly tested or verified complaints. The rulings are expected to fuel debate over gig worker protections ahead of a government review early next year: AFR

*

Regulatory: ASIC clarifies Bitcoin’s legal status. Bitcoin is “unlikely” to be a financial product, according to new ASIC guidance on digital assets. The regulator said Bitcoin doesn’t involve investment promises or pooled returns, so it falls outside the scope of managed investment or non-cash payment facilities (at least for now). But ASIC Commissioner Alan Kirkland warned that if businesses embed Bitcoin into financial products or services, they may still require an AFSL. The guidance also confirms gold-linked tokens and yield-bearing stablecoins are managed investment schemes, while digital wallets offering payment functionality are financial products. Meme coins, however, remain off the hook: Capital Brief

*

Corporate/Banking: APRA has softened its governance reform package after pushback from banks, insurers and super funds. Following 80 submissions and 57 stakeholder meetings, APRA will:

extend the tenure cap for non-exec directors to 12 years (up from 10 years)

scrap the proposal for two independent directors not serving on group boards

drop plans requiring early APRA engagement on responsible person appointments and succession planning

Chair John Lonsdale said the aim remains to lift governance standards without undue regulatory constraint, balancing flexibility across institutions. Revised standards and guidance will be released for further consultation in H1 2026: APRA

TALKING POINTS

Sleepless for status

Now who doesn’t love a Qantas rewards chat? Well, one traveller has confessed to flying to Brisbane and back overnight without leaving the airport — all to secure coveted Qantas Gold status. After nearly 20 years chasing status credits, a cancelled trip left them just short of the goal. So, they took a “status run” — a two-hour flight, five-hour layover, and another flight home — trading sleep for lounge access, priority boarding and airline prestige. Worth? We say yes: The Australian

*

Victoria is set to ban NDAs in workplace sexual harassment cases unless expressly requested by the employee, in an Australian-first reform unveiled by Premier Jacinta Allan. Victims could waive confidentiality after 12 months and disclose NDAs to health workers, police or lawyers. The bill also adds safeguards, including a 21-day cooling-off period and bans on bosses pressuring staff to sign: The Guardian

DEAL ROOM

Meta builds $27bn data centre

Meta: has partnered with Blue Owl Capital to build Hyperion, a $27bn data centre campus in Louisiana—financed by what Morgan Stanley calls the largest-ever private bond and project finance deal. The JV is 80% owned by Blue Owl, with Meta retaining 20%. Pimco bought roughly $18bn of the debt, while BlackRock took $3bn. Latham & Watkins advised Meta, Kirkland & Ellis acted for Blue Owl, Milbank repped Morgan Stanley and CC and Greenberg Traurig advised Morgan Stanley: NB

*

AUB Group: has confirmed it received an unsolicited $5.2bn takeover bid from Swedish private equity giant EQT, offering $45 per share in cash. The announcement only came after media speculation on the deal. The offer follows an earlier $43 per share approach in September. AUB has entered a six-week exclusivity period with EQT, granting access to DD. Allens is advising AUB. Ashurst advises

SECTOR SPECIFIC

PayPal meets ChatGPT

🚜 DIGGERS

Uranium and defence funds have surged 74% this year, outpacing even gold’s glittering 57% rise. AI’s hunger for clean energy and rising global defence budgets are fuelling the boom, says Global X. Fundies like Terra Capital and Maple-Brown Abbott are piling into uranium and counter-drone tech, with DroneShield up 500% as investors chase AI-powered and war-driven megatrends: AFR

*

Gina Rinehart’s Atlas Iron saw profit plunge 41% to $260m as iron ore prices fell 18% and Cyclone Zelia battered Pilbara operations. The billionaire’s Hancock Prospecting has now merged Atlas and Roy Hill under Hancock Iron Ore, calling the Atlas result “solid” despite disruptions: The Australian

🏦 FIN

After eight years at NAB, group GC Sharon Cook will retire on 31 December. CEO Andrew Irvine praised her “strong commitment to doing the right thing by customers.” Les Matheson will assume her role as group executive for customer and corporate services, while a new executive GC position will be created to oversee legal and regulatory affairs: Lawyers Weekly

*

Top fund managers say private credit isn’t in bubble territory, but there are signs of weaker lending standards in large corporate loans. Guggenheim’s Anne Walsh flagged reduced loan covenants as large company lending competition heats up. Oaktree’s Robert O’Leary added that the AI boom was causing an economy-wide bubble, with a “preponderance” of loans to software companies: Reuters

🏠 RETAIL & REAL ESTATE

Aussie builders are back in the black, as cost growth eases and loss-making pandemic projects wrap up. Hutchinson Builders’ profit more than doubled to $32.2m, while Richard Crookes Constructions swung to a $14.2m profit after two years of losses. Margins remain tight, but leaders say the industry’s “back to normal business”: AFR

*

Goodman Group has snapped up an 18.5ha San Jose site for $305m, planning a data and advanced manufacturing campus in the heart of Silicon Valley’s tech corridor. The Goodman Innovation Centre will feature two data centres with 97MW of power by 2028, tapping the AI-driven data boom. It expands Goodman’s global 5GW data pipeline across 13 cities: The Australian

📱 TECH & STARTUPS

OpenAI has partnered with PayPal to embed the fintech giant’s digital wallet directly into ChatGPT, letting users buy items found through the AI tool. From 2026, PayPal merchants will list inventory on ChatGPT with Instant Checkout and buyer protections built in. PayPal shares jumped 9% on the news, as the deal marks OpenAI’s first big e-commerce push: Capital Brief

*

Christine Zhang, a 19-year-old Harvard student, paused her degree after raising over $1m for a San Francisco AI startup she co-founded with her college roommate. The pair, now leading a six-person team, pivoted into generative optimisation for LLMs. Zhang says she gets student FOMO but “too good an opportunity to pass up” before returning to Harvard: Business Insider

JOB OPPORTUNITIES

P.S.

Till next time,

-Team PB